India Plant Based Milk Market Size

India Plant Based Milk Market Analysis

The India Plant Based Milk Market size is estimated at USD 59.02 million in 2025, and is expected to reach USD 117.58 million by 2030, at a CAGR of 14.78% during the forecast period (2025-2030).

In India, the youth are increasingly embracing veganism and flexitarian diets. As awareness of animal welfare and ethical consumption grows, plant-based milk is gaining traction. In response, brands like So Good and RAW Pressery have expanded their product lines to feature almond and soy milk. Plant-based milk, often with a smaller carbon footprint than dairy, appeals to eco-conscious consumers. With rising concerns about climate change and a drive for environmental sustainability, more Indians are opting for plant-based milk as a greener choice. Market players are seizing this opportunity, promoting their products by emphasizing sustainability and environmental benefits. For example, in March 2023, Dancing Cow Foods Private Limited launched its Oat & Millet Milk, announcing a commitment to rescue a cow for every 10,000 liters of its plant-based milk sold.

The convenience of switching to plant-based milk has increased, due to a variety of options like almond, coconut, soy, and oat. These alternatives are now widely available, found on supermarket shelves and online platforms, ensuring they are accessible nationwide. Key players in the Indian plant-based milk market include Dabur India Ltd, Danone SA, Nestlé SA, Wingreens Farms Private Limited (Raw Pressery), Sanitarium Health & Wellbeing Company (Life Health Foods), and The Hershey Company, among others. These players are using effective marketing strategies to inform consumers about the advantages of plant-based food and beverages. They are also launching products in attractive packaging, sizes, and colors to boost sales across the country. For instance, in September 2023, Drums Foods International Private Limited introduced its new oat milk product, highlighting its lactose-free, low-calorie, and vegan-certified attributes.

India Plant Based Milk Market Trends

Soy Milk Is Liked By Majority

In India, significant soybean production, coupled with strong domestic consumption, sets the stage for the soy milk market expansion. The easy access to affordable raw materials not only boosts production but also positions soy milk as a competitive and accessible alternative. This balance of supply and demand serves as a primary growth driver in the sector. For instance, data from the United States Department of Agriculture highlighted India as the world's fifth-largest soybean producer in 2023, contributing about 3% to global production with an output of 11.88 million metric tonnes for the 2023/2024 period, trailing only behind Brazil, the United States, Argentina, and China. Additionally, the International Grains Council noted India's consumption of soybean products, including milk, at 13.6 million tonnes for the 2021-22 period.

Furthermore, a rising awareness of plant-based alternatives, combined with heightened health consciousness, is propelling the adoption of soy milk in India. This growing recognition and evident consumer preference for plant-based options are pivotal in driving the soy milk market. Moreover, consumers increasing inclination towards high-protein vegan alternatives is amplifying the demand for soy milk. The protein-rich nature of soy milk, which matches cow's milk in protein content, positions it as a desirable and nutritious choice for those leaning towards plant-based diets. For instance, data from Proeon Inc. in 2024 indicates that over 80% of Indians are not meeting their daily protein needs, averaging 0.6 grams of protein per kilogram of body weight, while the recommendation stands at 0.8-1.0 grams. This notable protein shortfall underscores a significant market opportunity for soy milk, which offers a readily accessible and economical source of high-quality plant-based protein, addressing this prevalent nutritional gap. Overall, the Indian soy milk market is vibrant and competitive, featuring a blend of established brands, new entrants, and regional producers.

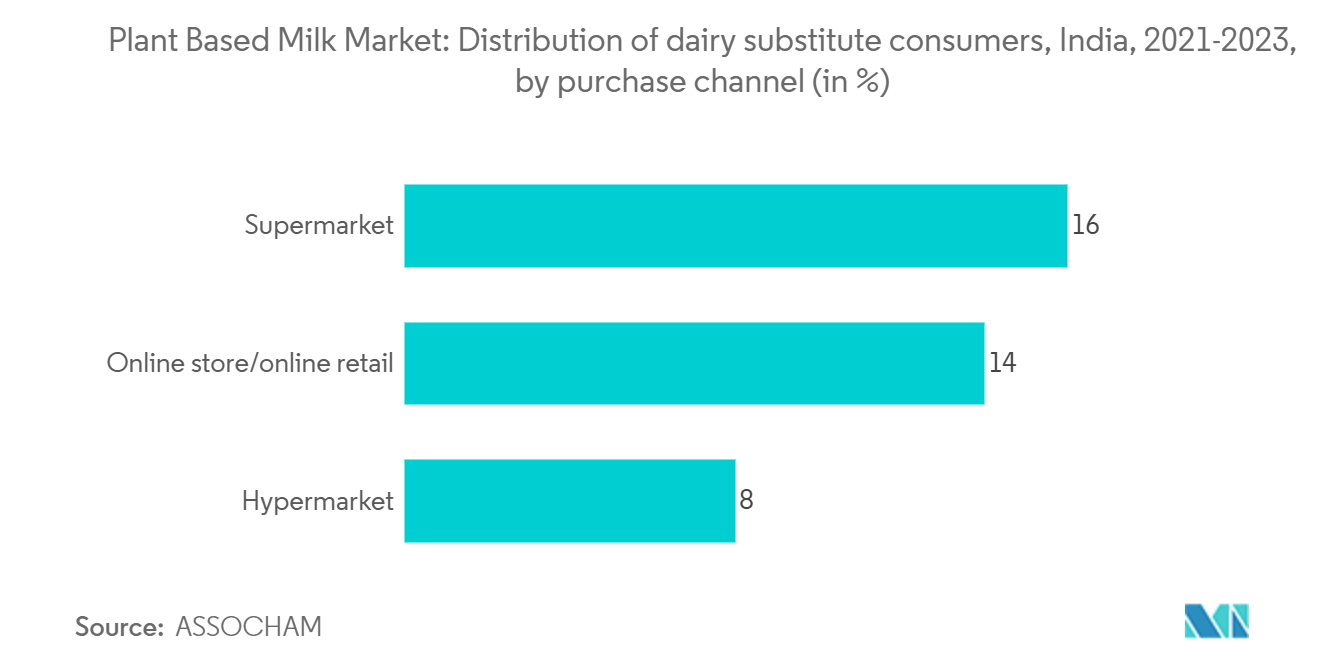

Off Trade Channels Contribute To The Majority Of The Sales

As health-conscious lifestyles gain traction among Indians, supermarkets and hypermarkets are expanding their range of plant-based alternatives. Shoppers at these venues are increasingly informed about veganism, lactose intolerance, and low-cholesterol diets, contributing to the surging popularity of plant-based milk. Brands are seizing the opportunity presented by the high foot traffic in supermarkets to engage with this health-centric audience.

In recent years, convenience stores have established a foothold in the plant-based milk market, increasing their stock volumes and adopting competitive pricing strategies. Additionally, in rural and semi-urban regions, independent small groceries and convenience stores have emerged as pivotal sales channels for plant milk products. Retailers, attuned to a health-conscious clientele, are progressively aligning their offerings with the broader wellness trend. Plant-based milk, derived from almonds, soy, or oats, is gaining traction among those seeking dairy alternatives, whether due to lactose intolerance, cholesterol concerns, or a preference for lower-calorie options. Brands focusing on plant-based milk are strategically positioning themselves in specialist health food stores, which emphasize nutritional value and cater to allergy-friendly needs.

The e-commerce segment, meanwhile, is on the brink of significant expansion. This anticipated growth is attributed to the rising awareness and adoption of e-commerce, capturing the interest of numerous market players. With India housing one of the world's largest internet user bases, the potential for e-commerce growth is immense. To put this in perspective, the Government of India's (GOI) Invest India platform reported in 2022 that India had over 800 million internet users, ranking it as the second-largest internet market globally. Collectively, these insights underscore the pivotal role of off-trade channels in distributing and driving the sales of plant-based milk products throughout India.

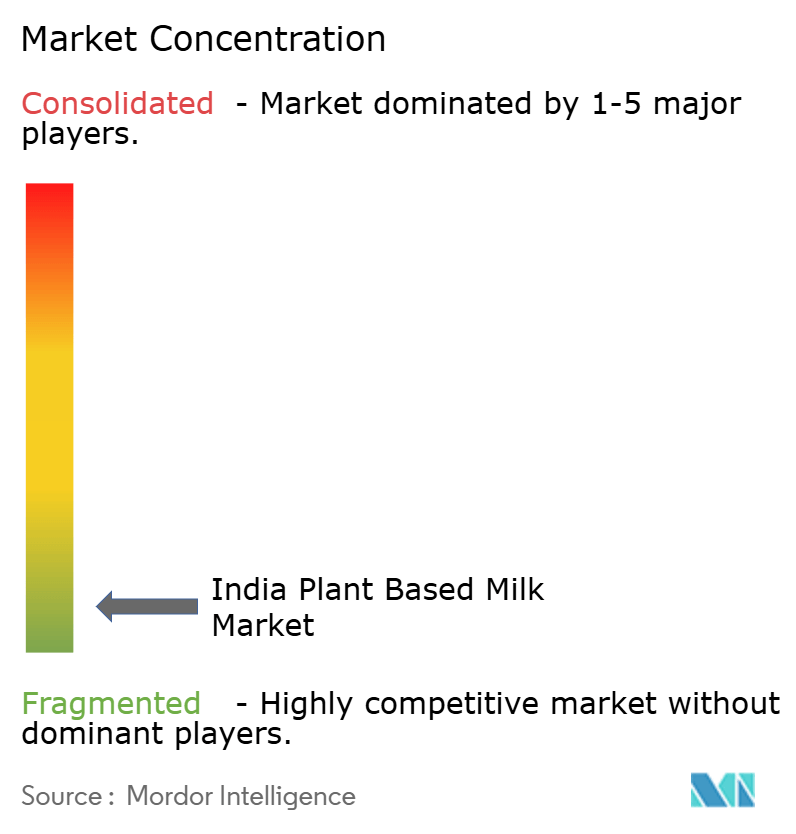

India Plant Based Milk Industry Overview

The Indian plant-based milk market is characterized by intense competition, with a multitude of domestic players striving for prominence. Dominating the landscape are major players like Danone S.A., The Hershey Company, Wingreens Farms Private Limited, Sanitarium Health & Wellbeing Company, and Drums Food International Private Limited. These key players are not only launching new products but are also engaging in mergers, acquisitions, and partnerships to cultivate a strong consumer base and solidify their market standing. Furthermore, these industry leaders are bolstering their competitive edge through strategic expansions, including significant capital investments aimed at boosting production capacity. This proactive approach ensures they can cater to the surging demand and uphold their market leadership.

India Plant Based Milk Market Leaders

-

The Hershey Company

-

Danone S.A.

-

Drums Food International Private Limited

-

Wingreens Farms Private Limited

-

Sanitarium Health & Wellbeing Company

- *Disclaimer: Major Players sorted in no particular order

India Plant Based Milk Market News

- September 2024: Maiva Fresh introduced its flagship product - the Maiva Unsweetened Almond Milk. The newly branded health beverage line, "Maiva Fresh," was promoted with the slogans "Pure Good" (focusing on health) and "Pure Joy" (emphasizing taste), highlighting its dual appeal of health and flavor. With zero cholesterol, a low glycemic index (GI), and fortification with Vitamin B12 and Vitamin D, Maiva Fresh Almond is positioned as an ideal daily choice.

- September 2024: Oxbow Brands unveiled its latest venture, the Vegan Drink Company (VDC). VDC emerges in response to the surging demand for dairy-free products, particularly among the expanding lactose-intolerant and vegan demographics. Understanding the unique nutritional requirements of its audience, VDC crafts its beverages with a rich mix of vital vitamins, such as A, D, B1, B2, and B12, guaranteeing a tasty and wholesome dairy-free choice.

- August 2024: 1.5 Degree Inc. launched a product line that includes oat milk and soy milk, catering to both vegan and non-vegan consumers in search of healthier, lactose-free alternatives. The entire product line underscores health benefits, boasting gluten-free, eco-friendly, cholesterol-free, and 100% vegan options.

India Plant Based Milk Industry Segmentation

Plant-based milk, derived from sources like nuts, grains, and legumes, is crafted by blending these ingredients with water. To closely resemble the texture and nutritional profile of cow's milk, manufacturers often incorporate additional elements such as vitamins, minerals, and stabilizers.

The India plant based milk market is segmented by product type and distribution channel. By product type, the market is segmented into almond milk, cashew milk, coconut milk, hazelnut milk, oat milk, and soy milk. By distribution channel, the market is segmented into off-trade and on-trade. The off-trade segment is further classified into supermarkets/hypermarkets, convenience stores, specialist retailers, online retail stores, and other off-trade channels. The market sizing has been done in value terms in USD for all the abovementioned segments.

| Product Type | Almond Milk | ||

| Cashew Milk | |||

| Coconut Milk | |||

| Hazelnut Milk | |||

| Oat Milk | |||

| Soy Milk | |||

| Distribution Channel | Off-Trade | Supermarkets/Hypermarkets | |

| Convenience Stores | |||

| Specialist Retailers | |||

| Online Retail Stores | |||

| Other Off-Trade Channels | |||

| On-Trade | |||

India Plant Based Milk Market Research Faqs

How big is the India Plant Based Milk Market?

The India Plant Based Milk Market size is expected to reach USD 59.02 million in 2025 and grow at a CAGR of 14.78% to reach USD 117.58 million by 2030.

What is the current India Plant Based Milk Market size?

In 2025, the India Plant Based Milk Market size is expected to reach USD 59.02 million.

Who are the key players in India Plant Based Milk Market?

The Hershey Company, Danone S.A., Drums Food International Private Limited, Wingreens Farms Private Limited and Sanitarium Health & Wellbeing Company are the major companies operating in the India Plant Based Milk Market.

What years does this India Plant Based Milk Market cover, and what was the market size in 2024?

In 2024, the India Plant Based Milk Market size was estimated at USD 50.30 million. The report covers the India Plant Based Milk Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the India Plant Based Milk Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

India Plant Based Milk Industry Report

Statistics for the 2025 India Plant Based Milk market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. India Plant Based Milk analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.

.webp)