Immunohematology Market Size

Immunohematology Market Analysis

The Immunohematology Market is expected to register a CAGR of 9.2% during the forecast period.

COVID-19 has impacted market growth. The increased COVID-19 cases and lockdowns imposed by the government all over the world have significantly decreased trauma cases, blood transfusion services, blood donation, and the admission of people suffering from blood disorders to avoid the risk of getting infected by the coronavirus. For instance, according to an article published in Transfusion Therapy and Hemotherapy in April 2022, the Hospitals were compelled to save their supplies in reaction to the decline in blood donations by postponing non-urgent surgeries and organ transplants or reducing transfusion volumes to prevent blood shortages. The same source stated that blood donation rates dropped on average by 38%, while in certain regions, they dropped by as much as 67%. Thus, the decreased blood donations and the demand for immunohematology testing decreased in the blood banks, which has impacted the market growth during the pandemic. Also, the decrease in the number of elective surgical procedures has impacted the market growth. For instance, as per an article published in PLOS One in March 2022, it has been observed that there was a 65.5% decrease in elective cases and a 52.7% decrease in the volume of adult cardiac surgery in the United States. Thus, the decreased number of surgeries and treatment services for patients suffering from blood-related disorders has impacted the demand for hematological testing. However, the resumed services and increased patient visits have increased the market growth and are expected to fuel the market growth over the forecast period.

Factors such as the increasing incidence of trauma and immuno-hematological disorders and technological advancements for the development of new products are expected to boost the market growth.

The incidence and prevalence of blood-related and other chronic disorders such as hemophilia, sickle cell disease, blood cancer, and others are increasing among the population. For instance, according to 2022 statistics published by the Leukemia Foundation, more than 1,35,000 people were living with blood cancer or related blood disorders in Australia in 2022, and this number is projected to reach more than 2,75,000 by 2035. Also, as per the same source, about 19,403 Australians were expected to be diagnosed with blood cancers such as leukemia, lymphoma, and myeloma in 2022. Thus, the increasing prevalence of leukemia and other blood-related cancers among the population is expected to increase the demand for blood transfusion to help treat low blood counts in patients, hence propelling the demand for immunohematology analyzers and screening antibodies over the forecast period.

Moreover, the rising product launches increase the availability of advanced hematology analyzers in the market over the forecast period. For instance, in September 2021, Ortho Clinical Diagnostics launched Immediate Spin Crossmatch (ISXM), ORTHO VISION, and ORTHO VISION MAX Analyzers to aid in detecting incompatibility between donors and recipients in blood transfusions. A serological test, ISXM, is used in blood transfusions to identify ABO blood type incompatibility between recipient serum and plasma and donor red blood cells.

Therefore, owing to the aforementioned factors, such as the high burden of leukemia and blood disorders and new product launches, the studied market is expected to grow over the forecast period. However, the high cost of products and lack of skilled personnel are likely to impede the growth of the immunohematology market over the forecast period.

Immunohematology Market Trends

Immunohematology Analyzer Segment Expects to Witness Significant Growth Over the Forecast Period

Immunohematology analyzers are computerized, highly specialized, and automated machines that study the RBC antigens and antibodies associated with blood transfusion. The immunohematology analyzers segment is anticipated to witness significant growth in the immunohematology market over the forecast period owing to factors such as the rising burden of blood disorders, increasing technological advancements, and rising adoption rates of automated immunohematology instruments.

The rising incidence and prevalence of blood-related disorders, such as anemia, blood malignancies, hemorrhagic diseases, and blood-borne infections, among the population raise the demand for hematological testing. Thus, several studies have been conducted to compare the efficacy and accuracy of automated immunohematology analyzers. For instance, according to an article published in Transfusion and Apheresis Science in October 2022, it has been observed that a fully automated system such as ORTHO VISION Analyzer provides the transfusion medicine laboratory with important benefits of end-to-end process control (from sample load to result in output). In addition, about 2,631 immunohematology test profiles were evaluated, for ABO/Rh, antibody detection, antibody identification, crossmatch, and DAT, using the ORTHO VISION analyzer and its ORTHO optic reader system, and both systems showed accurate results. Also, the same source stated that the manual BioVue method frequently takes 1.5-3 times longer than the automated approach to produce final results. Thus, the high accuracy and speedy results offered by the immunohematology analyzers are expected to increase their adoption, thereby contributing to market growth.

Furthermore, the rising company activities in launching automated hematology analyzers in the region are also contributing to the market growth. For instance, in March 2021, Grifols, Barcelona, Spain, launched a DG Reader Net semiautomated analyzer used to facilitate pretransfusion blood type compatibility testing in North America. DG Reader Net, a compact and simple tool, automates the reading and interpretation of DG Gel cards, a method that determines the presence of certain antigens in red blood cells and is used to indicate blood type compatibility. The DG Reader Net analyzer offers laboratories computer-assisted reading and interpretation of immunohematology (IH) tests with automatic results uploaded to the laboratory information system.

Therefore, owing to the aforementioned factors, such as the rising number of research studies and new product launches, the studied segment is anticipated to grow over the forecast period.

North America is Expected to Have the Significant Market Share Over the Forecast Period

North America is anticipated to hold a significant share of the market over the forecast period owing to factors such as the increasing burden of immune-hematological disorders, traumas, and growing company activities.

The increasing cases of blood-related disorders are the major factors propelling the market growth in the region. For instance, according to the 2023 statistics published by the American Cancer Society, about 59,610 new cases of leukemia and 20,380 new cases of acute myeloid leukemia (AML) are expected to be diagnosed in the United States in 2023. Additionally, as per the 2022 statistics published by Myeloma Canada, about 4,000 new multiple myeloma cases are expected to be diagnosed in Canada in 2022. Thus, the high number of populations suffering from blood disorders raises the demand for blood transfusion, which requires antibody-antigen matching using immunohematology testing, hence propelling the market growth.

Furthermore, the rising company focus on adopting various key strategies such as agreements, partnerships, and product launches increases the availability of technologically advanced products in the market. This is anticipated to fuel the market growth over the forecast period. For instance, in February 2021, Beckman Coulter launched the DxH 560 AL, a tabletop hematology analyzer designed to reduce the time and resource constraints faced by small- to mid-sized laboratories. The users can add up to 50 samples continuously, protect against blood-borne diseases, and spend less time on manual instrument operations with the analyzer's auto-loading, closed tube aspiration, and walk-away features. Similarly, in November 2021, HealthTab Inc., a wholly owned subsidiary of Avricore Health Inc., signed a non-exclusive pilot supplier distribution agreement with Abbott, the global healthcare company, for the handheld blood chemistry analyzer i-STAT Alinity, in Canada.

Therefore, owing to the aforementioned factors, such as the high burden of blood disorders and new product launches, the studied market is anticipated to grow over the forecast period.

Immunohematology Industry Overview

The immunohematology market is highly competitive and consists of significant small and large players in the market. The major players are evolving various strategies such as collaborations and acquisitions, and are actively involved in the launch of new products in the market. Some of the key players in the market are Bio-Rad Laboratories, Inc, Abbott Laboratories, Merck KGaA, Beckman Coulter, Inc., Thermo Fisher Scientific, F.Hoffmann La-Roche Ltd, Immucor, Inc., Grifols S.A. and many more.

Immunohematology Market Leaders

-

Grifols S.A.

-

Immucor Inc.

-

Thermo Fisher Scientific

-

Merck KGaA

-

Abbott Laboratories

- *Disclaimer: Major Players sorted in no particular order

Immunohematology Market News

- May 2022: Nihon Kohden Corporation, India, established a new hematology analyzer reagent factory.

- April 2022: Sysmex Europe launched its new three-part differential system, XQ-320 XQ-Series Automated Hematology Analyzer, which offers a range of functions related to quality control and patient data safety.

Immunohematology Industry Segmentation

As per the scope of the report, immunohematology is a branch of hematology and transfusion medicine that investigates antigen-antibody interactions and related phenomena in relation to the pathophysiology and clinical symptoms of blood diseases. For patients with hematological conditions such as auto-immune hemolytic anemia, a wide range of immune-hematological techniques are used to identify and resolve the diagnostic problems in these patients. The immunohematology market is segmented by product (immunohematology analyzers and immunohematology reagents), application (blood typing and antibody screening), end user (hospitals, diagnostic laboratories, and others), and geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market report also covers the estimated market sizes and trends for 17 countries across major regions globally. The report offers the value (in USD) for the above segments.

| By Products | Immunohematology Analyzers | ||

| Immunohematology Reagents | |||

| By Application | Blood Typing | ||

| Antibody Screening | |||

| By End User | Hospitals | ||

| Diagnostic Laboratories | |||

| Others | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Middle East and Africa | GCC | ||

| South Africa | |||

| Rest of Middle East and Africa | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

Immunohematology Market Research FAQs

What is the current Immunohematology Market size?

The Immunohematology Market is projected to register a CAGR of 9.2% during the forecast period (2025-2030)

Who are the key players in Immunohematology Market?

Grifols S.A., Immucor Inc., Thermo Fisher Scientific, Merck KGaA and Abbott Laboratories are the major companies operating in the Immunohematology Market.

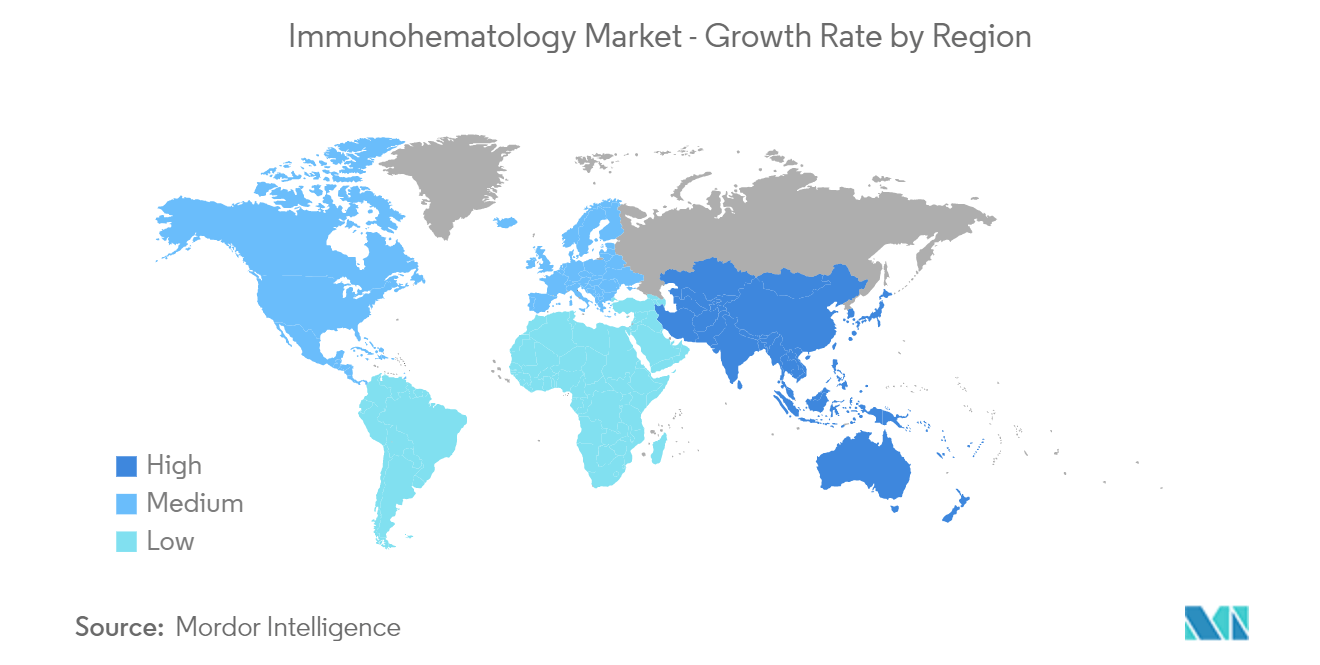

Which is the fastest growing region in Immunohematology Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Immunohematology Market?

In 2025, the North America accounts for the largest market share in Immunohematology Market.

What years does this Immunohematology Market cover?

The report covers the Immunohematology Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Immunohematology Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Immunohematology Industry Report

Statistics for the 2025 Immunohematology market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Immunohematology analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.