Brazil Plastic Packaging Market Analysis

The Brazil Plastic Packaging Market size is worth USD 17.25 Billion in 2025, growing at an 1.47% CAGR and is forecast to hit USD 18.56 Billion by 2030.

- The utilization of plastic packaging has emerged as a crucial component for numerous enterprises, owing to its modern design that facilitates innovative packaging solutions. The swift growth of the food and beverage, personal care, and pharmaceutical industries, along with the increasing prevalence of organized and online retail globally, is anticipated to drive market expansion. A heightened emphasis on advanced packaging solutions, combined with the growth and development of the packaging sector, is a significant factor contributing to the rising demand for plastic packaging.

- Plastic packaging is an exceptionally lightweight and highly space-efficient option for storage. Its minimal storage requirements and ease of mobility significantly reduce the carbon footprint linked to transportation. Furthermore, it protects items from contamination, spoilage, and damage throughout the shipping and storage processes. The lightweight nature and resealable features enhance convenience for consumers when using and storing products. Moreover, the increasing prevalence of e-commerce brands is driving the demand for robust and protective plastic packaging to guarantee the secure delivery of goods to customers.

- According to ITA, Brazil is the largest economy in Latin America. The country accounted for a swift e-commerce growth rate of 14.3%, which is projected to surpass the value of USD 200 billion by 2026. The growth rate was largely a fallout of the COVID-19 pandemic, during which the Brazilian government utilized digital wallets for pandemic relief, granting millions their inaugural access to online retailers. Brazilian consumers have swiftly embraced the convenience and unique offers provided by e-commerce, facilitating the growth of online retail. As e-commerce sales in the region continue to rise, they present lucrative opportunities for players in the market.

- In Brazil, the demand for plastic packaging is propelled by industries such as personal care and cosmetics. Kao Corporation highlighted Brazil's prominence, ranking as the fourth-largest global market for beauty and personal care. Driven by shifting consumption trends among the rising middle-income demographic and Gen Z, the market is poised for a 7.7% annual growth rate. Data from IBGE, referencing the Brazilian Association of the Personal Hygiene, Perfumery and Cosmetics Industry (ABIHPEC), revealed that annual expenditures have consistently surpassed BRL 100 billion (USD 17.08 billion) over the last decade. Such substantial figures are expected to boost the demand for various types of plastic packaging solutions significantly.

- Plastic is expected to maintain its status as a favored material for consumer packaging solutions, representing a substantial portion of the consumer packaging sector in Brazil. Similar to other nations, Brazil is enhancing its waste collection infrastructure, which is crucial for generating high-quality post-consumer resin (PCR) that can be reintegrated into the manufacturing process. This initiative is vital for establishing a circular economy for plastic packaging. Furthermore, the Brazilian government has initiated legislation aimed at phasing out single-use plastics nationwide. These developments are likely to stimulate innovations within the sustainable plastic packaging market.

- Low-density polyethylene (LDPE), polypropylene (PP), high-density polyethylene (HDPE), and polyethylene terephthalate (PET) are among the most commonly utilized materials in the production of various items, including bottles, jars, trays, containers, wraps, films, and pouches. These materials are favored due to their cost efficiency, lightweight nature, versatile functionalities, and robust barrier properties against moisture. The increasing demand for sustainable packaging solutions is encouraging manufacturers to incorporate recycled plastic resins in the creation of these products.

- Several companies are investing and operating significantly in the region, helping them gain a competitive edge in the market. For instance, in the fiscal year 2023, Amcor capitalized on its distinctive position by collaborating with key stakeholders to enhance the recyclability of its packaging solutions. In May 2023, the Amcor Flexibles manufacturing facility in Londrina, Brazil, achieved the International Sustainability and Carbon Certification Plus (ISSC Plus) status, which facilitated the integration of advanced recycled materials across its product offerings.

- The elasticity of polyethylene (PE) packaging may diminish with extended use, leading to compression or deformation of the contained product. Furthermore, the physical characteristics of PE plastic materials, including films, such as reduced elasticity and an inability to satisfy the demands of applications that require resistance to fire and aggressive chemicals, are expected to pose considerable challenges to the adoption of PE packaging throughout the forecast period.

Brazil Plastic Packaging Market Trends

The PE Segment is Expected to Hold a Significant Market Share

- Polyethylene (PE), recognized for its flexibility and recyclability, is widely utilized across various industries. Its cost-effectiveness and versatility render it a favored choice for packaging and protective materials. Its adaptability has contributed to the expansion of its usage in Brazil, particularly in plastic bags, wraps, and a range of packaging solutions catering to all end-user segments. Additionally, the rising investments in industries such as food and beverages are anticipated to further propel market growth.

- With the increasing population of Brazil, the necessity for effective transportation, safeguarding, and preservation of products from their source to the consumer's location has become critical. This requirement has driven innovations in processing and preservation methods, resulting in the growth of the market. According to Brazilian Plastics, Brazil is the seventh-largest consumer of plastics globally. Braskem, a key market leader, has established a significant presence in Brazil's resin market. Furthermore, the plastics conversion industry in Brazil comprises approximately 11,000 converters.

- The expansion and advancement of the packaging industry are expected to further stimulate the growth of the PE segment. The Brazilian Flexible Plastic Packaging Industry Association (ABIEF) reported that per capita consumption of plastic packaging in Brazil increased by 2.5% in 2023, reaching an average of 10.6 kilograms per individual annually. The food industry is the primary consumer of plastic packaging in the nation. In 2023, the gross production value of Brazil's packaging industry was BRL 144.4 billion (USD 25.70 billion), an increase from BRL 123.20 billion (USD 21.93 billion) in 2022.

- In July 2023, Braskem successfully completed a 30% expansion of its bio-based ethylene facility, following an investment of USD 87 million in Rio Grande do Sul, Brazil. This expansion increased the plant's capacity from 200,000 to 260,000 tons annually, strategically addressing the rising demand for sustainable solutions. Braskem's bio-based ethylene not only contributes to product development but also plays a crucial role in capturing CO2 from the atmosphere. With an ambitious goal, Braskem intends to elevate its biopolymer production to one million tons by 2030 and achieve carbon neutrality by 2050.

- End-user industries such as cosmetics and personal care are expected to drive the demand for PE packaging solutions in Brazil. The growing investments in boosting the production of personal care products across the region are expected to drive the segment’s growth. In April 2024, MercadoLibre announced its intention to invest BRL 23 billion (USD 4.6 billion) in the Brazilian market. This investment represented a significant 21.1% increase compared to the previous year, highlighting the online retailer's dedication to strengthening its presence in this vital market. Additionally, as polyethylene packaging becomes increasingly important in the beauty industry, offering reusable, resealable, and easily dispensable options, the rising investments in the industry are expected to enhance demand.

- The increasing consumer preferences for personal care products are anticipated to boost the demand for aesthetically pleasing packaging, consequently propelling the growth of this segment. As reported by the Brazilian Association of the Toiletries, Perfumery, and Cosmetics Industry (ABIHPEC), Brazil's exports of personal care items surged by more than 17% quarter-over-quarter in the first quarter of 2023. This upward trend in personal care product exports is likely to generate growth opportunities for manufacturers of consumer packaging.

- World Bank indicated that the agricultural sector's share of Brazil's gross domestic product (GDP) rose from 5.77% in 2022 to 6.24% in 2023. Beyond their primary function in packaging, polyethylene (PE) materials are widely utilized as greenhouse films within the sector. Furthermore, the initiatives launched by the Ministry of Agriculture in 2023, which focus on decreasing carbon emissions in agriculture and enhancing sustainability, are anticipated to stimulate the demand for PE packaging in greenhouse farming. These critical elements are also projected to create significant market opportunities.

The Food Segment is Expected to Hold a Significant Market Share

- Plastic packaging is extensively utilized in the food and beverage industry. Its remarkable moisture resistance and capacity to preserve freshness make it suitable for a wide range of products, including fresh fruits and vegetables, frozen items, and liquids. According to the USDA, Brazil's gross domestic product (GDP) reached USD 2.17 trillion in 2023, reflecting a growth of 2.9% compared to the previous year, with significant contributions from the food and beverage industry. The anticipated increase in production capacity and export levels within this industry is expected to drive the demand for plastic packaging.

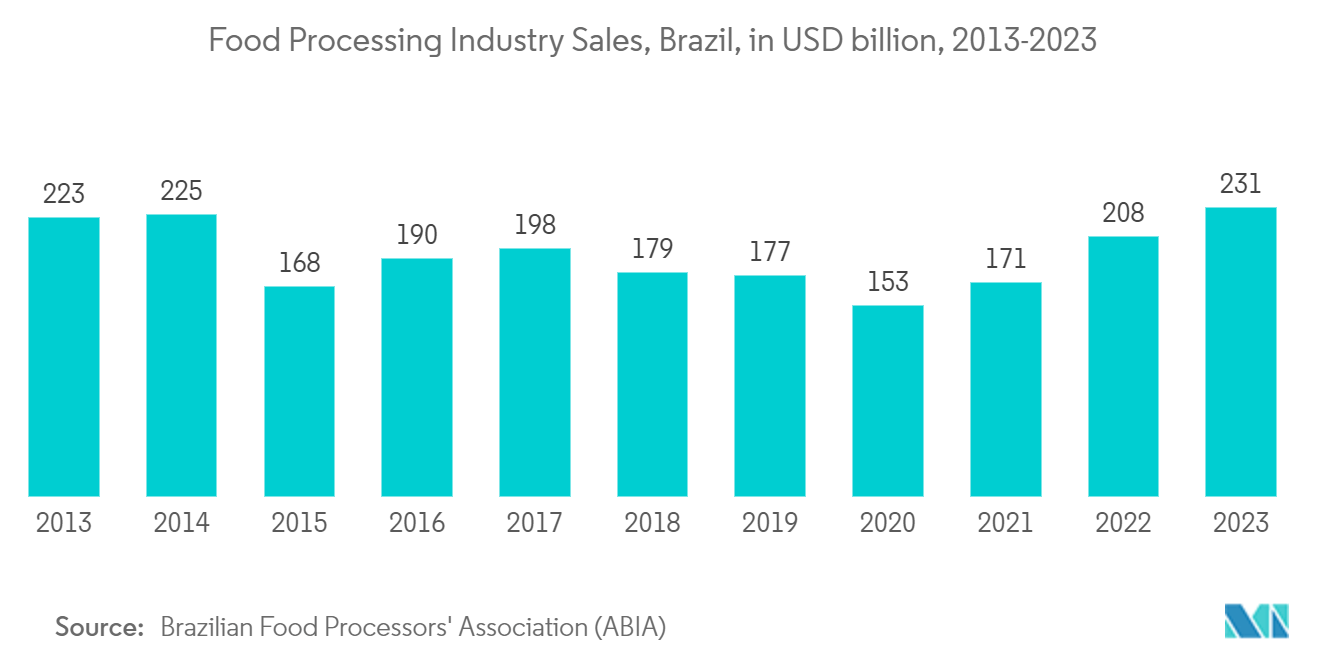

- The food industry in Brazil is experiencing consistent growth, propelled by swift urbanization and an increasing preference for packaged food products. According to the Brazilian Food Processors Association (ABIA), the food processing industry generated revenues amounting to USD 231 billion in 2023, marking a 7.2% rise compared to the prior year. This revenue represented 10.8% of the country's GDP. The industry comprises over 38,000 businesses, primarily small and medium-sized enterprises. These significant developments within the industry are expected to generate considerable market opportunities.

- The perceptions of Brazilian consumers regarding food packaging have undergone considerable transformation in recent years. This change is largely influenced by the increasing awareness of environmental issues, health factors, and evolving lifestyle trends. A detailed report entitled “Percepção do consumidor com relação à embalagem de alimentos: tendências” explored the shifting preferences in food packaging among Brazilian consumers. Consumers are increasingly leaning toward products that feature environmentally friendly packaging, encompassing materials that are biodegradable, recyclable, or derived from sustainable sources.

- Moreover, the report suggested that, as the significance of sustainability increasingly resonates with consumers, food packaging practices are anticipated to develop further. Manufacturers who proactively adapt to these trends and emphasize consumer preferences are likely to thrive in a dynamic market environment. Consequently, food manufacturers are reassessing their packaging designs to meet the demands of consumers who prioritize convenience and accessibility. The report indicated that Brazil will remain a focal point for investment by packaging companies like Novelis, Duravant, and SIG.

- The growth of the segment can be attributed to the increased awareness among Brazilian consumers about healthy eating habits, a rising demand for organic and sustainable products, and a growing consciousness regarding consumer health. Although the GDP growth forecast for 2024 remains conservative, the outlook for the food industry appears optimistic. ABIA anticipates a growth rate of 1.2% in the coming year despite persistent challenges associated with elevated production costs.

- Similarly, the growing investments by leading food companies in the region to improve production capabilities are expected to stimulate demand for packaging materials. In December 2023, Nestlé announced its plan to invest USD 1.2 billion in the production of food and beverages in Brazil. The company indicated that various investments will be executed from 2023 to 2025. These efforts were designed to foster "business growth, portfolio transformation, and operational efficiency" in its food offerings within the country. The allocated funds will focus on increasing production capacity and promoting "innovation in products and packaging."

- The use of various plastic packaging items, such as bottles and jars, is expected to experience considerable growth in the region's milk industry. According to FAO, Brazil, which is one of the foremost milk producers worldwide, will generate significant demand for polyethylene packaging films. According to the USDA, milk production increased by roughly 4.3% in 2023, reaching a total of 24.7 million metric tons (MMT). In 2024, milk production is expected to increase by approximately 1.2%, culminating in a total of 25 MMT.

Brazil Plastic Packaging Industry Overview

The Brazilian Plastic Packaging Market is highly competitive and has several major players. A few of the players enjoy better market goodwill and extended geographical recognition and presence. The major players, who have a relatively prominent share of the market, are focusing on expanding their customer base across different end-user industries. Some of the major players operating in the market include DS Smith PLC, Amcor Limited, ES-Plastic GmbH, Bemis Company Inc., Anchor Packaging Ltd, and Berry Global Inc.

Brazil Plastic Packaging Market Leaders

-

DS Smith PLC

-

Amcor Limited

-

ES-Plastic GmbH

-

Bemis Company, Inc.

-

Anchor Packaging Ltd

- *Disclaimer: Major Players sorted in no particular order

Brazil Plastic Packaging Market News

- July 2024: Termotécnica introduced its DaColheita Bio packaging, signifying the company's first foray into the use of alternative materials sourced from renewable and biodegradable origins. This launch was a strategic initiative aimed at diversifying its material portfolio, with the initial offerings consisting of horticultural trays crafted from sugar cane bagasse, a widely available agricultural byproduct in Brazil that is also compostable.

- March 2024: Amcor collaborated with Stonyfield Organic, a yogurt manufacturer, and Cheer Pack to introduce the inaugural all-polyethylene (PE) spouted pouch. This groundbreaking packaging offers a sustainable alternative while maintaining high performance standards. The innovative pouch supersedes the previous multi-laminate structure used by Stonyfield Organic for its YoBaby refrigerated yogurt, featuring a more environmentally responsible design. The packaging incorporates Amcor’s AmPrima Plus, an all-PE film engineered to comply with the APR Design Guide for recyclability.

- January 2024: Berry Global Group Inc. introduced a customizable rectangular Domino bottle made from up to 100% post-consumer recycled (PCR) plastic, targeting the beauty, home, and personal care industries. The 250 ml Domino bottle features a 75 ml wide front face and customizable side panels, enabling printing on all four sides of the container. This design maximizes branding opportunities, allowing companies to develop distinctive packaging that stands out on store shelves.

Brazil Plastic Packaging Industry Segmentation

Plastic packaging encompasses the utilization of plastic materials for the containment, safeguarding, and transportation of a wide range of products. This form of packaging enables the protection, preservation, storage, and transport of goods through various methods.

The Brazilian plastic packaging market is segmented by material (polyethylene (PE), bi-orientated polypropylene (BOPP), cast polypropylene (CPP), polyvinyl chloride (PVC), ethylene vinyl alcohol (EVOH), and other material types), packaging type (rigid and flexible), product (bottles and jars, tub, cup bowls and trays, intermediate bulk containers, pouches, and others), and end user (food, beverage, cosmetics and personal care, and others). The market sizes and forecasts are provided in terms of value (USD) for all the above segments.

| By Material | Polyethene (PE) |

| Bi-orientated Polypropylene (BOPP) | |

| Cast polypropylene (CPP) | |

| Polyvinyl Chloride (PVC) | |

| Ethylene Vinyl Alcohol (EVOH) | |

| Other Material Types | |

| By Packaging Type | Rigid |

| Flexible | |

| By Product | Bottles and Jars |

| Tub, Cup Bowls and Trays | |

| Intermediate Bulk Containers | |

| Pouches | |

| Others | |

| By End-User | Food |

| Beverage | |

| Cosmetics and Personal Care | |

| Others |

| Polyethene (PE) |

| Bi-orientated Polypropylene (BOPP) |

| Cast polypropylene (CPP) |

| Polyvinyl Chloride (PVC) |

| Ethylene Vinyl Alcohol (EVOH) |

| Other Material Types |

| Rigid |

| Flexible |

| Bottles and Jars |

| Tub, Cup Bowls and Trays |

| Intermediate Bulk Containers |

| Pouches |

| Others |

| Food |

| Beverage |

| Cosmetics and Personal Care |

| Others |

Brazil Plastic Packaging Market Research FAQs

How big is the Brazil Plastic Packaging Market?

The Brazil Plastic Packaging Market size is worth USD 17.25 billion in 2025, growing at an 1.47% CAGR and is forecast to hit USD 18.56 billion by 2030.

What is the current Brazil Plastic Packaging Market size?

In 2025, the Brazil Plastic Packaging Market size is expected to reach USD 17.25 billion.

Who are the key players in Brazil Plastic Packaging Market?

DS Smith PLC, Amcor Limited, ES-Plastic GmbH, Bemis Company, Inc. and Anchor Packaging Ltd are the major companies operating in the Brazil Plastic Packaging Market.

What years does this Brazil Plastic Packaging Market cover, and what was the market size in 2024?

In 2024, the Brazil Plastic Packaging Market size was estimated at USD 17.00 billion. The report covers the Brazil Plastic Packaging Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Brazil Plastic Packaging Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Brazil Plastic Packaging Industry Report

Statistics for the 2025 Brazil Plastic Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Brazil Plastic Packaging analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.