FMCG Packaging Market Analysis

The FMCG Packaging Market size is worth USD 0.93 Trillion in 2025, growing at an 4.64% CAGR and is forecast to hit USD 1.17 Trillion by 2030.

- The Fast-Moving Consumer Goods (FMCG) packaging market is a pivotal segment of the broader packaging industry. Its primary mission is to preserve, protect, and present everyday items, ranging from food and beverages to personal care and household products. Characterized by rapid product turnover, the market increasingly demands packaging solutions that prioritize convenience, durability, and safety. Beyond mere protection, packaging serves as a brand differentiator, upholds product quality, and caters to consumer needs, underscoring its significance in the success of FMCG products.

- Sustainability is emerging as a dominant trend in the FMCG packaging arena. Heightened consumer awareness regarding the environmental repercussions of packaging materials is steering a move away from conventional plastics. Companies are delving into alternatives like biodegradable plastics, recyclable materials, and plant-based options. This sustainability push is bolstered by global government regulations targeting plastic waste reduction and recycling promotion, compelling FMCG firms to embrace greener packaging solutions.

- Convenience is another pivotal driver in FMCG packaging. Features that simplify consumer use—like resealable bags, single-serve portions, and portable containers—are gaining traction. As modern lifestyles grow busier, there's a heightened demand for easy packaging to handle, store, and dispose of. In response, FMCG companies are innovating designs prioritizing convenience, ensuring products remain fresh and high-quality, even on the go.

- The surge of e-commerce is reshaping the FMCG packaging landscape. Packaging must be robust enough to endure shipping challenges with more consumers turning to online platforms for their FMCG needs. This necessitates sturdy protective solutions and is easy to open and dispose of. As online retail burgeons, FMCG brands are channeling investments into packaging that safeguards products during transit, all while being cost-effective and visually appealing to online consumers.

- Government regulations aimed at enhancing environmental safety are reshaping the FMCG packaging landscape. By curbing single-use plastics and pushing for sustainable alternatives, these regulations steer companies towards recyclable, biodegradable, or compostable packaging. However, such transitions often come with challenges: these eco-friendly options can be pricier and more complicated to source. Furthermore, initiatives like extended producer responsibility (EPR) programs, coupled with the need for robust waste management infrastructures, introduce both logistical and financial hurdles for businesses. While these regulations may constrain market flexibility in the near term, they spur innovation in sustainable packaging and promote eco-conscious practices among companies. As consumer demand for environmentally responsible products grows, these shifts could pave the way for long-term growth opportunities in the FMCG sector.

- The future looks bright for the FMCG packaging market, with growth on the horizon. Factors fueling this expansion include rising consumer demand for packaged goods, the e-commerce boom, and an intensified focus on sustainability. As companies pour resources into packaging innovations, the emphasis will be on enhancing performance while curbing environmental impact. With sustainability carving out a niche as a market differentiator, FMCG packaging is set to adapt, catering to eco-conscious consumers and regulatory demands, paving the way for fresh avenues of innovation and growth.

FMCG Packaging Market Trends

Paper Segment is Expected to Hold Major Share

- As companies seek sustainable alternatives to traditional plastic packaging, the FMCG packaging market is increasingly turning to paper. Paper, a renewable and biodegradable material, is now replacing plastics in packaging for various FMCG products, spanning food, beverages, personal care items, and household goods. This shift towards paper packaging is fueled by environmental concerns, a growing consumer demand for eco-friendly options, and government regulations to curb plastic waste.

- One of the primary benefits of paper in FMCG packaging is its sustainability. Unlike plastic packaging, which can linger in landfills for centuries, paper's biodegradable and recyclable nature significantly lessens environmental impact. With consumers becoming more eco-conscious, companies are pivoting to paper-based packaging to align with sustainability goals and adhere to regulations targeting plastic pollution. This transition is especially pertinent in sectors like food packaging, where there's a pressing need for safe, eco-friendly materials that can substitute single-use plastics without compromising product quality.

- Beyond its sustainability, paper packaging boasts versatility and customization. It can be shaped and sized to cater to various FMCG products. For instance, beverages, snacks, and other consumer goods use paperboard and corrugated cardboard. The capability to print vibrant graphics on paper enables brands to stand out and boost shelf appeal. Moreover, paper packaging can be crafted to be lightweight yet durable, ensuring products reach consumers safely.

- The shift to paper packaging also responds to mounting regulatory pressures on plastics. Globally, governments are tightening the reins on plastic packaging, especially single-use variants. The European Union, India, and various Southeast Asian countries are at the forefront, having enacted or planning bans or taxes on plastic packaging. Such regulations nudge FMCG companies towards sustainable alternatives like paper, helping them sidestep compliance hurdles and retain market relevance.

- Yet, transitioning to paper packaging is challenging. While paper is more sustainable, it sometimes needs more durability or barrier properties than plastic. This is crucial for items needing moisture protection or extended shelf life, like certain foods. Companies are thus challenged to innovate, crafting paper solutions that offer these protective traits while staying true to sustainability. Furthermore, paper packaging can occasionally come at a premium compared to plastic, potentially affecting product pricing in sensitive markets.

- The FMCG market's pivot to paper packaging marks a pivotal move towards curbing plastic waste and championing sustainability. With consumers increasingly favoring eco-friendly products and regulations tightening, paper packaging's prominence is set to rise, especially in the food and beverage sectors. While challenges in performance and cost persist, the relentless innovation in paper solutions bodes well for its continued adoption in the FMCG realm.

- For instance, in June 2024, Saica Group, a frontrunner in packaging solutions, and Mondelez, a major player in the FMCG arena, unveiled a new paper-based product. This innovative packaging, tailored for multipacks in the confectionery, biscuit, and chocolate sectors, is recyclable within the paper waste stream. It's adept for heat sealing and can be produced either coated or uncoated, based on the desired finish.

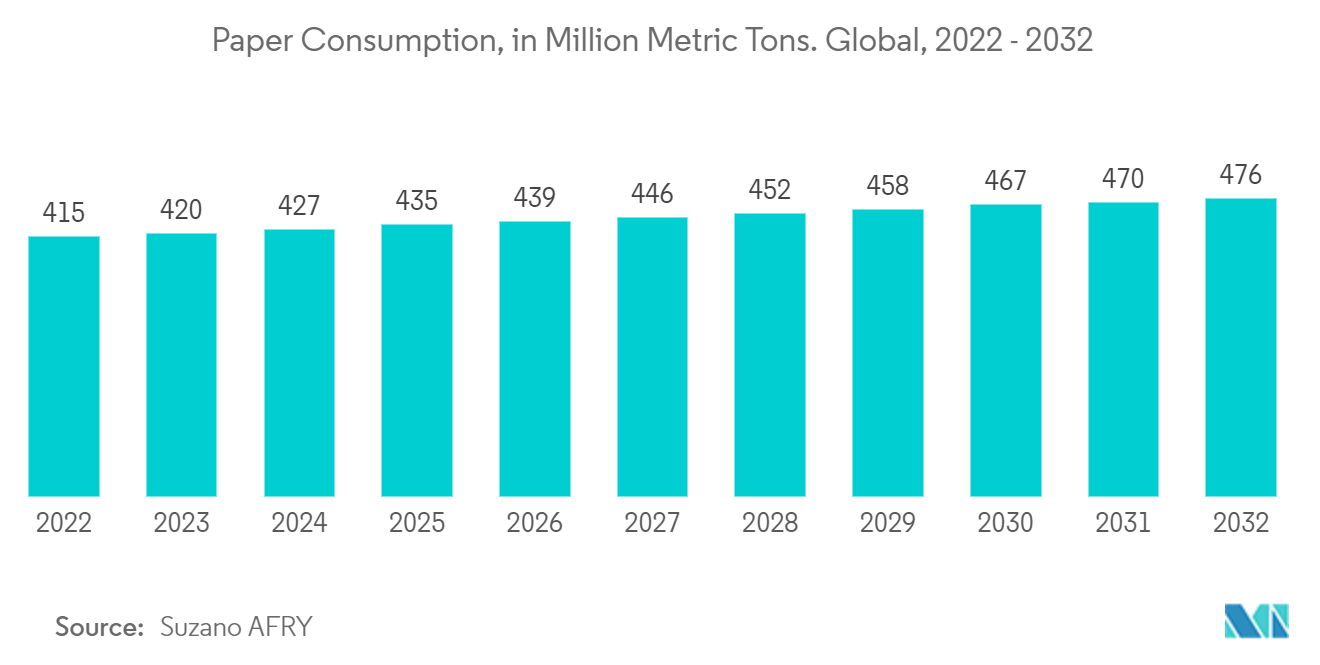

- Global paper consumption is projected to rise from 415 million metric tons in 2022 to an estimated 476 million metric tons by 2032, underscoring the surging demand for paper across diverse sectors, notably in FMCG packaging. With sustainability gaining traction among consumers and governments alike, paper is increasingly favored over plastic packaging. This anticipated uptick in paper consumption underscores the burgeoning adoption of paper-based packaging solutions.

- This shift is propelled by a growing consumer preference for eco-friendly products and mounting regulatory pressures to curb plastic waste. Such trends resonate with the overarching evolution in FMCG packaging, where companies are pivoting towards paper-based solutions, aligning with environmental objectives, and responding to consumer calls for greener packaging alternatives.

Asia-Pacific Region is Expected to Hold Significant Market Share

- Asia Pacific's FMCG packaging market is booming, fueled by the continent's vast population, rising incomes, swift urbanization, and a pivot towards sustainable packaging. With Asia emerging as one of the globe's fastest-growing consumer markets, it's set to spearhead the global FMCG packaging arena. Packaging plays a pivotal role in the sale and distribution of a myriad of goods, from food and beverages to personal care, household items, and healthcare products.

- Convenience is a primary catalyst propelling Asia's FMCG packaging market. As consumers prioritize convenience, there's a surge in demand for user-friendly, portable, and time-efficient packaging. Urban centers, in particular, are witnessing heightened demand for ready-to-eat meals, packaged snacks, and beverages, especially those boasting resealable and lightweight packaging. Moreover, the e-commerce boom and the rise of online food delivery services amplify the demand for packaging that's not only durable and protective but also adept at withstanding the rigors of shipping and handling.

- The burgeoning middle class in Asia is another pivotal force driving the FMCG packaging market. With rising disposable incomes, there's a marked shift towards premium products, often accompanied by attractive, high-quality packaging. This trend is especially pronounced in emerging markets like India, Indonesia, and the Philippines, where consumers gravitate towards branded, premium FMCG offerings that promise added value. Packaging becomes a decisive factor in consumer attraction in these markets, prompting companies to invest in innovative and visually striking designs to set their products apart.

- Several Asian countries are taking center stage in the evolving FMCG packaging market. China, leveraging its vast consumer base, is championing sustainability and pushing for convenient packaging, a trend amplified by its booming e-commerce sector. Urbanization and rising incomes drive a surge in packaged food demand in India, positioning it as a pivotal market for sustainable and innovative packaging solutions. With its stringent environmental regulations and discerning consumers, Japan is leading the charge in eco-friendly packaging innovations. South Korea is seeing a robust appetite for innovative and eco-conscious packaging solutions.

- India's booming FMCG sector is creating substantial opportunities for the packaging industry, fueled by surging consumer demand and escalating product prices. The FMCG market, valued at USD 167 billion in 2023, is on track to grow at a CAGR of 27.9% from 2021 to 2027, potentially hitting the USD 615.87 billion mark, as per the Indian Brand Equity Foundation. This growth underscores the escalating demand for effective and sustainable packaging solutions. Urban consumers, who made up 65% of the FMCG market in 2022, are leading the charge in demand for packaged goods, especially in categories like food, beverages, personal care, and household items. Meanwhile, with rural areas accounting for over 35% of the market, there's a pronounced need for diverse packaging solutions tailored to varied consumer preferences and buying behaviors.

- Further, India's packaged food market, set to rise from USD 51.3 billion in 2022 to an estimated USD 67.5 billion by 2025 and USD 70.2 billion by 2026, offers a golden opportunity for the FMCG packaging sector. As this market grows, there's an escalating demand for packaging that ensures product freshness, offers convenience, and aligns with sustainability trends. To meet these demands, FMCG packaging companies are pivoting towards solutions like biodegradable plastics, paper-based packaging, and recyclable materials, appealing to both urban and rural consumers who are becoming increasingly eco-conscious.

FMCG Packaging Industry Overview

The FMCG packaging market is fragmented and features key players, including Ball Corporation, Berry Global Inc., Sealed Air Corporation, Mondi Group, and Amcor Group. These companies are actively expanding their businesses through innovations, collaborations, mergers and acquisitions, and investments in sustainable packaging solutions to meet evolving consumer demands. Additionally, they focus on enhancing operational efficiency and adopting advanced technologies to gain a competitive edge in the market.

FMCG Packaging Market Leaders

-

Ball Corporation

-

Berry Global Inc.

-

Sealed Air Corporation

-

Mondi Group

-

Amcor Group

- *Disclaimer: Major Players sorted in no particular order

FMCG Packaging Market News

- December 2024: Ball Corporation, a global leader in sustainable aluminum packaging for beverages and personal care products, has partnered with Dabur India Limited. Dabur, a storied consumer goods company with a legacy of over 135 years, is set to enhance its Réal juice lineup. Together, they are introducing the new Réal Bites, now packaged in fully recyclable aluminum cans, in India.

- September 2024: In a strategic move, Tetra Pak has teamed up with a prominent player in Europe's juice, nectar, and soft drink sectors to unveil the Tetra Prisma Aseptic 300 Edge beverage carton. This cutting-edge package boasts a unique appearance and features an ergonomic design, aligning with consumers' growing preference for taller, slimmer packaging.

- April 2024: Pakka Limited, a manufacturer of compostable packaging solutions, has teamed up with Brawny Bear, a nutrition company celebrated for its date-based health food products. This collaboration has led to the launch of Date Energy Bars, marking the debut of India's energy bar packaged in compostable flexible material.

- April 2024: Amcor unveiled a new one-liter polyethylene terephthalate (PET) bottle, crafted entirely from 100% post-consumer recycled (PCR) content, specifically designed for carbonated soft drinks (CSDs).

FMCG Packaging Industry Segmentation

The FMCG packaging market centers on crafting and supplying packaging solutions for Fast-Moving Consumer Goods (FMCG). These goods encompass everyday essentials like food, beverages, personal care items, household products, and over-the-counter healthcare items, frequently purchased at relatively low costs. Packaging is vital for safeguarding and preserving products, branding, marketing, and regulatory standards. Consumer behavior trends, technological advancements, sustainability regulations, and the demand for innovative and convenient packaging solutions drive the market.

The FMCG packaging market is segmented by material type (paper and paperboard, plastic, metal, and glass), by application (food, beverages, cosmetics and personal care, pharmaceuticals, and household care and other applications), and by Geography (North America [United States and Canada], Europe [United Kingdom, Germany, France, Italy, Spain, and Rest of Europe], Asia [China, India, Japan, South Korea, Australia and New Zealand and Rest of Asia], (Latin America [Brazil, Mexico, Columbia and Rest of Latin America], Middle East and Africa [United Arab Emirates, Saudi Arabia, South Africa, and Rest of the Middle East and Africa]). The market sizes and forecasts are provided in terms of value (USD) for all the above segments.

| By Material Type | Paper and Paperboard | ||

| Plastics | |||

| Metal | |||

| Glass | |||

| By Application | Food | ||

| Beverages | |||

| Cosmetics and Personal Care | |||

| Pharmaceuticals | |||

| Household Care | |||

| Other Applications | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Italy | |||

| Spain | |||

| Asia | China | ||

| India | |||

| Japan | |||

| South Korea | |||

| Australia and New Zealand | |||

| Latin America | Brazil | ||

| Mexico | |||

| Colombia | |||

| Middle East and Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| South Africa | |||

FMCG Packaging Market Research FAQs

How big is the FMCG Packaging Market?

The FMCG Packaging Market size is worth USD 0.93 trillion in 2025, growing at an 4.64% CAGR and is forecast to hit USD 1.17 trillion by 2030.

What is the current FMCG Packaging Market size?

In 2025, the FMCG Packaging Market size is expected to reach USD 0.93 trillion.

Who are the key players in FMCG Packaging Market?

Ball Corporation, Berry Global Inc., Sealed Air Corporation, Mondi Group and Amcor Group are the major companies operating in the FMCG Packaging Market.

Which is the fastest growing region in FMCG Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in FMCG Packaging Market?

In 2025, the North America accounts for the largest market share in FMCG Packaging Market.

What years does this FMCG Packaging Market cover, and what was the market size in 2024?

In 2024, the FMCG Packaging Market size was estimated at USD 0.89 trillion. The report covers the FMCG Packaging Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the FMCG Packaging Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

FMCG Packaging Industry Report

Statistics for the 2025 FMCG Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. FMCG Packaging analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.

.webp)