Europe Plastic Packaging Films Market Size

Europe Plastic Packaging Films Market Analysis

The Europe Plastic Packaging Films Market size in terms of shipment volume is expected to grow from 7.90 million tonnes in 2025 to 9.00 million tonnes by 2030, at a CAGR of 2.64% during the forecast period (2025-2030).

- Plastic films play a crucial role in personal care product packaging, enhancing shelf life, preventing breakage, and preserving active ingredients, often eliminating the need for extra preservatives. European manufacturers are at the forefront, developing advanced high-barrier films that offer oxygen, moisture, and scent protection for their packaged goods. These high-barrier films are essential in maintaining the quality and efficacy of products, ensuring they reach consumers in optimal condition.

- The European plastic film market is poised to witness a dominance of food packaging applications. This shift is primarily attributed to the rising trend of downgauging, which has facilitated the move from rigid to flexible packaging. The surge in demand for barrier films is a direct response to the increasing appetite for fresh produce, including meat, fruits, vegetables, and seafood. Retailers, manufacturers, and consumers are all pushing for extended product shelf life and reduced packaging waste, further fueling this demand. The packaging segment dominated Europe's demand for plastics converters, capturing a significant 39% share.

- Due to its diverse physical properties, polyethylene (PE) is the most prevalent plastic material. Its widespread adoption can be attributed to its cost-efficiency in production, which sets it apart from other plastics. Polyethylene boasts the lowest softening point among primary packaging plastics, leading to energy savings. In the flexible packaging sector, LDPE, HDPE, and LLDPE emerge as the go-to variants of polyethylene.

- In March 2024, the Council of the European Union and the European Parliament concluded negotiations on the European Union’s Packaging and Packaging Waste Regulation. This legislation establishes ambitious waste reduction targets, requiring all EU-sold packaging to be recyclable and prominently labeled for recycling. It also enforces smaller packaging sizes, mandates minimum recycled content for plastic packaging, sets reusability goals, and bans specific packaging formats. These stringent measures present a notable challenge to the European plastics sector. The regulation aims to significantly reduce environmental impact and promote a circular economy within the European Union, encouraging innovation and sustainability in packaging design and materials.

- Over the next five to ten years, European plastic recycling is poised for a significant surge, driven by mounting pressure from regulators and a more environmentally conscious consumer base. Governments and major brands are continually refining targets to reduce waste and enhance the circularity of the plastic value chain. While many European recyclers have long aimed for these goals, their success has been modest. This is despite efforts from chemical industry players to expand recycling access, adopt cutting-edge technologies, and ramp up sustainability initiatives.

- Manufacturers across various regions are heavily investing in R&D and expanding their facilities to develop new products. This includes integrating recycling activities into their product development strategies.

- For instance, Berry Global Group Inc.'s Flexibles division, a critical player in a pan-European initiative, bolstered the recycling capabilities in three European facilities in March 2024. This move is a strategic step in its broader project to scale up the production of its Sustane line of recycled polymers. The initiative is primed to cater to the surging market appetite for top-tier films crafted from recycled materials by tapping into the company's extensive global network for recycled plastics.

Europe Plastic Packaging Films Market Trends

Food Segment to Hold Significant Market Share

- Plastic films are extensively used in European nations to wrap many products: baked goods, biscuits, frozen foods, seafood, chips, snacks, meat, dairy, dry fruits, and even pet food. The European barrier film market is poised for growth in the future, primarily fueled by the food and pet food sectors. This surge directly responds to consumers' escalating packaging preferences, prioritizing health, hygiene, lightweight properties, and eco-friendliness.

- Each product in the food sector comes with its unique set of qualities and packaging requirements. Consequently, it's imperative that food packaging maintains the proper environmental conditions from the moment of packaging to consumption. With their flexible, solvent-free, and impermeable co-extruded structure (comprising single or multiple layers), plastic films are designed not to react chemically with the food they encase. These films go beyond limiting mineral oil and UV radiation migration; they prevent food from interacting with oxygen, carbon dioxide, or moisture. Crafted from specialized materials, these rigid barriers are instrumental in preserving the food's color, taste, texture, aroma, and flavor.

- Rising food consumption in the region is a crucial driver behind the increasing demand for various plastic films tailored to diverse food products. This trend is fueled by the need for better packaging solutions that ensure food safety, extend shelf life, and enhance product presentation. As consumers become more health-conscious and seek convenience, the market for plastic films in food packaging continues to expand, offering opportunities for innovation and growth.

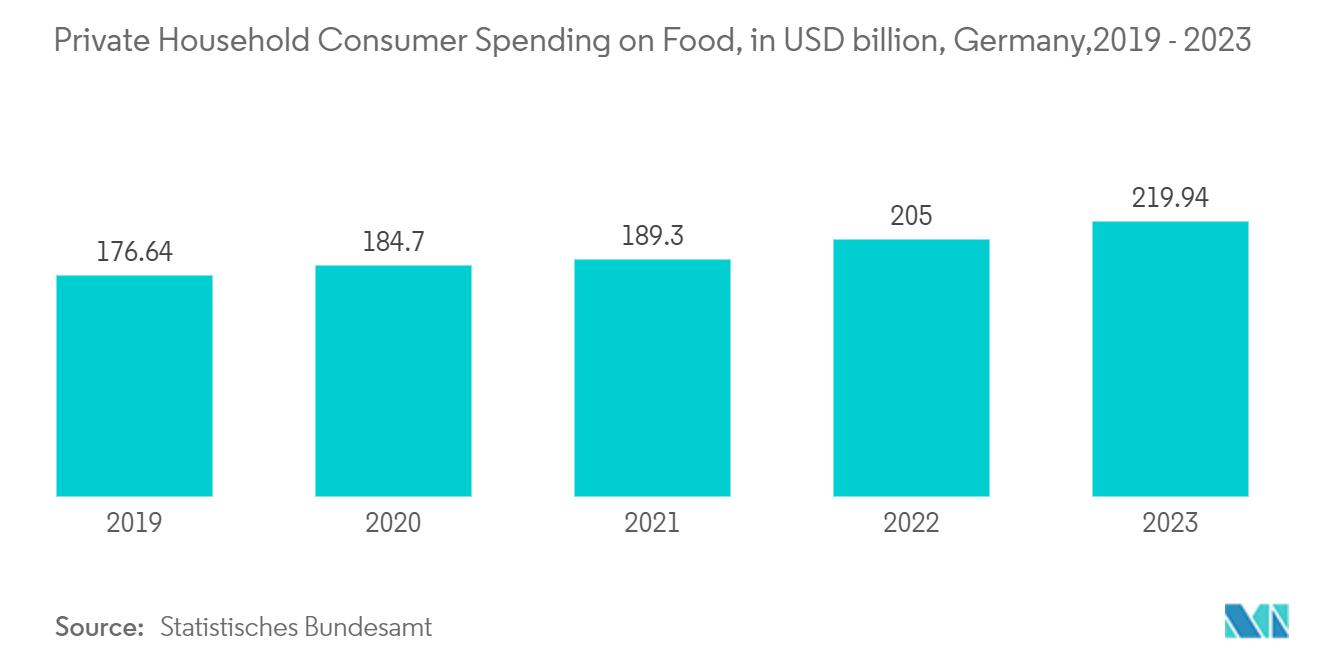

- In Germany, consumer spending on food witnessed a notable rise, climbing from USD 176.64 billion in 2019 to USD 219.94 billion in 2023, driven by escalating consumption trends. This increase reflects a growing demand for diverse food products, influenced by factors such as higher disposable incomes, changing dietary preferences, and an expanding population. The trend indicates a robust market potential for food-related businesses and investors.

- Plastic films play a crucial role in the European food industry, enhancing shelf life and shielding products from external factors by serving as barriers against moisture and oxygen. Evolving food packaging demands, driven by novel applications, are setting higher standards for packaging materials. A key focus area is the pressing demand for enhanced barrier films to craft more effective packaging solutions. Improving the barrier properties of packaging films is essential to prolong food shelf life and mitigate the risks of spoilage and damage. One common approach is to coat the packaging sheet with either PVDC or aluminum, enhancing its barrier capabilities.

- Manufacturers in the packaging industry are introducing innovative plastic films tailored for food packaging, enhancing product safety and shelf life. For instance, companies spanning the flexible food packaging supply chain collaborated to introduce a novel snack packaging. This innovative packaging, used for Sunbites, a brand under PepsiCo, comprises 50% recycled plastic and meets stringent food contact regulations. The packaging, unveiled in the United Kingdom and Ireland, is crafted using an advanced recycling process that ensures the recycled materials meet EU regulatory standards for food-contact packaging and medical devices. Leveraging these cutting-edge PP films, PepsiCo rolled out the eco-friendly Sunbites packaging in the United Kingdom. This initiative is part of PepsiCo Positive, the company's program aimed at phasing out virgin fossil-based plastics from its European crisp and chip bags by 2030.

Germany Expected to Hold Significant Share in the Market

- Germany is Europe's leading pharmaceutical market and ranks fourth globally, trailing only the United States, China, and Japan. Moreover, the pharmaceutical sector in Germany has seen a surge in the adoption of flexible packaging. This shift is primarily driven by the packaging's ability to shield medications from oxygen and moisture, preserving their efficacy until consumption.

- Germany's reputation as a pharmaceutical research, sales, and manufacturing hub is bolstered by its pioneering innovations, historical status as the "world's pharmacy," and a rising demand for healthcare products. Europe's largest pharmaceutical market is outpacing the overall German economy, propelled by shifting demographics, a rise in chronic illnesses, and an increasing emphasis on preventive and self-care measures.

- For instance, Coveris, a specialist in flexible packaging, unveiled a new recyclable thermoforming film in November 2023 designed specifically for medical devices. The company, headquartered in Vienna, debuted 'Formpeel P' at the Compamed trade show in Düsseldorf, Germany. The co-extruded film is puncture-resistant and can be paired with either a peelable polyethylene (PE) or polyolefin (PO) base. When combined with a sustainable lidding film, these bottom films, free of polyamide, present a compelling eco-friendly packaging solution for medical applications.

- As the German population is maturing, there has been a notable shift toward valuing food quality, health, and well-being. This evolving mindset, coupled with a receptiveness to new food trends and cultural influences, is paving the way for significant opportunities in plastic film packaging. The increasing demand for high-quality, health-conscious food products necessitates advanced packaging solutions that preserve freshness and extend shelf life. Additionally, the influence of global culinary trends is driving innovation in packaging designs to cater to diverse consumer preferences.

- Further, Germany stands out as one of Europe's fastest-growing e-commerce markets, driven by a surge in internet adoption. By 2023, e-commerce penetration in Germany had already hit 80%. Moreover, the country's online population is projected to grow from 62.4 million in 2020 to 68.4 million by 2025. Notably, plastic film packaging is gaining traction in e-commerce circles. Its appeal lies in its enhanced protection and durability, effectively safeguarding products against breakage and spills and ensuring bundled items stay intact.

- Further, retail sales revenue in Germany has shown consistent growth. In 2023, the German retail sector generated approximately USD 703.78 billion in sales revenue, marking a notable increase from USD 591.12 billion in 2019. This surge underscores the rising demand for plastic film and highlights a growing emphasis on innovation and sustainability. The continuous growth in retail sales revenue reflects Germany's robust economic environment and consumer confidence. Additionally, the increased revenue has driven advancements in packaging technologies, particularly in the development of eco-friendly plastic films, aligning with global sustainability trends.

Europe Plastic Packaging Films Industry Overview

The European plastic packaging films market is fragmented, with several global and regional players, such as Innovia Films (CCL Industries Inc.), TORAY FILMS EUROPE, Berry Global Inc., SÜDPACK Holding GmbH, and Cosmo Films, vying for attention in a contested market space. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition.

- July 2024: Innovia Films, a leading material developer and producer, unveiled an expansion to its sustainable film lineup. This extension, Encore, focuses on biaxially oriented polypropylene (BOPP) films, emphasizing the incorporation of chemically recycled polymers specifically tailored for food-contact applications. Furthermore, Innovia Films has forged a strategic partnership with Prevented Ocean Plastic, resulting in a novel film composition integrating 30% of POP-sourced materials.

- March 2024: SÜDPACK and SN Maschinenbau collaborated to introduce a recyclable film solution tailored for stand-up pouches featuring spouts. Lauded for their resealable design, these pouches are crafted explicitly for liquid or pasty foods, ranging from fruit purees to items requiring hot filling and pasteurization. SÜDPACK emphasizes that the pouches are crafted from polypropylene-based films, thus meeting recyclability standards. Additionally, the pouches feature PP spouts, integrating MENSHEN LoTUS technology, ensuring a seamless connection through precise heat distribution and conductivity coordination.

Europe Plastic Packaging Films Market Leaders

-

Innovia Films (CCL Industries Inc.)

-

TORAY FILMS EUROPE

-

Berry Global Inc.

-

SÜDPACK Holding GmbH

-

Cosmo Films

- *Disclaimer: Major Players sorted in no particular order

.webp)

Europe Plastic Packaging Films Market News

- March 2024: Jindal Films, a key global player in producing specialty BOPP and BOPE films for flexible packaging and labeling, pioneered in PP and PE mono-material solutions. These innovations are tailored to assist the industry in aligning with Europe's forthcoming mechanical recycling standards.

- January 2024: Berry Global unveiled an enhanced iteration of its Omni Xtra polyethylene cling film, positioning it as a certified recyclable substitute for conventional PVC options. Initially tailored for fruits, vegetables, meats, poultry, and deli items, the new Omni Xtra+ film boasts heightened impact resistance, enhanced elasticity, and a more consistent stretching profile.

Europe Plastic Packaging Films Industry Segmentation

Plastic films are versatile, serving to wrap products, overwrap various packaging types (from individual packs to palletized loads), create sachets, bags, and pouches, and are often part of laminates, where they are combined with other plastics and materials for packaging. The report also delves into the demand for these converted packaging films, analyzing them across essential resin and application categories. This broad scope mirrors the diverse needs of the market and the shifting preferences of consumers and businesses.

The European plastic packaging films market is segmented by type (polypropylene {biaxially oriented polypropylene [BOPP] and cast polypropylene [CPP]}, polyethylene {low-density polyethylene [LDPE] and linear low-density polyethylene [LLDPE]}, polyethylene terephthalate {biaxially oriented polyethylene terephthalate [BOPET]}, polystyrene, bio-based, and PVC, EVOH, PETG, and other film types), end-user industry (food [candy and confectionery, frozen foods, fresh produce, dairy products, dry foods, meat, poultry, and seafood, pet food, and other food products [seasonings and spices, spreadables, sauces, condiments, etc. ]), healthcare, personal care and home care, industrial packaging, and other end-user industries), and country (France, Germany, Italy, United Kingdom, Spain, Poland, Nordic, and Rest of Europe). The market sizes and forecasts are provided in terms of volume (tonnes) for all the above segments.

| By Type | Polypropylene(PP) (Biaxially Oriented Polypropylene (BOPP),Cast polypropylene (CPP)) | ||

| Polyethylene (Low-Density Polyethylene (LDPE), Linear low-density polyethylene (LLDPE)) | |||

| Polyethylene Terephthalate (Biaxially Oriented Polyethylene Terephthalate (BOPET)) | |||

| Polystyrene | |||

| Bio-Based | |||

| PVC, EVOH, PETG, and Other Film Types | |||

| By End-user Industry | Food | Candy and Confectionery | |

| Frozen Foods | |||

| Fresh Produce | |||

| Dairy Products | |||

| Dry Foods | |||

| Meat, Poultry, and Seafood | |||

| Pet Food | |||

| Other Food Products (Seasonings and Spices, Spreadables, Sauces, Condiments, etc.) | |||

| Healthcare | |||

| Personal Care and Home Care | |||

| Industrial Packaging | |||

| Other End-user Industries (Agricultural, Chemical, Etc.) | |||

| By Country | France | ||

| Germany | |||

| Italy | |||

| United Kingdom | |||

| Spain | |||

| Poland | |||

Europe Plastic Packaging Films Market Research FAQs

How big is the Europe Plastic Packaging Films Market?

The Europe Plastic Packaging Films Market size is expected to reach 7.90 million tonnes in 2025 and grow at a CAGR of 2.64% to reach 9.00 million tonnes by 2030.

What is the current Europe Plastic Packaging Films Market size?

In 2025, the Europe Plastic Packaging Films Market size is expected to reach 7.90 million tonnes.

Who are the key players in Europe Plastic Packaging Films Market?

Innovia Films (CCL Industries Inc.), TORAY FILMS EUROPE, Berry Global Inc., SÜDPACK Holding GmbH and Cosmo Films are the major companies operating in the Europe Plastic Packaging Films Market.

What years does this Europe Plastic Packaging Films Market cover, and what was the market size in 2024?

In 2024, the Europe Plastic Packaging Films Market size was estimated at 7.69 million tonnes. The report covers the Europe Plastic Packaging Films Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Europe Plastic Packaging Films Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Europe Plastic Packaging Films Industry Report

Statistics for the 2025 Europe Plastic Packaging Films market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Plastic Packaging Films analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.

.webp)