ASEAN Chemical Logistics Market Size

ASEAN Chemical Logistics Market Analysis

The ASEAN Chemical Logistics Market size is estimated at USD 47.53 billion in 2025, and is expected to reach USD 74.92 billion by 2030, at a CAGR of 9.53% during the forecast period (2025-2030).

- The ASEAN chemical logistics market is mainly driven by the surge in urbanization and demand for petroleum products on a daily basis.

- As the ASEAN region is undergoing rapid development, its energy demand has surged to unprecedented levels. Over the past 15 years, energy consumption in the region has spiked by 60%, with projections indicating a further two-thirds increase by 2040. A key driver of this soaring energy demand is the region's burgeoning economy, which requires more energy to sustain its growth. Additionally, Southeast Asia's population is expected to rise by 20%, with urban areas alone anticipating an influx of over 150 million people. Together, these dynamics underscore the region's escalating energy needs.

- Today, oil and coal each account for over a quarter of the region's energy demand, with natural gas contributing roughly one-fifth. In 2023, coal was responsible for generating half of the region's electricity, which in turn accounted for 80% of emissions from the power sector. Additionally, coal met 30% of the region's industrial energy demand, including a notable increase in nickel production in Indonesia. Southeast Asia, alongside the Middle East, is one of the few regions where GDP and emissions are rising in tandem. This trend underscores the carbon-intensive nature of Southeast Asia's ongoing economic development.

- In the STEPS scenario, clean energy is projected to fulfill over 35% of the energy demand growth by 2035. This surge is primarily fueled by a swift expansion of wind and solar PV, coupled with a consistent push for modern bioenergy, geothermal, and other low-emission technologies. Consequently, clean energy's share in the overall energy mix is anticipated to reach a quarter. Yet, this scenario also foresees an uptick in fossil fuel consumption: oil demand is expected to rise by 20% by 2035, while coal and gas demand is projected to grow by over 30%. As the demand for chemicals rises, so does the need for efficient logistics.

ASEAN Chemical Logistics Market Trends

Robust growth in oil and gas sector

- Oil demand in Southeast Asia is projected to increase from 5 million barrels per day (b/d) in 2023 to 6.4 million b/d by 2035, and further to 7 million b/d in 2050.

- The transport sector predominantly drives the surge in oil demand, with consumption doubling from 1.3 million b/d in 2000 to the current 2.8 million b/d in 2023. Given the prevailing policies and trends, gasoline and diesel consumption for road transport is expected to rise by roughly 30% by 2050, nearing 1.6 million b/d.

- Gas demand in the region is set to climb from approximately 170 billion cubic meters (bn m³) now, to about 210 bn m³ in 2030, and reach 270 bn m³ by 2050.

- According to the IEA, overall energy demand is anticipated to surge by "about a third by 2035 and two-thirds by 2050," with nearly half of this growth being satisfied by fossil fuels. However, under the APS scenario, energy demand is projected to grow at a more modest rate of around 40% by 2050, attributed to swift advancements in efficiency, electrification, and fuel switching.

- Malaysia's oil and gas sector is in a transformative phase, aiming to enhance exploration and production activities. In 2023, Malaysia's daily oil production reached around 565,000 barrels, up from 561,000 barrels in 2022. Despite a decline in oil production since 2020, Malaysia secured its position as the fourth largest oil producer in the Asia Pacific and the second largest in Southeast Asia, trailing only Indonesia.

- TotalEnergies' acquisition of a significant stake in SapuraOMV and Chevron's purchase of Hess (including their Malaysian assets) underscore a strong confidence in Malaysia's energy landscape.

- Leading this renewed focus, PETRONAS has launched the Malaysia Bid Round 2024 (MBR 2024), unveiling new exploration blocks and clusters of Discovered Resource Opportunities (DRO). Under the banner “Transforming Your Future with Advantaged Energy,” PETRONAS seeks to cement Malaysia's status as a prime destination for energy investments. This strategy not only aims to attract substantial capital but also to nurture extensive international collaborations, all in line with national goals for energy security. As the market evolves, the demand for logistics continues to grow.

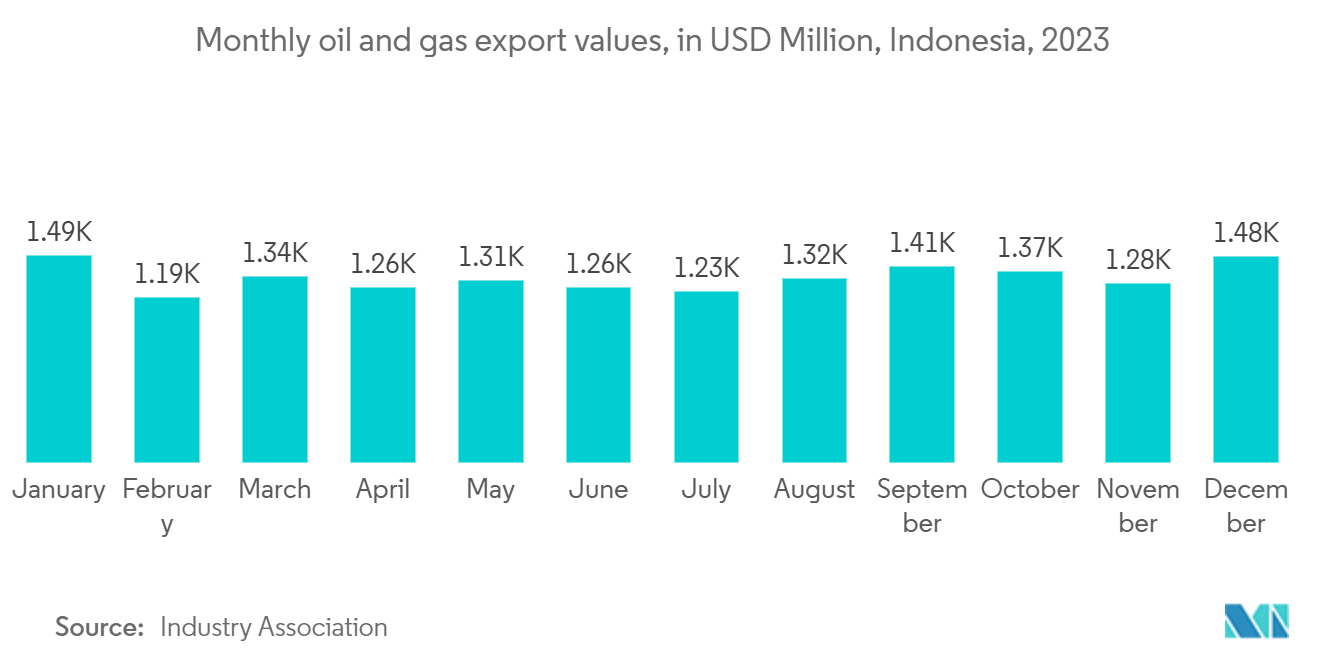

Indonesia holds a prominent position in the market

Indonesia is capitalizing on recent discoveries and strategic initiatives to bolster the appeal of its oil and gas sector. By mid-2024, the country plans to unveil new exploration blocks in the North Sumatra basin, emphasizing the extraction of unconventional resources. This initiative is further supported by significant amendments to the Oil and Gas Law and the rollout of investor-centric fiscal policies, all designed to simplify the investment journey.

Additionally, Indonesia has intensified its drilling endeavors, targeting around 40 wells, a significant uptick from the 20 wells drilled at the pandemic's height. These drilling activities, underpinned by successful bidding rounds, are central to Indonesia's vision of harmonizing energy production with economic growth and environmental stewardship. Enhancements to production-sharing contract terms, coupled with fresh regulatory reforms, are strategically designed to catalyze the emergence of new, large-scale oil and gas ventures.

In a bid to curtail its petrochemical industry's heavy reliance on imports, Indonesia has set ambitious targets for 2024. The nation boldly asserts its goal of achieving complete self-sufficiency in petrochemicals by 2027, coinciding with the completion of the Tanah Kuning Kalimantan Industrial Park Indonesia (KIPI). Once operational, KIPI is poised to be Southeast Asia's premier petrochemical hub and the globe's largest integrated industrial zone. As a result, government initiatives and sustainability reforms are fueling the demand for chemical logistics in the market.

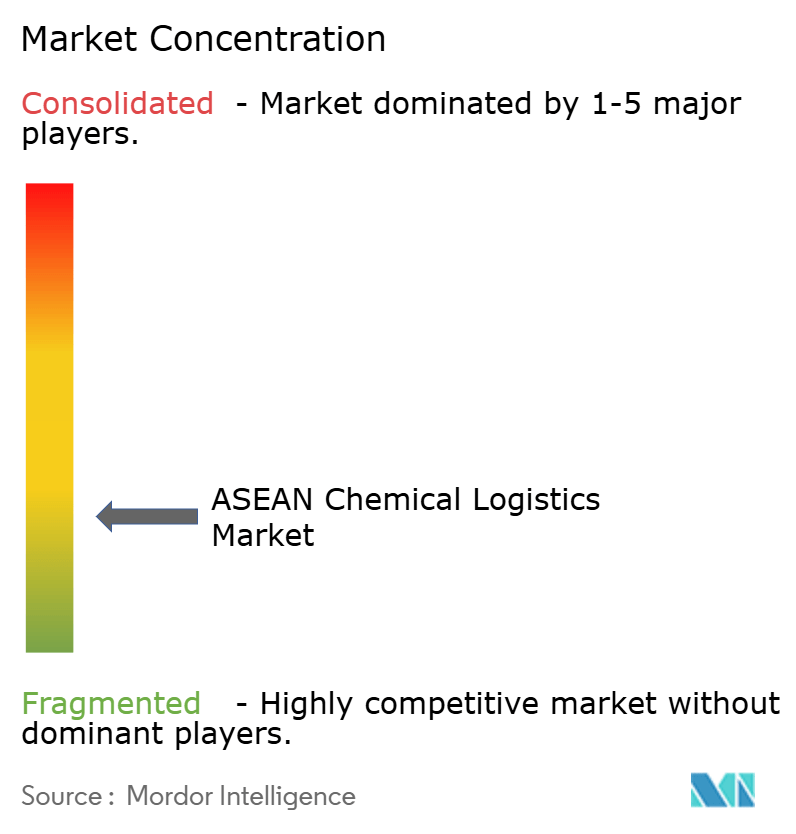

ASEAN Chemical Logistics Industry Overview

The ASEAN chemical logistics market is moderately fragmented. The major players in the market include Den Hartogh Logistics, SCG Chemicals Public Company Limited, Noatum Logistics, Mitsubishi Chemical Logistics, Dachser etc.

ASEAN Chemical Logistics Market Leaders

-

Den Hartogh Logistics

-

SCG Chemicals Public Company Limited

-

Noatum Logistics

-

Mitsubishi Chemical Logistics

-

Dachser

- *Disclaimer: Major Players sorted in no particular order

ASEAN Chemical Logistics Market News

- March 2024: Mitsui O.S.K. Lines, Ltd. revealed that its fully owned subsidiary, MOL Chemical Tankers Pte. Ltd., has successfully acquired all shares of Fairfield Chemical Carriers Pte. Ltd. This acquisition allows MOLCT to merge its fleet of 81 multi-segregated chemical tankers, equipped with stainless steel tanks, with the 36 vessels from FCC. As a result, MOLCT now boasts one of the world's largest fleets of its kind. This move further bolsters the company's specialized focus on multi-segregated chemical tankers with stainless steel tanks, a recognized strength of the firm.

- March 2024: Royal Den Hartogh Logistics, a global transportation specialist catering to the chemical, gas, and food sectors, has broadened its portfolio with the acquisition of H&S Group. H&S Group stands out as a frontrunner in transporting liquid foodstuffs across Europe. The merger presents a prime opportunity for both entities to synergize their strengths, enhance their smart logistics offerings, and extend their market presence.

ASEAN Chemical Logistics Industry Segmentation

Chemical logistics is the transfer of chemical commodities with a supply chain using logistics organization services like warehousing and transportation. Chemicals are an essential aspect of practically every industry, including plastics processing, pharmaceuticals, food manufacturing, and vehicle manufacturing. The chemical industry provides products for the majority of industries. Liquid or solid chemicals are used to make pharmaceuticals, food, and other everyday items.

ASEAN chemical logistics market is segmented by service (transportation, warehousing, customs & security, green logistics, consulting & management services, and others), by mode of transportation (roadways, railways, airways, waterways, pipelines), by end-user (pharmaceutical industry, cosmetic industry, oil and gas industry, specialty chemicals industry, and other end-users), and by geography (Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines, and the Rest of ASEAN). The report offers market size and forecasts for the ASEAN Chemical Logistics Market in value (USD) for all the above segments.

| By Service | Transportation |

| Warehousing, Distribution, and Inventory Management | |

| Others | |

| By Mode of Transportation | Roadways |

| Railways | |

| Airways | |

| Waterways | |

| Pipelines | |

| By End User | Pharmaceutical Industry |

| Specialty Chemical Industry | |

| Oil and Gas Industry | |

| Cosmetic Industry | |

| Others | |

| By Geography | Singapore |

| Thailand | |

| Malaysia | |

| Vietnam | |

| Indonesia | |

| Philippines | |

| Rest of ASEAN |

| Transportation |

| Warehousing, Distribution, and Inventory Management |

| Others |

| Roadways |

| Railways |

| Airways |

| Waterways |

| Pipelines |

| Pharmaceutical Industry |

| Specialty Chemical Industry |

| Oil and Gas Industry |

| Cosmetic Industry |

| Others |

| Singapore |

| Thailand |

| Malaysia |

| Vietnam |

| Indonesia |

| Philippines |

| Rest of ASEAN |

ASEAN Chemical Logistics Market Research FAQs

How big is the ASEAN Chemical Logistics Market?

The ASEAN Chemical Logistics Market size is expected to reach USD 47.53 billion in 2025 and grow at a CAGR of 9.53% to reach USD 74.92 billion by 2030.

What is the current ASEAN Chemical Logistics Market size?

In 2025, the ASEAN Chemical Logistics Market size is expected to reach USD 47.53 billion.

Who are the key players in ASEAN Chemical Logistics Market?

Den Hartogh Logistics, SCG Chemicals Public Company Limited, Noatum Logistics, Mitsubishi Chemical Logistics and Dachser are the major companies operating in the ASEAN Chemical Logistics Market.

What years does this ASEAN Chemical Logistics Market cover, and what was the market size in 2024?

In 2024, the ASEAN Chemical Logistics Market size was estimated at USD 43.00 billion. The report covers the ASEAN Chemical Logistics Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the ASEAN Chemical Logistics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

ASEAN Chemical Logistics Industry Report

Statistics for the 2025 ASEAN Chemical Logistics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. ASEAN Chemical Logistics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.