Electric Vehicle Financing Market Size

Electric Vehicle Financing Market Analysis

The Electric Vehicle Financing Market size is estimated at USD 62.53 billion in 2025, and is expected to reach USD 112.94 billion by 2030, at a CAGR of 12.55% during the forecast period (2025-2030).

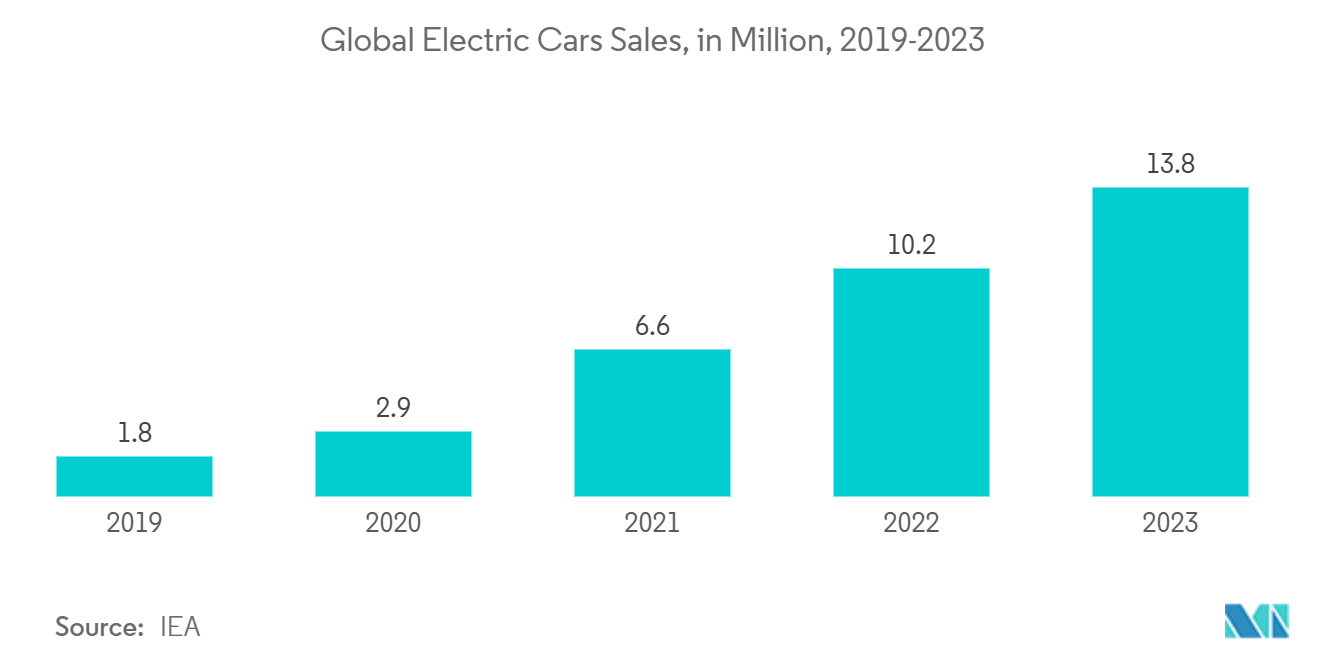

Government incentives, heightened environmental awareness, and technological strides are propelling the electric vehicle (EV) sector's rapid expansion. Enhancements such as extended battery range, quicker charging, declining prices, and lower operating costs have positioned EVs as a compelling alternative to traditional gas-powered vehicles, further energizing the sector's growth.

Electric cars, while gaining popularity, often carry a higher upfront purchase price compared to traditional petrol vehicles. Although running costs for electric cars tend to be significantly lower over time, the initial price tag poses a challenge for many potential buyers. However, electric car financing emerges as a viable solution to this hurdle. With the rising adoption of electric vehicles, the demand for electric vehicle financing is set to surge, propelling the market forward.

Growing concerns over air pollution and urban congestion have fueled the demand for electric vehicles (EVs), especially as cities grapple with these challenges. With a compact design and enhanced maneuverability, EVs are increasingly favored in bustling urban settings. Furthermore, as populations swell, so does the appetite for EVs, bolstered by supportive government initiatives and tax policies in numerous countries. For instance,

- China, over half of the world's electric cars, has already surpassed its 2025 target for new energy vehicle (NEV) sales, solidifying its status as a global leader in the electric vehicle (EV) arena. In a bid to further amplify domestic sales, China has rolled out an extension of its tax exemption policy for NEVs. Originally slated to conclude in 2023, this tax break will now be in effect until 2027. This move underscores China's dedication to nurturing its pivotal EV industry. Here, we unpack the policy announcement and its ramifications for the sector.

- As the population growth does contribute to rising electricity demand, the widespread adoption of electric vehicles will further intensify this demand. For instance, as per the recent report published by NITI Aayog the overall outlook for EV volumes in India is optimistic, with projections indicating a growth to 30-35 lakh units by 2026, primarily driven by increased adoption in the 2W segment.

Various EV makers are collaborating with market vendors, driven by these growth factors. For example, in September 2023, L&T Finance partnered with Ather Energy, an electric vehicle manufacturer. Together, they unveiled a financing arrangement enabling customers to secure up to 100 percent financing, contingent on the loan-to-value (LTV) of Ather's vehicles. The loan amount, anchored to the on-road price, will fluctuate based on the creditworthiness of each individual customer. Such collaborations are expected to push the market forward in the future.

Electric Vehicle Financing Market Trends

Government Policies And Incentives Are Set To Propel The Market.

Government policies have played a pivotal role in the rise of electric vehicles (EVs). Over the past decade, the government has rolled out various initiatives to promote EV adoption, including tax incentives for EV owners and the establishment of public EV charging infrastructure.

Despite the allure of electric vehicles (EVs), their high upfront costs and limited financing options have hindered widespread adoption. In response, the governments of many countries has rolled out a series of incentives and policies to promote EV usage.

o In India, One of the flagship initiatives is the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) program. By providing financial incentives to EV buyers, FAME II effectively reduces the initial purchase price. This initiative has not only spurred a surge in EV demand but has also expanded the financing options available to potential buyers.

Furthermore, the government has unveiled subsidies aimed at bolstering EV charging infrastructure, thereby promoting electric vehicle adoption. Through this initiative, financial incentives are extended to both individuals and companies for establishing EV charging stations. As a result, the surge in charging infrastructure availability has spurred a heightened demand for EVs. This uptick in demand, in turn, has expanded the financing options accessible to prospective EV buyers.

- As per the International Trade Administration, Germany's government has set an ambitious target: by 2030, the nation will boast one million fully operational and accessible charging points for electric vehicles (EVs). Over the past ten years, both federal and state governments have rolled out numerous strategic initiatives and funding programs to bolster this vision. By 2023, Germany had made significant strides, boasting approximately 116,000 public charging points. These points collectively offered an impressive installed charging capacity of 5.2 gigawatts (GW), marking a 30% increase from the previous year.

Government initiatives and policies are increasingly supporting the adoption of electric vehicles (EVs). This backing is poised to bolster EV sales, subsequently driving demand in the electric vehicle financing market.

Asia-Pacific region will drive the market

Electric vehicles (EVs) are reshaping economies and power dynamics across the Asia-Pacific region. China stands at the forefront, dominating both production and sales, as new EV factories emerge throughout Asia. Meanwhile, emerging economies leverage their late-developer status, channeling massive investments, strategic subsidies, and expansive fiscal policies into the EV sector to bolster their economic clout. This push is further intensified by regional competition for critical minerals and a tussle between traditional auto manufacturers and EV newcomers, driving a technological upheaval in green tech.

Driven by a rising global demand for personal vehicles and a shift towards cleaner technologies, the passenger car segment is fueling the growth of the electric vehicle financing market. With heightened environmental awareness among consumers and stricter emissions regulations from governments, automakers face mounting pressure to boost fuel efficiency and cut carbon emissions in their passenger vehicles. This has spurred notable advancements in electric vehicle design, evolving from enhanced internal combustion engines (ICEs) to hybrids and fully electric models, all crafted to align with contemporary efficiency benchmarks and environmental priorities. As sales of passenger cars surge, so does the demand for electric vehicle financing, propelling the market forward.

- For instance, As of December 2024, India's electric vehicle (EV) industry, buoyed by a 26.5% year-on-year sales surge, recorded sales of 1.94 million units, as per Vahan data from the Ministry of Road Transport and Highways (MoRTH). This uptick from 1.5 million units in 2023 has pushed the nation's overall EV penetration to 7.46%, up from 6.39% the 2023

As electric vehicle (EV) sales surge, banks are offering EV loans at more favorable interest rates compared to those for internal combustion engine (ICE) vehicles. In response, many banks are teaming up with automakers, not only to finance the production of EVs but also to extend loans directly to customers, bolstering the financing landscape in the EV sector. For instance,

- In 2024, Wardwizard Innovations & Mobility Ltd, known for its electric vehicle brands Joy e-bike and Joy e-rik, forged a strategic alliance with Mufin Green Finance Ltd. Mufin, a non-banking financial company (NBFC), specializes in loans for electric three-wheelers. Through this partnership, the duo seeks to offer customized financing solutions for Wardwizard's L3 Passenger and L5 Cargo electric three-wheelers, making them more accessible to customers in India.

- In 2024, GT Force, a prominent player in the electric two-wheeler arena, has teamed up with CASHe Green. CASHe Green is the e-two-wheeler financing arm of CASHe, a leading AI-driven credit platform in India. This collaboration seeks to simplify the financing process for GT Force's popular models, including GT Vegas and GT Ryd Plus.

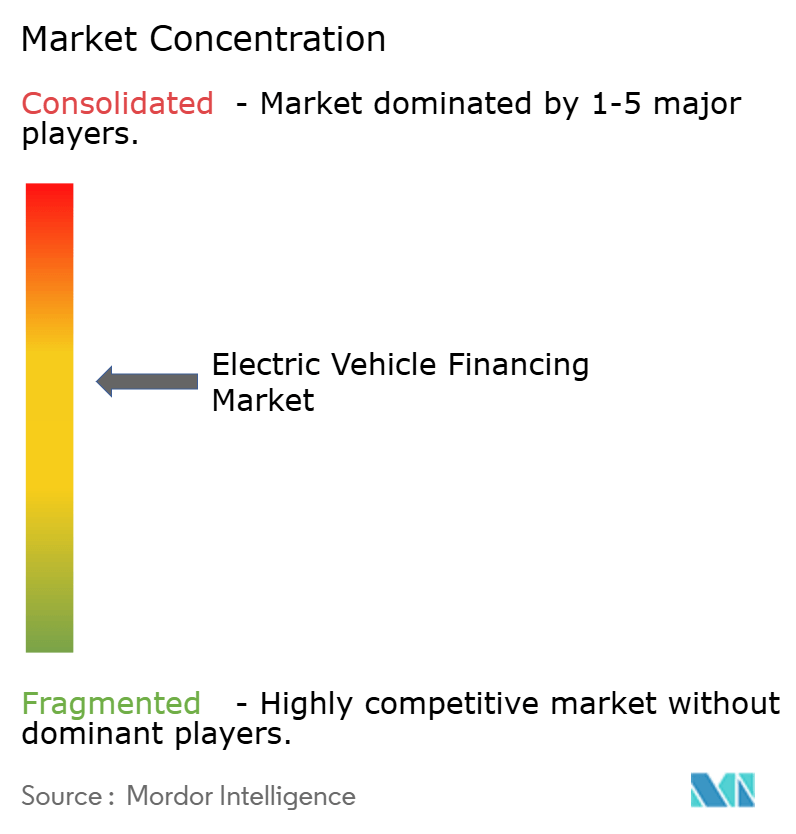

Electric Vehicle Financing Industry Overview

The electric vehicle financing market is fragmented and is in the growth phase. Competition is expected to intensify over the coming years because of the lucrative opportunities available to various players in the market. The key vendors in the market are focusing on various growth strategies, such as expansion, portfolio upgradation, and mergers and acquisitions, to increase their market share and expand their regional base. For instance,

In 2024, Revfin and Bajaj Auto teamed up to boost the adoption of high-speed three-wheelers. This collaboration merges Revfin's financial services acumen and in-depth knowledge of the three-wheeler market with Bajaj Auto's robust market presence and varied product lineup. The partnership's goal is to fast-track Bajaj's entry into the electric high-speed three-wheeler segment.

Electric Vehicle Financing Market Leaders

-

Bank Of America

-

Ally

-

Wells Fargo

-

Ford Financial Services

-

CaptialOne

- *Disclaimer: Major Players sorted in no particular order

Electric Vehicle Financing Market News

- January 2024: In January 2024, Fisker, the Californian electric vehicle manufacturer, has chosen Santander Consumer Finance as its preferred finance provider in the UK. This collaboration comes on the heels of Fisker inaugurating its first "Fisker Lounge" at Westfield London. With this partnership, Fisker is excited to offer its customers financing options from Santander Consumer Finance, a prominent player among Europe’s consumer finance giants.

- 2024: Mega Corporation unveiled Lendingo, a new division dedicated to financing electric vehicles. Lendingo aims to provide customized financial solutions not just for electric vehicles, but also for EV batteries and rickshaws. With a focus on supporting MSMEs, Lendingo seeks to bolster sustainable growth in the burgeoning electric mobility market.

Electric Vehicle Financing Industry Segmentation

The electric vehicle financing market is Segmented by Type (New Vehicle, Used Vehicle), by Source Type (Banks, Credit Unions, Financial Institutions, Others), End-Use Type (Passenger cars, Commercial Vehicles, Two-Wheelers, Three-Wheelers), and by Geography (North America, Europe, Asia-Pacific and Rest of World).

The Report Offers Market Size and Forecast for the Forklift Rental Market in Value (USD) for all the Above Segments.

| By Type | New Vehicle | ||

| Used Vehicle | |||

| By Source Type | Banks | ||

| Credit Unions | |||

| Financial Institutions | |||

| Others | |||

| By Vehicle Type | Passenger Cars | ||

| Commercial Vehicles | |||

| Two-Wheelers | |||

| Three-Wheelers | |||

| By Geography | North America | United States | |

| Canada | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| India | |||

| Japan | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Rest of World | Saudi Arabia | ||

| South Africa | |||

| United Arab Emirates | |||

| Rest of World | |||

| New Vehicle |

| Used Vehicle |

| Banks |

| Credit Unions |

| Financial Institutions |

| Others |

| Passenger Cars |

| Commercial Vehicles |

| Two-Wheelers |

| Three-Wheelers |

| North America | United States |

| Canada | |

| Rest of North America | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Asia-Pacific | China |

| India | |

| Japan | |

| South Korea | |

| Rest of Asia-Pacific | |

| Rest of World | Saudi Arabia |

| South Africa | |

| United Arab Emirates | |

| Rest of World |

Electric Vehicle Financing Market Research FAQs

How big is the Electric Vehicle Financing Market?

The Electric Vehicle Financing Market size is expected to reach USD 62.53 billion in 2025 and grow at a CAGR of 12.55% to reach USD 112.94 billion by 2030.

What is the current Electric Vehicle Financing Market size?

In 2025, the Electric Vehicle Financing Market size is expected to reach USD 62.53 billion.

Who are the key players in Electric Vehicle Financing Market?

Bank Of America, Ally, Wells Fargo, Ford Financial Services and CaptialOne are the major companies operating in the Electric Vehicle Financing Market.

Which is the fastest growing region in Electric Vehicle Financing Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Electric Vehicle Financing Market?

In 2025, the Asia Pacific accounts for the largest market share in Electric Vehicle Financing Market.

What years does this Electric Vehicle Financing Market cover, and what was the market size in 2024?

In 2024, the Electric Vehicle Financing Market size was estimated at USD 54.68 billion. The report covers the Electric Vehicle Financing Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Electric Vehicle Financing Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Electric Vehicle Financing Industry Report

Statistics for the 2025 Electric Vehicle Financing market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Electric Vehicle Financing analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.