Balsa Wood Market Size

Balsa Wood Market Analysis

The Balsa Wood Market size is estimated at USD 176.85 million in 2025, and is expected to reach USD 213.98 million by 2030, at a CAGR of 4.85% during the forecast period (2025-2030).

- The global balsa wood market continues to grow, driven by demand from wind energy, marine, and aerospace sectors. Balsa wood's lightweight properties, high strength-to-weight ratio, and insulation characteristics make it suitable for applications ranging from model airplanes to small furniture. The material's workability with hand and power tools has increased its use in DIY projects. Latin America dominates balsa wood production, with Ecuador and Peru as major producers. According to the Ecuadorian Association of the Wood Industry (Asociación Ecuatoriana de Industriales de la Madera, AIMA), Ecuador has approximately 15,000 hectares of balsa plantations. These plantations are divided into two categories. The first consists of small and medium-sized producers with plantations up to 40 hectares, with an average plantation size of less than 5 hectares. These producers sell their production to traders who aggregate large volumes for resale to processing-export companies. Ecuador maintains its position as the primary global supplier by complementing domestic production with balsa harvested in Peru to meet demand.

- Balsa wood is widely used across industries due to its lightweight characteristics and structural strength. In aerospace and aviation, it serves as a core material in sandwich composites for aircraft components, including interior panels and structural elements. The marine industry uses balsa wood in boat construction, specifically for deck cores and hull components, benefiting from its natural buoyancy and water resistance properties. The wind energy sector represents a major market for balsa wood, particularly in wind turbine blade manufacturing. China is the primary importer of balsa wood in the Asia Pacific region, while North America and Europe show increasing demand driven by growth in the aerospace, marine, and renewable energy sectors.

Balsa Wood Market Trends

Increasing Use For Wind Mill Turbines

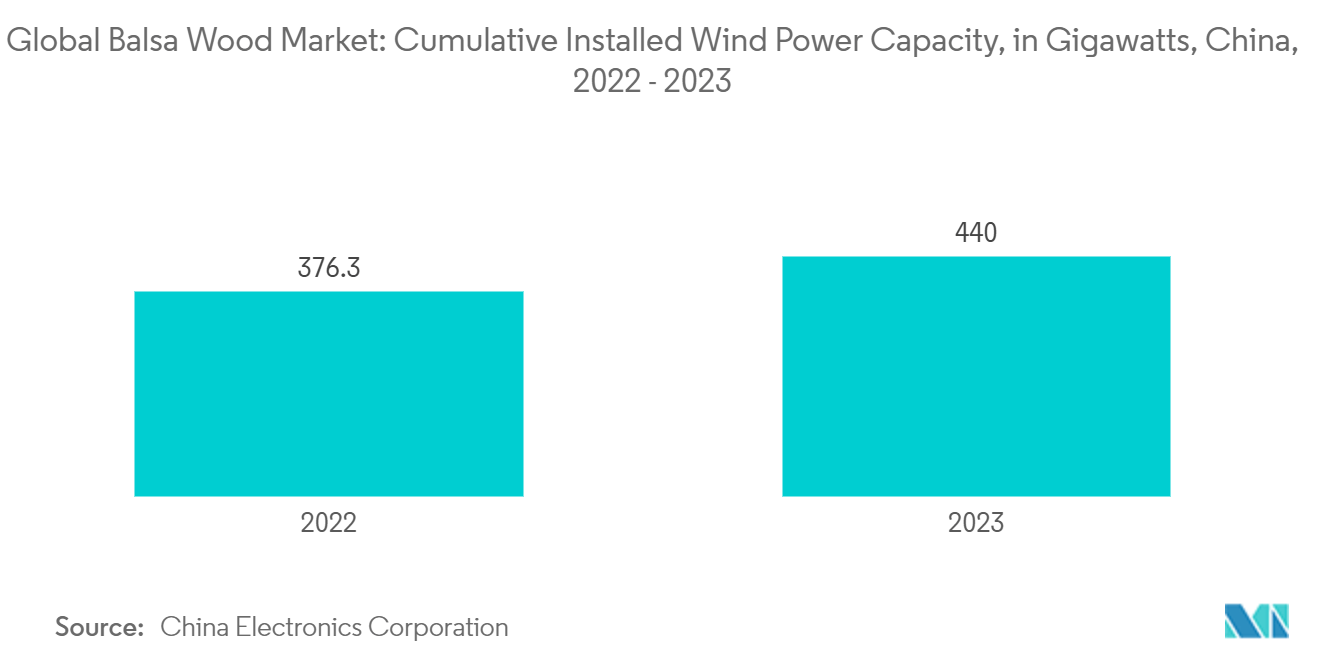

- The wind energy sector is a major consumer of balsa wood, primarily using it in wind turbine blade manufacturing. The expansion of wind power installations and increased focus on renewable energy sources drive market growth. Global demand for balsa wood has increased due to the worldwide transition from fossil fuels to wind energy. Balsa wood is a key core material for wind turbine blades because of its soft texture and lightweight properties. China is the largest market for balsa wood in wind turbine applications, as wind energy capacity continues to expand rapidly in the country. According to China Electronics Corporation, China's Cumulative Installed Wind Power Capacity reached 440 gigawatts in 2023.

- Other key markets for balsa wood include the European Union (EU), which imports over 20 percent of the balsa-sawn wood in international trade. The top five EU markets in 2023 included Denmark, Poland, Netherlands, Germany, and Italy. In March 2023, the 27 EU nations modified their 2030 renewable energy targets, raising them from 32% to a potential 45%, with an interim target of 42.5%. Additionally, the US government has set a target of achieving 100% clean electricity by 2035, which may increase the demand for balsa wood in wind turbine production. These factors are projected to increase the use of balsa wood in wind turbine manufacturing, thereby expanding the market in these countries.

Asia-Pacific Dominates The Market

- China stands out as the dominant player in the balsa wood market, both in the Asia Pacific region and globally. European Union publications highlight that China accounts for nearly 75% of balsa-sawnwood imports in international trade. This is largely due to China's status as the largest and fastest-growing producer of wind energy, coupled with its role as a turbine manufacturer for export. Under a Free Trade Agreement, China is solidifying its status as Ecuador's most significant trading partner. The China Electricity Council revealed that in 2023, China nearly doubled its utility-scale solar and wind power capacity additions compared to any prior year. This surge in wind power capacity aligns with China's ambition to achieve carbon neutrality by 2060. Initially, this growth was bolstered by policy and fiscal incentives, notably the National Renewable Energy Fund. While China has scaled back on the breadth of wind and solar development subsidies, its wind industry has become firmly established. It continues to thrive, with turbines actively being exported to the United States and Europe.

- The balsa wood market in Australia maintains steady demand, primarily from marine and wind energy applications. Australia has local players like Auszac Pty Ltd, which grows, manufactures, distributes, and retails balsa wood products. The Indian and Japanese markets show growth potential due to increased construction activities and renewable energy projects.

Balsa Wood Industry Overview

The Global Balsa Wood Market is fragmented with many small and large suppliers offering different types of products based of regional and stakeholders preferences. Key players include KJP Select Hardwoods Inc, Carbon-Core Corp., Schweiter Technologies AG (3A Composites Holding AG), Diab Group AB, and Balsa USA, Inc., among others. These industry players bolstered their market presence through increased partnerships and strategic expansions.

Balsa Wood Market Leaders

-

KJP Select Hardwoods Inc

-

Carbon-Core Corp.

-

Schweiter Technologies AG (3A Composites Holding AG)

-

Diab Group AB

-

Balsa Usa, Inc

- *Disclaimer: Major Players sorted in no particular order

Balsa Wood Market News

- December 2024: Researchers at Empa's Cellulose & Wood Materials lab in Switzerland are developing a new composite material derived from hardwood: luminous wood. These researchers have successfully created glow-in-the-dark balsa wood, opening avenues for technical applications and potential use in designer furniture or jewelry.

- January 2024: Researchers at Linköping University in Sweden are delving into the potential of wood to pave the way for more environmentally-friendly electronic devices. Their recent breakthrough involves crafting a transistor from balsa wood, hinting at promising prospects in the electronics sector.

Balsa Wood Industry Segmentation

The balsa tree, or Ochroma pyramidale, is a large, fast-growing species native to the Americas. Its soft and lightweight wood finds applications in crafts, notably in model aircraft. Due to its buoyancy, balsa wood serves a variety of purposes: from surfboards and buoys to fishing floats. Historically, it has also been a material of choice for life rafts and lifebelts.

The Global Balsa Wood Market is Segmented by Application (Aerospace and Defense, Wind Energy, Others), and Geography (North America, Europe, Asia-Pacific, South America, Africa). The Report Offers Market Sizing and Forecast in Value (USD).

| Application | Aerospace and Defense | ||

| Wind Energy | |||

| Others (Marine and Boats, Construction, Furniture) | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Spain | |||

| Russia | |||

| Rest of Europe | |||

| Asia-Pacific | India | ||

| China | |||

| Indonesia | |||

| Rest of Asia-Pacific | |||

| South America | Peru | ||

| Ecuador | |||

| Rest of South America | |||

| Africa | South Africa | ||

| Rest of Africa | |||

| Aerospace and Defense |

| Wind Energy |

| Others (Marine and Boats, Construction, Furniture) |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Spain | |

| Russia | |

| Rest of Europe | |

| Asia-Pacific | India |

| China | |

| Indonesia | |

| Rest of Asia-Pacific | |

| South America | Peru |

| Ecuador | |

| Rest of South America | |

| Africa | South Africa |

| Rest of Africa |

Balsa Wood Market Research FAQs

How big is the Balsa Wood Market?

The Balsa Wood Market size is expected to reach USD 176.85 million in 2025 and grow at a CAGR of 4.85% to reach USD 213.98 million by 2030.

What is the current Balsa Wood Market size?

In 2025, the Balsa Wood Market size is expected to reach USD 176.85 million.

Who are the key players in Balsa Wood Market?

KJP Select Hardwoods Inc, Carbon-Core Corp., Schweiter Technologies AG (3A Composites Holding AG), Diab Group AB and Balsa Usa, Inc are the major companies operating in the Balsa Wood Market.

Which is the fastest growing region in Balsa Wood Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Balsa Wood Market?

In 2025, the Europe accounts for the largest market share in Balsa Wood Market.

What years does this Balsa Wood Market cover, and what was the market size in 2024?

In 2024, the Balsa Wood Market size was estimated at USD 168.27 million. The report covers the Balsa Wood Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Balsa Wood Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.