Canada Cold Chain Logistics Market Analysis

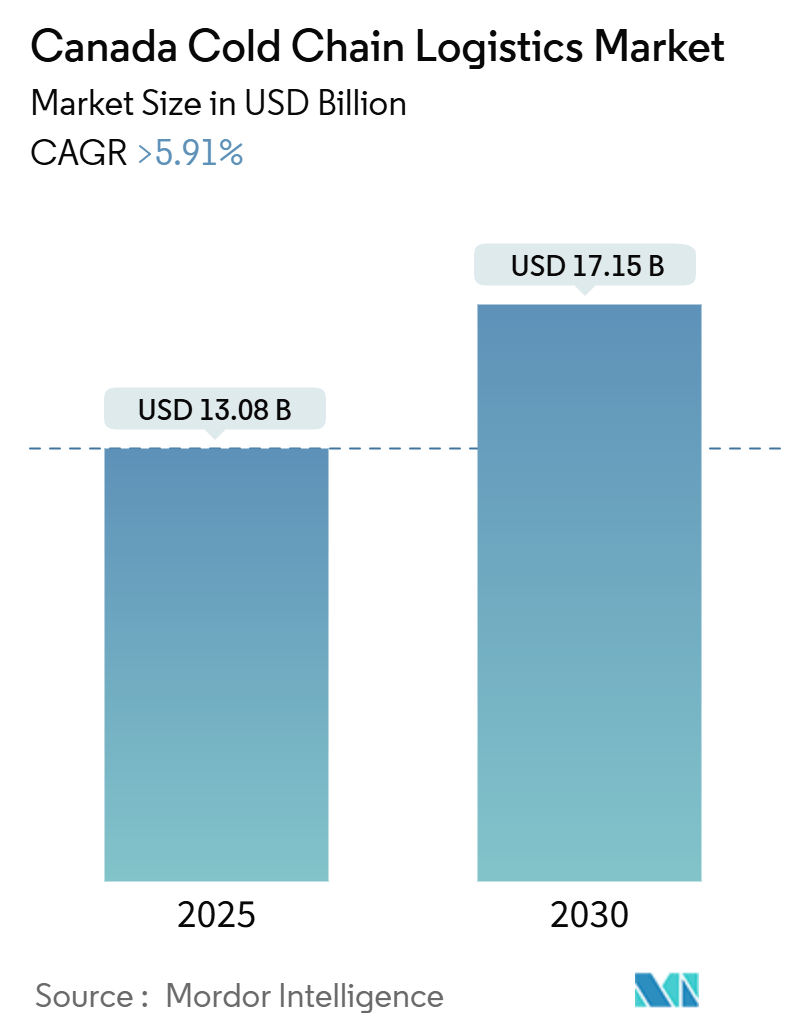

The Canada Cold Chain Logistics Market size is estimated at USD 13.08 billion in 2025, and is expected to reach USD 17.15 billion by 2030, at a CAGR of greater than 5.91% during the forecast period (2025-2030).

- Cross-border supply chains play a pivotal role in Canada's food sector, with substantial volumes of food and agricultural products crossing the Canadian-U.S. border daily. The U.S. represents over 50% of the value of all Canadian agricultural and agrifood exports while accounting for roughly 60% of the value of Canadian food imports.

- The U.S. stands as a net importer of Canadian beef and cattle, and Canada heavily depends on seasonal fresh produce imports from both the U.S. and Mexico. Given the perishable nature of these goods, cold chain logistics are vital for most imports and exports. Annually, the U.S. imports fresh produce valued at over USD 22 billion from more than 125 nations. Notably, Mexico and Canada contribute 77% and 11%, respectively, to the U.S.'s total fresh fruit and vegetable imports. Given the finite shelf lives of fresh produce, effective transportation is paramount.

- Globally, the Food Supply Cold Chain (FSCC) isn't evenly distributed. Canada boasts a robust FSCC, adept at maintaining optimal temperatures for perishable goods. However, interruptions in the FSCC are not uncommon. In Canada, 5% of avoidable food losses occur during distribution, 12% at retail, and 21% at the consumer level. Inadequate temperature maintenance throughout the FSCC is believed to be a primary culprit for these losses. Canada's vast landmass complicates temperature maintenance, especially given its sizable urban population and dispersed rural and remote communities. While road transportation primarily serves urban deliveries, air transport is essential for reaching remote areas, notably Northern villages.

- Canada's multitude of water ports presents a significant global advantage. Ocean ports on the Pacific and Atlantic coasts provide access to Asian and European markets, respectively. Additionally, the St. Lawrence Seaway enhances port services to various Canadian and U.S. locations within the Great Lakes. The Great Lakes further bolster intermodal logistics for Canada's central provinces and the U.S. With its superior port availability, infrastructure, and accessibility, Canada stands out as a leader in both importing and exporting. The country's unique location, natural assets, and logistical prowess facilitate global product distribution.

- Canada is a prominent exporter of fresh, chilled, and frozen meats, particularly bovine products and pork, alongside seafood. Due to its colder climate limiting local production, Canada imports a majority of its fruits and vegetables. The state—whether chilled or frozen—of these imports and exports varies by product. For instance, both imported and exported bovine and salmon products are typically fresh or chilled, whereas imports of pork and exports of crab and lobster are predominantly frozen.

Canada Cold Chain Logistics Market Trends

Rise in Shipments of meat products Driving the Demand for Cold Chain Logistics Services

Canada's meat industry is pivotal in the nation's economy, generating substantial annual revenues. The country produces diverse meat products, including beef, veal, pork, and lamb. Canadian firms offer various products, from fresh and frozen meats to sausages and deli items.

Globally, Canada ranks among the top beef, pork, and chicken producers. Alberta, a Canadian province, is the leading beef producer, accounting for approximately 40% of the nation's total beef output.

While Canadians' meat consumption per capita (39.4 kg in 2018) surpassed the global average, it lagged behind other North American regions. Forecasts indicated an uptick to 40.7 kg per person by 2023. The economic ramifications of meat consumption are significant, with the beef sector alone injecting USD 24 billion annually into Canada's economy.

Canada's beef sector plays a crucial role in bolstering the nation's economy, contributing billions each year. The industry encompasses a wide range of meats, from beef and veal to more niche offerings like rabbit and bison.

Looking ahead, Canada's meat industry is poised for both financial growth and increased production. Notably, Canada's growth rate is anticipated to outpace that of the United States, signaling a promising trajectory for the industry.

Increased Investments Canada's Warehousing Market

NewCold, a rapidly expanding leader in automated warehousing and cold chain logistics, unveiled plans in April 2024 to invest USD 222 million and generate over 50 new jobs in Alberta’s agri-food sector. With backing from Invest Alberta and a grant from the Government of Alberta, NewCold is set to establish a state-of-the-art food storage facility in Coaldale, southern Alberta. This move bolsters the region's status as Canada's premier food corridor and aims to stimulate long-term economic growth.

NewCold has pinpointed Southern Alberta as the prime site for its advanced cold storage, aligning with the region's burgeoning food processing industry. This facility will serve as a vital infrastructure, distributing food nationwide and solidifying the area’s reputation as an agri-food corridor.

Furthermore, NewCold is channeling investments into enhancing rail connectivity with Canadian Pacific Kansas City (CPKC), facilitating smoother and more secure product exports. Specifically, funds will be directed towards municipal rail lines, transforming Coaldale into a prominent export hub.

Beyond the 50 permanent jobs, NewCold is eyeing collaborations with post-secondary institutions to craft training programs, diversifying the local talent pool. Additionally, the facility's construction phase is set to generate up to 200 jobs.

Alberta agencies are fostering robust partnerships, ensuring businesses receive the necessary support. Invest Alberta played a pivotal role in linking NewCold with incentives and the local business ecosystem. The Government of Alberta, through its Innovation and Growth Fund, allocated a grant of USD 2.1 million to bolster NewCold’s expansion. Meanwhile, the Town of Coaldale expedited NewCold’s operations and commits to ongoing strategic support, ensuring the company benefits from a competitive edge, skilled workforce, and essential connectivity.

NewCold’s cutting-edge warehouse will leverage proprietary technology to uphold food safety and quality, boasting a 50% energy efficiency edge over conventional cold stores. This technological investment underscores their commitment to sustainable value chains and a vision of resource conservation.

The establishment of NewCold’s facility in Alberta is a strategic move to meet the surging demand for cold storage and logistics. This initiative stands to benefit local producers, offering them avenues to expand their businesses while prioritizing food safety.

NewCold is gearing up to kickstart construction, procure equipment, and commence hiring. The ambitious timeline envisions surpassing 50 onsite employees by the close of 2026.

Canada Cold Chain Logistics Industry Overview

Canada's cold chain logistics market landscape is fragmented in nature with a mix of global and local players. Most of the imports and exports products need to be monitored in refrigerated transports. Due to technological development, companies are growing their market presence by developing new methods to manage cold chain logistics. Some of the strong players in the country are Americold Logistics, Congebec, Lineage Logistics Ltd and Conestoga amongst others. Canada is uniquely positioned to take advantage of emerging trade opportunities from developed economies and to serve as a gateway to North America. The cold chain logistics network in the country is well-developed, with a wide range of services, industries rely on transportation and logistics networks to deliver rapid, integrated, and secure solutions to leverage their global supply chains. The market started reviving from the pandemic by growing positively post-pandemic.

Canada Cold Chain Logistics Market Leaders

-

Americold Logistics

-

Lineage Logistics Ltd

-

Congebec Logistics, Inc.

-

Confederation Freezers

-

Conestoga Cold Storage

- *Disclaimer: Major Players sorted in no particular order

Canada Cold Chain Logistics Market News

- January 2023: Cargill finalized its acquisition of Owensboro Grain Company, a fifth-generation family-owned soybean processing facility and refinery in Owensboro, Kentucky. By integrating Owensboro Grain Company, Cargill aims to bolster its North American oilseeds network capacity, addressing the surging demand for oilseeds in food, feed, and renewable fuel markets.

- September 2022: McCain Foods sealed the deal to acquire Scelta Products, a Netherlands-based frozen food producer. This acquisition, finalized on September 8, 2022, significantly bolsters McCain's frozen vegetable appetizer market portfolio.

- January 2022: CHS Inc. and Cargill, two leading agribusinesses in the U.S., revealed plans to broaden their joint venture, TEMCO LLC. They are incorporating Cargill's export grain terminal situated in Houston, Texas. This strategic addition enhances TEMCO's export capabilities, enabling smoother shipping access for grains, oilseeds, and byproducts via the port of Houston.

Canada Cold Chain Logistics Industry Segmentation

The technology and mechanism that allows for the secure delivery of temperature-sensitive goods and items along the supply chain are known as cold chain logistics. Any product that is perishable or is branded as such would almost certainly need cold chain management. Foods including meat and fish, produce, medical supplies, and pharmaceuticals could all fall under this category.

The Canadian Cold Chain Logistics Market is segmented by Service (Storage, Transportation, and Value-added Services), by Temperature Type (Chilled, Frozen, and Ambient), and by End User (Horticulture, Dairy Products, Meats, Fish, Poultry, Processed Food Products, Pharma, Life Sciences, and Chemicals, and Other Applications). A comprehensive background analysis of the Canadian Cold Chain Logistics Market covering the current market trends, restraints, technological updates, and detailed information on various segments and the competitive landscape of the industry. The report offers the market size and forecasts in values (USD billion) for all the above segments.

| By Service | Storage |

| Transportation | |

| Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.) | |

| By Temperature | Chilled |

| Frozen | |

| Ambient | |

| By End User | Horticulture (Fresh Fruits & Vegetables) |

| Dairy Products (Milk, Ice-cream, Butter, etc.) | |

| Meats, Fish, Poultry | |

| Processed Food Products | |

| Pharma, Life Sciences, and Chemicals | |

| Other End Users |

| Storage |

| Transportation |

| Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.) |

| Chilled |

| Frozen |

| Ambient |

| Horticulture (Fresh Fruits & Vegetables) |

| Dairy Products (Milk, Ice-cream, Butter, etc.) |

| Meats, Fish, Poultry |

| Processed Food Products |

| Pharma, Life Sciences, and Chemicals |

| Other End Users |

Canada Cold Chain Logistics Market Research FAQs

How big is the Canada Cold Chain Logistics Market?

The Canada Cold Chain Logistics Market size is expected to reach USD 13.08 billion in 2025 and grow at a CAGR of greater than 5.91% to reach USD 17.15 billion by 2030.

What is the current Canada Cold Chain Logistics Market size?

In 2025, the Canada Cold Chain Logistics Market size is expected to reach USD 13.08 billion.

Who are the key players in Canada Cold Chain Logistics Market?

Americold Logistics, Lineage Logistics Ltd, Congebec Logistics, Inc., Confederation Freezers and Conestoga Cold Storage are the major companies operating in the Canada Cold Chain Logistics Market.

What years does this Canada Cold Chain Logistics Market cover, and what was the market size in 2024?

In 2024, the Canada Cold Chain Logistics Market size was estimated at USD 12.31 billion. The report covers the Canada Cold Chain Logistics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Canada Cold Chain Logistics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Canada Cold Chain Logistics Industry Report

Statistics for the 2025 Canada Cold Chain Logistics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Canada Cold Chain Logistics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.