Africa Container Glass Market Size

Africa Container Glass Market Analysis

The Africa Container Glass Market size is estimated at 4.78 Thousand kilotons in 2025, and is expected to reach 6.06 Thousand kilotons by 2030, at a CAGR of 4.86% during the forecast period (2025-2030).

Glass containers, known for their clarity, recyclability, and inert properties, are emerging as eco-friendly choices in today's sustainability-focused landscape. Furthermore, advancements in glass manufacturing technology have transformed the market, giving rise to lighter, more durable, and cost-efficient packaging solutions.

- As production processes evolve and consumer awareness of environmental impacts grows, container glasses are set to retain their prominence in various sectors, notably food & beverages, pharmaceuticals, and others.

- The South African retail food market, dominated by five major corporations - Shoprite Holdings Ltd., Pick n Pay Retailers Pty Ltd., SPAR Group Ltd., Walmart-owned Massmart, and Woolworths Holdings Ltd., plays a significant role in driving demand for glass packaging in the region.

- Together, these companies account for over 60% of retail food sales in the country, with total retail food sales in South Africa reaching USD 39 billion in 2023, according to the United States Department of Agriculture (USDA).

- The increasing popularity of glass packaging in Africa is driven by its multifaceted advantages, which make it an ideal choice for a wide range of products across various industries. Glass packaging offers premium quality, sustainability, and consumer safety, which are highly valued in the African market.

- As environmental concerns grow and consumers become more conscious of the impact of packaging materials, glass’s 100% recyclability, non-toxic nature, and ability to preserve product integrity are key drivers of its demand.

- The glass bottles and containers market in Africa faces growth constraints due to the availability and increasing adoption of alternative packaging solutions. Plastic, metal, and paper-based packaging options are gaining popularity, primarily due to their cost-effectiveness, lighter weight, and easier transportation than glass. These alternatives appeal to industries where cost efficiency and logistics are crucial factors.

Africa Container Glass Market Trends

Alcoholic Beverages Segment Holds Major Market Share

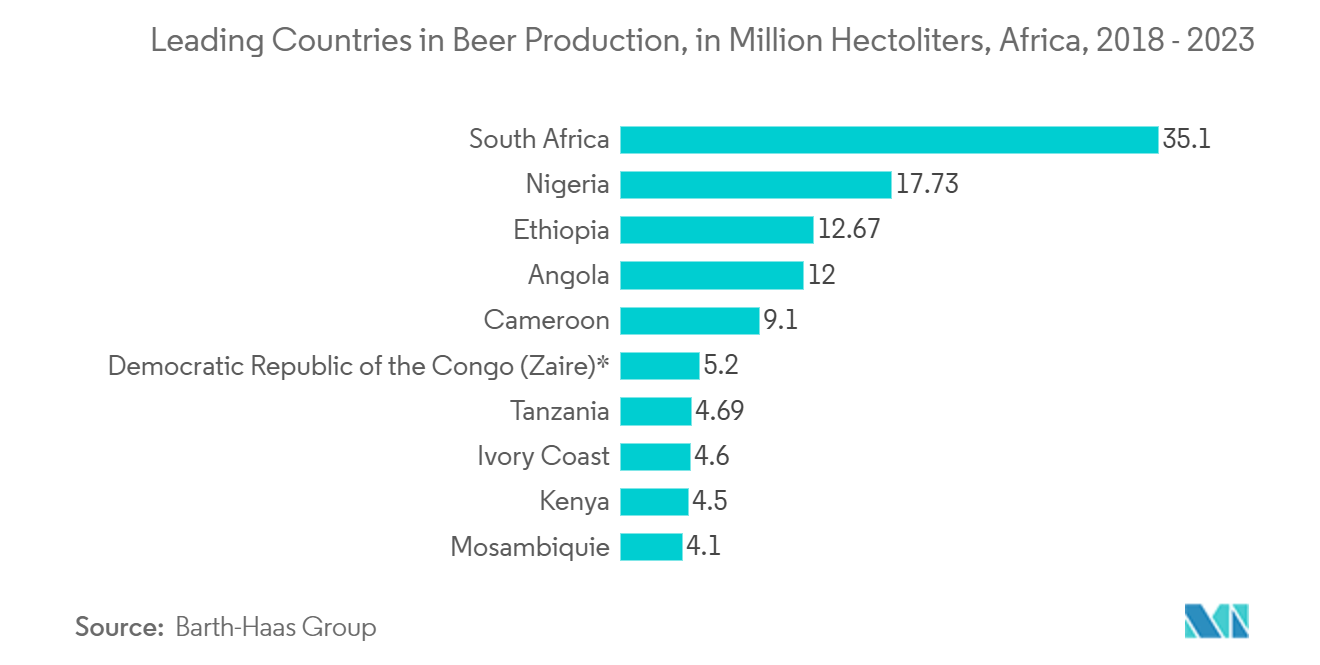

Beer markets are growing, which can help boost the African glass bottle industry. As alcohol consumption rises, so will the demand for packaging materials to store and distribute these beverages.

The growing popularity of cider in South Africa, particularly in social settings like nightclubs, indicates an increase in demand for glass bottles, as cider is typically sold in glass bottles or other premium packaging. The market is expected to grow at a 3% CAGR, sustaining demand for glass packaging.

Rising Wine Consumption Drives Demand for Glass Packaging in South Africa

- Wine is typically packaged in glass bottles, and as consumption increases, so will the demand for glass packaging. The rise in wine consumption in South Africa will likely lead to an increase in the need for glass bottles to store and transport this wine.

- According to the International Organisation of Vine and Wine, wine consumption in South Africa recorded a level of 4.5 hectoliters in 2023, when compared with 2020, which was 3.1 hectoliters.

- With the rise in wine consumption and the increasing competition in the market, wineries may seek to differentiate their products through unique and attractive glass bottle designs.

- As South Africa is a significant wine producer and exporter, the increased local consumption of wine could be complemented by the growth in the export market. Wine exports are often packaged in glass bottles, meaning an increase in export activity will further increase the demand for glass bottles.

South Africa Holds Significant Market Share

- The glass bottle market in South Africa is experiencing a significant shift driven by increasing demand for eco-friendly packaging solutions. Consumers are becoming more environmentally conscious, leading to a preference for glass bottles over plastic due to their recyclability and perception as a cleaner, more natural material.

- This trend is particularly evident in the food and beverage sectors, where brands respond to consumer preferences by choosing glass containers. South Africa's strong focus on recycling is evident through widespread consumer participation in glass recycling programs, aligning with its goals to reduce its carbon footprint and improve waste management practices.

- Furthermore, companies are implementing returnable glass programs to promote a closed-loop approach, reinforcing the sustainability efforts within the packaging industry and contributing to the overall growth of the glass bottle market in the region.

- For instance, in February 2024, Heineken, the multinational beer producer, invested ZAR 2.3 billion (USD 0.12 billion) in its returnable bottle program in South Africa. This investment has more than doubled the company's share of returnable glass beer bottles as part of its goal to increase the use of returnable glass bottles to 65%. This initiative aligns with Heineken's global ambition to achieve net-zero carbon emissions by 2040.

- Recent advancements in glass technology, including lightweight glass bottles and containers with enhanced features, are becoming increasingly popular in South Africa. These innovations aim to reduce production costs, improve convenience, and meet the evolving needs of modern consumers with the growing beverage industry in the region.

- For instance, in October 2024, Switch Energy Drink introduced its new premium 275ml glass bottle range, featuring sleek packaging. Halewood South Africa will serve as the exclusive distributor for this product.

Africa Container Glass Industry Overview

The African container glass market is semi-consolidated, with regional and local conglomerates and specialized players operating across various segments. While several large multinational companies dominate specific high-value segments, numerous regional and niche players contribute to the overall competition, making the market highly diverse. This market is driven by the demand for the African container glass market across a wide range of end-user verticals, allowing both large and small companies to coexist and thrive.

Some of the major players in the Africa container glass market are Ardagh Glass Packaging–Africa (AGP–A) (Ardagh Group S.A.), Isanti Glass, Middle East Glass Manufacturing Co SAE, Nover (National Glass and Abrasives Company (ENAVA)), and The National Company For Glass and Crystal (SAE) among others.

Africa Container Glass Market Leaders

-

Ardagh Group S.A.

-

Beta Glass Plc

-

Middle East Glass Manufacturing Co.

-

United Glass Containers Company (UGC)

-

Societe dExploitation de Verrerie Au Maroc (SEVAM)

- *Disclaimer: Major Players sorted in no particular order

Africa Container Glass Market News

- October 2024: Switch Energy Drink introduced its new premium 275ml glass bottle range, featuring sleek packaging. Halewood South Africa will serve as the exclusive distributor for this product.

- July 2024: Isanti Glass, a food and beverage glass packaging manufacturer, joined South Africa's national buy local campaign. This membership reflects the company's commitment to supporting local procurement, boosting domestic production, and creating jobs in South Africa.

Africa Container Glass Industry Segmentation

The Africa container glass market study tracks the demand for containers utilized in various end-user industries, including beverages (both alcoholic and non-alcoholic), food, cosmetics, pharmaceuticals, and others. Additionally, it assesses the sales volume of container glass throughout the region. In this report, Geography-wise, the Democratic Republic of Congo is studied under the rest of Africa’ to track the market.

African container glass market is segmented by end-user vertical (beverages [alcoholic beverages (beer, wine, spirits, and other alcoholic beverages {cider and other fermented drinks}), non-alcoholic beverages (juices, carbonated drinks (CSDs), dairy product-based drinks, other non-alcoholic beverages)], food [jam, jelly, marmalades, honey, sausages and condiments, oil, pickles], cosmetics and personal care, pharmaceuticals (excluding vials and ampoules), and perfumery), by color (green, amber, flint and other colors). The report offers market forecasts and size in volume (kilotons) for all the above segments.

| By End-user Vertical | Bevarages | Alcoholic | Beer | |

| Wine | ||||

| Spirits | ||||

| Other Alcoholic Beverages (Cider and Other Fermented Drinks) | ||||

| Non-Alcoholic | Juices | |||

| Carbonated Drinks (CSDs) | ||||

| Dairy Product Based Drinks | ||||

| Other Non-Alcoholic Beverages | ||||

| Food (Jam, Jelly, Marmalades, Honey, Sausages and Condiments, Oil, Pickles) | ||||

| Cosmetics and Personal Care | ||||

| Pharmaceuticals (excluding Vials and Ampoules) | ||||

| Perfumery | ||||

| By Color | Green | |||

| Amber | ||||

| Flint | ||||

| Other Colors | ||||

| By Country*** | South Africa | |||

| Egypt | ||||

| Nigeria | ||||

| Morocco | ||||

Africa Container Glass Market Research Faqs

How big is the Africa Container Glass Market?

The Africa Container Glass Market size is expected to reach 4.78 thousand kilotons in 2025 and grow at a CAGR of 4.86% to reach 6.06 thousand kilotons by 2030.

What is the current Africa Container Glass Market size?

In 2025, the Africa Container Glass Market size is expected to reach 4.78 thousand kilotons.

Who are the key players in Africa Container Glass Market?

Ardagh Group S.A., Beta Glass Plc, Middle East Glass Manufacturing Co., United Glass Containers Company (UGC) and Societe dExploitation de Verrerie Au Maroc (SEVAM) are the major companies operating in the Africa Container Glass Market.

What years does this Africa Container Glass Market cover, and what was the market size in 2024?

In 2024, the Africa Container Glass Market size was estimated at 4.55 thousand kilotons. The report covers the Africa Container Glass Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Africa Container Glass Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Africa Container Glass Industry Report

Statistics for the 2025 Africa Container Glass market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Africa Container Glass analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.