Medical Devices Market Size

Medical Devices Market Analysis

The Medical Devices Market size is estimated at USD 681.57 billion in 2025, and is expected to reach USD 955.49 billion by 2030, at a CAGR of 6.99% during the forecast period (2025-2030).

Factors such as the increasing prevalence of chronic disease, technological advancements in Medical Device Technologies, and a consistent rise in the aging population are expected to boost the Medical Devices Market's growth.

The senior population is more prone to age-related disorders that are less prevalent among younger people. For instance, in January 2023, an article published in the Journal of the American Heart Association reported that around 70% of individuals more than 70 years of age are likely to develop cardiovascular disorders, and more than two-thirds are associated with noncardiovascular morbidities. In December 2022, another article published in the International Journal of Medical Sciences mentioned that the incidence of cardiac dysrhythmias, including bradyarrhythmia and tachyarrhythmia, increases with advancing age. Thus, over 80% of pacemaker implementations were required in the United States to relieve the symptoms caused by bradycardia. Therefore, the senior population is at high risk of developing cardiovascular disorders (CVDs), which is expected to increase the demand for cardiac surgeries and devices that help monitor heart conditions regularly, propelling the growth of the Medical Devices Industry.

The increasing burden of chronic diseases worldwide also drives the demand for effective and advanced treatment services involving various diagnostic and surgical procedures. Thus, the demand for Medical Devices is rising worldwide. For instance, in July 2023, data published by the Diabetes Canada Organization reported that, in Canada, around 5.88 million people, or about 15% of the population, had type 1 and type 2 diabetes in 2023. In addition, as per the same source, this number is anticipated to reach around 7.41 million diabetic cases in 2033. Similarly, an article published in the Journal of BMC Public Health in January 2024 mentioned that the prevalence of chronic obstructive pulmonary disease (COPD) was 12.64% among people over 40 years across the world. Thus, the expected increase in the number of people with diabetes and COPD may boost the demand for various Medical Devices to monitor the condition regularly, contributing to the growth of the Medical Equipment Market.

The increasing focus on developing technologically advanced Medical Device Technologies and increasing product launches contribute to the Medical Devices Market growth. For instance, in November 2023, Orthofix Medical launched the lateral lumbar interbody system waveform in the United States. It is incorporated with porous and wavelike structures to perform lateral lumbar interbody fusion procedures. This design enables the distribution of compressive loads and provides high porosity, which improves imaging characteristics and enhances graft packability. Additionally, in January 2023, Getinge launched a new Servo-C mechanical ventilator, which provides lung-protective therapeutic tools for pediatric and adult patients. Servo-C facilitates the accessibility to healthcare and is affordable for hospitals globally. It is developed to facilitate customized respiratory treatments that are safe and easy to use.

Therefore, the growing burden of chronic diseases, the growing geriatric population, and technological advancements in Medical Technology are anticipated to boost the Medical Technology Industry's growth over the forecast period. However, strict regulations and uncertainty in reimbursement are anticipated to impede the growth of the Medical Devices Market over the forecast period.

Medical Devices Market Trends

Cardiology Devices Segment is Expected to Hold a Major Share in the Medical Device Market Over the Forecast Period

The cardiology segment is expected to witness significant growth in the Medical Devices Industry over the forecast period due to the rising prevalence of cardiovascular diseases, strategic initiatives by key market players, and technological advancement in cardiology devices, including those in the Implantable Medical Devices Market.

The rising incidences and prevalence of obesity, diabetes, hypertension, and high cholesterol are also contributing to the demand for cardiological Medical Devices, as patients suffering from these diseases are likely to develop cardiac complications in their lifetime.

Cardiovascular devices are used for the diagnosis of heart diseases and the treatment of related health problems. The devices used in cardiology are classified into three categories: surgical, therapeutic, and diagnostic. Some widely used cardiovascular devices include Wearable Medical Devices such as electrocardiograms (ECG), defibrillators, pacemakers, cardiac rhythm management devices, catheters, grafts, heart valves, and stents.

The growing number of people suffering from cardiovascular diseases is the key factor driving the demand for Medical Devices. For instance, as per the 2022 data published by the Centers for Disease Control and Prevention (CDC), around half of the adults (approximately 127 million individuals) have one or more cardiovascular diseases in the United States. Additionally, in September 2022, an article published in the BMC Public Health mentioned that, by 2035, more than 130 million adults in the United States will have some heart disease, which may lead to a total cost of USD 1.1 trillion.

Growth in company activities and increasing technological advancements, such as artificial intelligence in cardiac Wearable Medical Devices, have led to an increasing number of patients being managed with cardiology devices, resulting in exponential therapeutical and monitoring outcomes. This reflects emerging Medical Device Industry Trends and is expected to boost the segment's growth over the forecast period. For instance, in July 2023, Abbott received approval from the US Food and Drug Administration for the dual chamber leadless pacemaker AVEIR dual chamber (DR), which is used to treat abnormal or slow heart rhythms in individuals. In April 2022, Translumina launched its dual drug polymer-free coated stent, VIVO ISAR, in Europe.

Therefore, owing to the growing burden of cardiovascular disorders and new product launches by market players, the segment is expected to contribute significantly to the Medical Device Market Growth over the forecast period.

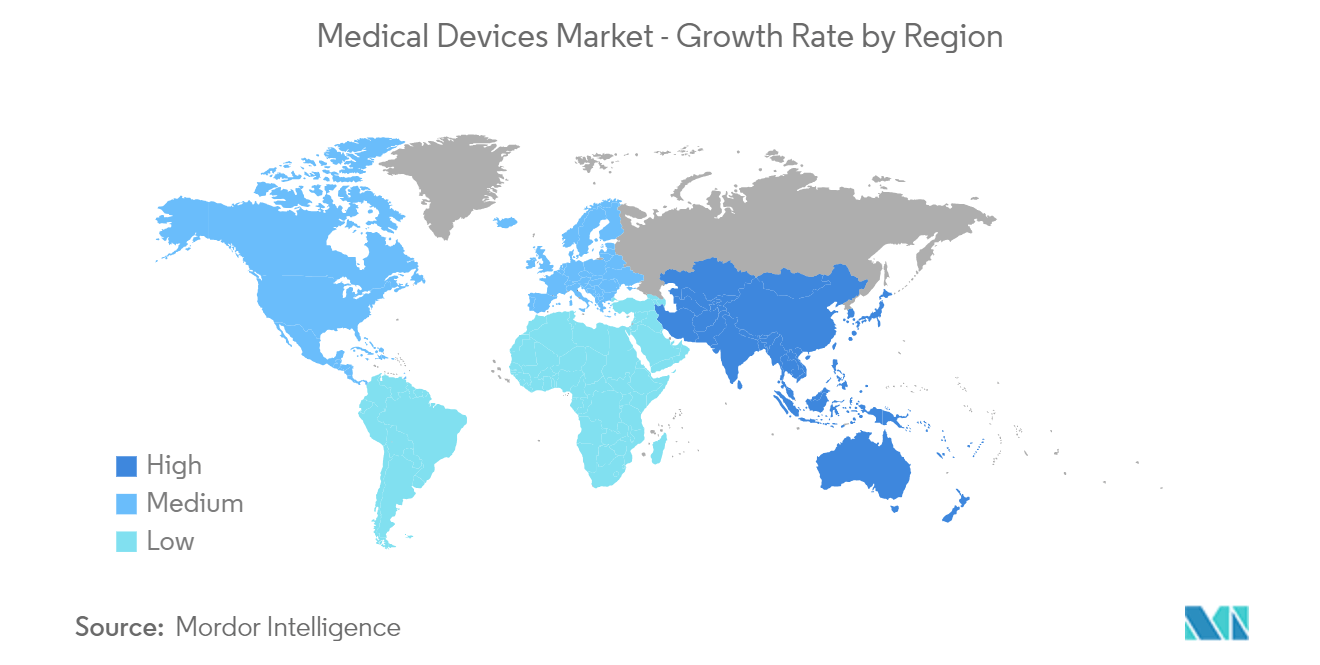

North America is Expected to Continue to Grow During the Forecast Period

North America is expected to make a major contribution to the Medical Devices Market over the forecast period due to the growing burden of chronic diseases, high healthcare expenditures, and the presence of key players.

In addition, the increasing geriatric population will likely boost the Medical Devices Industry Growth over the forecast period. For instance, according to the 2022 statistics published by the United Nations Population Fund, in Canada, a large proportion of the population was estimated to be aged between 15 and 64 years, accounting for 65% of the total population in the current year. In addition, as per the same source, 19% of the population in Canada was estimated to be aged 65 years and above in 2022. Thus, the rising geriatric population is more prone to developing chronic diseases such as cardiopulmonary diseases, respiratory diseases, and orthopedic disorders, which increase the demand for diagnostic imaging and surgical procedures. This factor, in turn, is anticipated to fuel the growth of Medical Devices, thereby propelling the Medical Device Market Growth over the forecast period.

The rising prevalence of chronic diseases, such as cardiovascular diseases, coronary heart diseases, and stroke, along with rising respiratory diseases, such as acute respiratory syndrome, among the population leads to increased cardiopulmonary bypass procedures, resulting in an increasing demand for Medical Devices. For instance, in October 2023, an article published in the Journal of Cardiac Failure reported that the prevalence rate of heart failure is about 1.9-2.6% among adults in the United States and is higher among the older population. Additionally, the same resource reported that the prevalence rate is expected to reach 8.5% among individuals aged 65-70. Thus, the high burden of cases of heart failure in the country is expected to increase the demand for Medical Devices for better diagnosis and treatment, which is further expected to boost the US Medical Devices Market over the forecast period.

Similarly, a research study published in Frontiers in Public Health in May 2023 revealed that various factors led to an increased prevalence of diabetes among US adults, such as genetic domain, demographic domain, obesity, and biological and psychosocial factors associated with diabetes. Thus, biological factors such as systolic blood pressure, serum cholesterol, and the use of antihypertensive medications are associated with diabetes, which is expected to increase the demand for Medical Devices for remote monitoring and diabetes management solutions, thereby boosting market growth.

The growing focus of companies on developing advanced products and adopting various business strategies, such as collaborations and acquisitions to retain their market position, also contributes to the Medical Device Industry Outlook and market's growth. For instance, in November 2022, PENTAX Medical introduced a new performance endoscopic ultrasound (EUS) system in Canada, a combination of the ARIETTA 65 PX ultrasound scanner and J10 Series Ultrasound Gastroscopes. It will provide better imaging and allow clinicians to manage high case volumes efficiently. Additionally, in March 2022, Respira Labs, a respiratory healthcare tech business based in the United States, released Sylvee. This AI-powered wearable lung monitor employs acoustic resonance to assess lung function and identify lung volume variations. It can aid in the early detection and treatment of chronic obstructive pulmonary disease (COPD), asthma, and COVID-19, reflecting the latest Medical Devices Industry Trends.

Therefore, the Medical Devices Market is expected to grow over the forecast period due to the increasing geriatric population, rising burden of chronic diseases, and product launches.

Medical Devices Industry Overview

The Medical Devices Market is competitive and consists of several major players in the MedTech Industry. The market players are developing various Medical Devices with advanced technologies and incorporating other strategies such as acquisitions, partnerships, and geographical expansions to boost their businesses. Companies like Abbott, Koninklijke Philips NV, Johnson & Johnson Services Inc., Medtronic PLC, and GE HealthCare are among the Largest Medical Device Companies holding substantial shares in the market.

Medical Devices Market Leaders

-

Koninklinje Philips NV

-

Medtronic PLC

-

Johnson & Johnson Services Inc.

-

Abbott

-

GE HealthCare

- *Disclaimer: Major Players sorted in no particular order

Medical Devices Market News

- March 2024: Stryker Corporation introduced a novel, innovative product, LIFEPAK CR2 automated external defibrillator (AED), to improve cardiac care and enhance patient outcomes.

- January 2024: Accelus launched a linesider modular-cortical system that can be used for spinal implant surgeries. This implant is expected to be used by the surgeons to support the spine during surgeries.

Medical Devices Industry Segmentation

As per the scope of the report, a medical device is any type of instrument, apparatus, appliance, machine, implant, or any other related/similar article used for diagnosing, treatment, monitoring, prevention, or alleviation of diseases.

The medical devices market is segmented by type of device and geography. By type of device, the market is segmented into respiratory devices, cardiology devices, orthopedic devices , diagnostic imaging devices (radiology devices), endoscopy devices, ophthalmology devices, and other devices. The report also covers the estimated market sizes and trends for 17 countries across major regions globally. For each segment, the market size is provided in terms of value (USD).

| By Type of Device | Respiratory Devices | ||

| Cardiology Devices | |||

| Orthopedic Devices | |||

| Diagnostic Imaging Devices (Radiology Devices) | |||

| Endoscopy Devices | |||

| Ophthalmology Devices | |||

| Other Devices | |||

| By Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Middle East and Africa | GCC | ||

| South Africa | |||

| Rest of Middle East and Africa | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Respiratory Devices |

| Cardiology Devices |

| Orthopedic Devices |

| Diagnostic Imaging Devices (Radiology Devices) |

| Endoscopy Devices |

| Ophthalmology Devices |

| Other Devices |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Asia-Pacific | China |

| Japan | |

| India | |

| Australia | |

| South Korea | |

| Rest of Asia-Pacific | |

| Middle East and Africa | GCC |

| South Africa | |

| Rest of Middle East and Africa | |

| South America | Brazil |

| Argentina | |

| Rest of South America |

Medical Device Technologies Market Research FAQs

How big is the Medical Devices Market?

The Medical Devices Market size is expected to reach USD 637.04 billion in 2024 and grow at a CAGR of 6.99% to reach USD 893.07 billion by 2029.

What is the current Medical Devices Market size?

In 2024, the Medical Devices Market size is expected to reach USD 637.04 billion.

Who are the key players in Medical Devices Market?

Koninklinje Philips NV, Medtronic PLC, Johnson & Johnson Services Inc., Abbott and GE HealthCare are the major companies operating in the Medical Devices Market.

Which is the fastest growing region in Medical Devices Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Medical Devices Market?

In 2024, the North America accounts for the largest market share in Medical Devices Market.

What years does this Medical Devices Market cover, and what was the market size in 2023?

In 2023, the Medical Devices Market size was estimated at USD 592.51 billion. The report covers the Medical Devices Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Medical Devices Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What is the fastest-growing segment in the Medical Devices Technologies Market?

The cardiology devices segment is experiencing the fastest growth within the Medical Devices Technologies Market.

Who is the target market for Medical Device Technologies?

The target market for Medical Device Technologies includes healthcare providers, hospitals, clinics, research institutions, and other healthcare-related organizations.

Our Best Selling Reports

Medical Equipment Industry Report

The Global Medical Device Market Research Report provides comprehensive industry analysis and insights into key market trends. The report covers a diverse range of device types, including respiratory devices, cardiology devices, orthopedic devices, diagnostic imaging devices, endoscopy devices, ophthalmology devices, and other devices. The market segmentation is also detailed by geography, encompassing North America, Europe, Asia-Pacific, the Middle East & Africa, and South America.

The report includes an industry overview, highlighting the market growth and market forecast, and emphasizes the importance of understanding industry trends to stay competitive. It offers a detailed market analysis, including market leaders and market share, providing a thorough industry outlook. The industry research delves into the market size and market value, offering a market review that is essential for industry sales and market predictions.

Furthermore, the report provides market data and industry statistics, ensuring that stakeholders have access to crucial industry information. The market segmentation is meticulously detailed, and the report also discusses the industry size and growth rate. The industry reports and market overview offer a comprehensive view of the current market landscape.

Customization options are available, allowing for a tailored analysis based on specific interests such as in vitro diagnostics, anesthesia, kidney and dialysis devices, drug delivery devices, wound management devices, and dental devices. The report also covers various types of technologies, including molecular diagnostics, non-invasive monitoring, mobility aid technologies, micro-fluids and MEMS, bio-implants, and telemedicine.

The report is an invaluable resource for ASCs, medical device industries, pharmaceutical and research organizations, providing a detailed market outlook and report pdf. The industry research and market predictions included in the report are essential for understanding the future direction of the global medical device market. The report example provided offers a clear and concise summary of the key findings and market trends.