Italy OOH And DOOH Market Size

Italy OOH And DOOH Market Analysis

The Italy OOH And DOOH Market size is estimated at USD 344.07 million in 2025, and is expected to reach USD 454.82 million by 2030, at a CAGR of 5.74% during the forecast period (2025-2030).

- The Italian out-of-home and digital out-of-home advertising sectors are experiencing significant growth, driven by technological advancements, changing consumer behavior, and strategic investments from significant advertising firms. The rise in urbanization, increasing population mobility, and the effectiveness of OOH and DOOH in capturing consumer attention are key factors propelling this demand.

- Italy's urban population has been steadily increasing, leading to higher foot traffic in cities. The urban population in Italy reached 71.9% in 2023. As urban areas grow and evolve, the demand for effective advertising solutions in public spaces increases. This trend presents significant opportunities for OOH and DOOH advertisers in Italy to engage urban audiences.

- Further, the advent of digital technology has revolutionized traditional OOH advertising. DOOH platforms enable dynamic, real-time content updates, interactive displays, and targeted advertising based on data analytics. These technological capabilities make DOOH advertising more engaging and effective. The integration of digital screens with programmatic advertising platforms allows for the automated buying and selling of ad spaces, optimizing ad placements and increasing the efficiency of campaigns.

- Advertisers in Italy are increasingly integrating OOH and DOOH campaigns with social media and mobile platforms. This multi-channel approach amplifies the reach and impact of advertising efforts, creating a seamless experience for consumers across different touchpoints.

- Companies in Italy are launching interactive DOOH screens in collaboration with ad companies. The screens allow consumers to engage with content through their smartphones or social media accounts and are gaining popularity. For instance, in May 2024, Adform, a company that provides a safe media buying platform, announced that it is partnering with VIOOH. This new launch will strengthen the company's programmatic omni-channel offerings. Such developments are expected to increase in the coming years, driving the overall market.

Italy OOH And DOOH Market Trends

Growing Demand for Digital OOH (LED Screens) in Italy

- Digital out-of-home advertising, particularly through LED screens, is rapidly transforming the advertising landscape in Italy. This shift is driven by technological advancements, urbanization, and changing consumer behaviors. LED screens offer dynamic and engaging content, making them an attractive option for advertisers aiming to capture the attention of a diverse and mobile audience.

- DOOH providers in Italy are adopting LED screens to provide high-resolution, vibrant displays that enhance the visual appeal of advertisements. The capability to display dynamic content, including videos and animations, makes them more engaging than traditional static billboards.

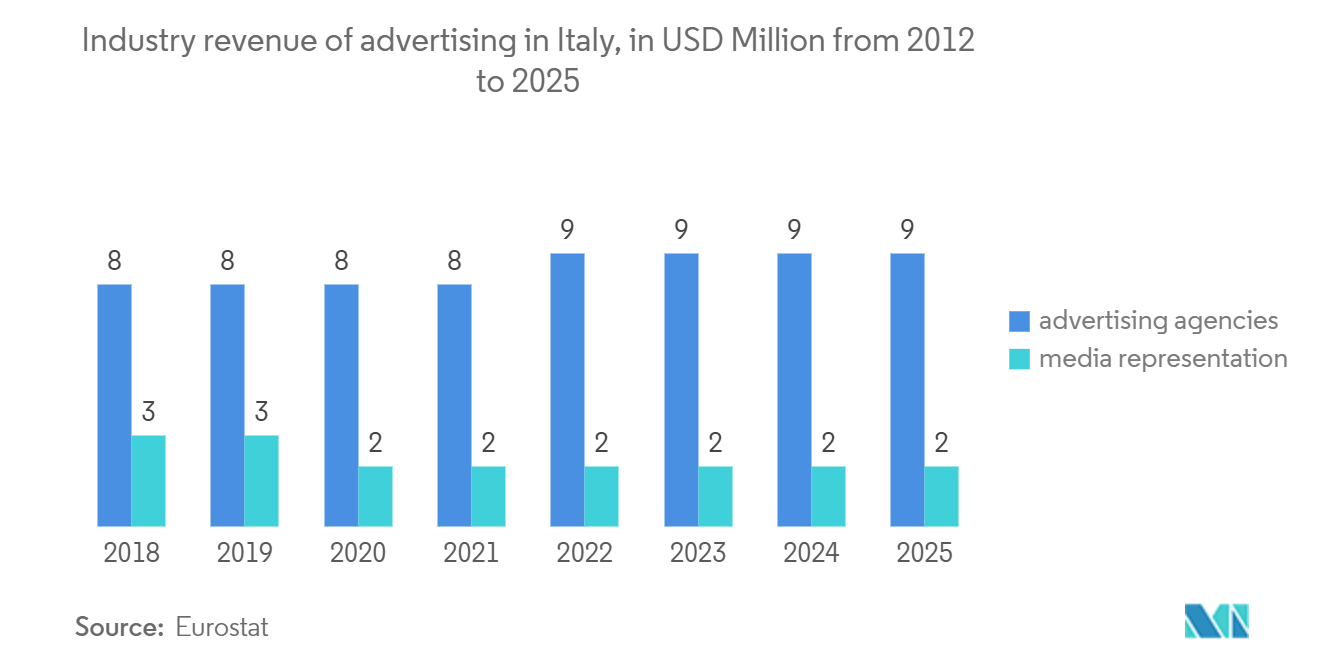

- Also, advertising agencies in Italy are increasing their budgets by providing advertisements through LED screens, with the shift toward adopting OOH and DOOH advertisements in Italy. As per the Eurostat report, the industry revenue of advertising agencies is growing. For instance, the industry revenue of advertising agencies was USD 8,821.6 million in 2018, which reached USD 9,944.9 million in 2023. This growth represents the rising inclination of businesses toward advertising agencies for their advertising demand.

- The primary drivers that are propelling the demand for LED screens in Italy include their brightness and ability to display moving content, which attract customers and capture the attention of passersby, even in crowded and busy environments. Also, advertisers can easily change the content based on the time of day, weather conditions, or current events, ensuring relevance and timeliness.

- The Italian government's push toward smart city development includes the installation of smart infrastructure and IoT technologies. These advancements should further integrate LED screen advertising into urban environments, providing new opportunities for data-driven and contextually relevant ads. Smart city initiatives will enable more efficient management of digital advertising assets, allowing for better placement and utilization of LED screens.

Increasing Demand for OOH and DOOH Advertisement Among Retailers

- Out-of-home and digital out-of-home advertising are experiencing significant growth in Italy, particularly among retailers. Italy is witnessing a growth in retail sales. According to the report by ISTAT in September 2023, retail sales in Italy saw a 2.7% increase from the previous year. Notably, sales in large-scale distribution surged by 5.5%, driven by a significant 7.1% growth in food distribution, especially in supermarkets. The growth in the retail sector is driving the demand for OOH and DOOH advertising. With the growing sales, retailers have started adopting various advertising strategies.

- Consumer behavior in Italy is transforming, marked by an increasing inclination toward experiential shopping and digital engagements. Thus, retailers are pivoting toward out-of-home and digital out-of-home strategies to attract consumers and enhance foot traffic in their physical stores. The increasing reliance on smartphones and digital devices has also contributed to the popularity of DOOH as it seamlessly integrates with mobile marketing efforts.

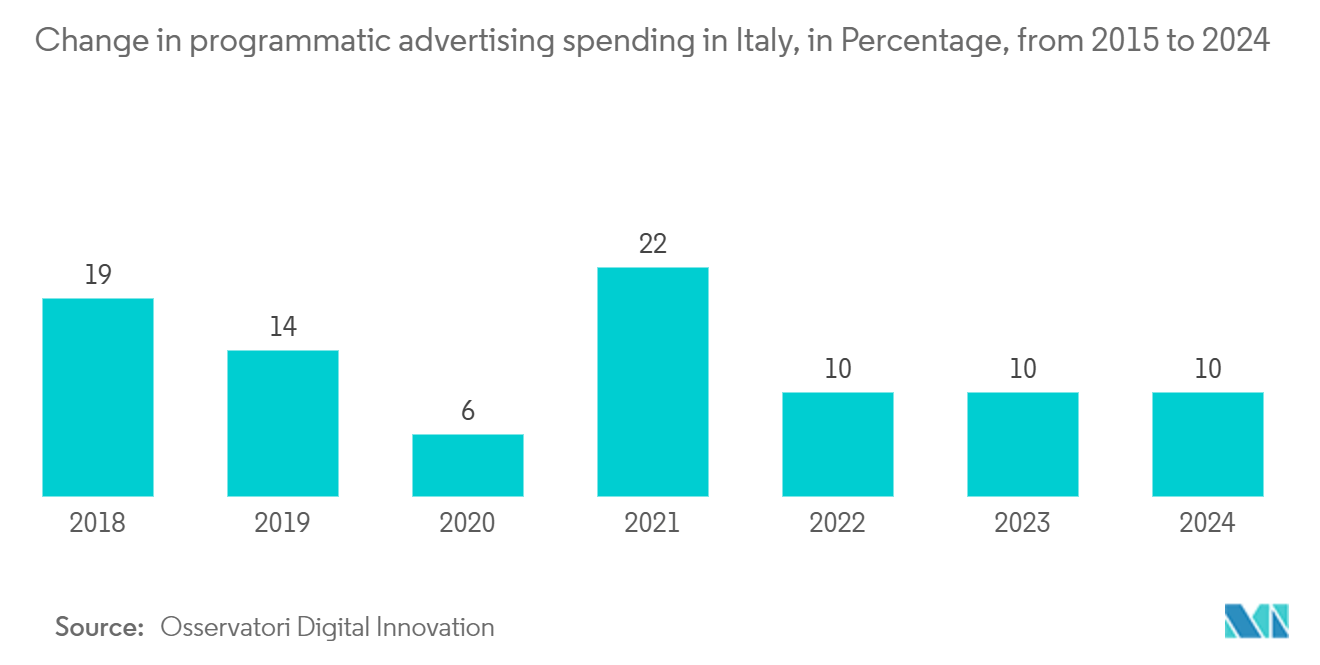

- OOH and DOOH advertising are effective tools for building brand visibility and awareness. In Italy's competitive retail market, many retailers try to stand out by adopting various advertising strategies, including digital displays that offer creative visuals and dynamic content that attract retail customers. Also, there has been a change in programatic advertisment in the country. According to the report by Osservatori Digital Innovation, programmatic advertising spending in Italy is changing. It is expected to grow by 10%, reaching EUR 930 million. This is driving the OOH and DOOH market's growth in the retail sector.

- The future of OOH and DOOH advertising in Italy's retail sector appears promising, with continued growth expected in the coming years. As technology evolves, retailers will have access to more sophisticated tools and solutions to enhance their advertising efforts. Additionally, the increasing importance of data privacy and consumer consent should drive the development of more transparent and ethical advertising practices.

Italy OOH And DOOH Industry Overview

The Italian OOH and DOOH market is semi-consolidated, with some of the major market vendors holding a significant share of the market. Local companies dominate the country's OOH and DOOH advertising landscape. Partnerships, acquisitions, and merger activities are shaping the future of the Italian OOH and DOOH market. The major players in the market include JCDecaux SE, Hivestack, Broadsign, and Dentsu.

- January 2024: Pikasso Italia unveiled the inaugural DOOH screen of the Milano Collection in the Romana District. Positioned strategically, the digital screen capitalizes on a steady stream of passing vehicles guided by two traffic lights, which effectively extend the viewer's exposure time.

Italy OOH And DOOH Market Leaders

-

JCDecaux SE

-

Hivestack

-

Broadsign

-

Dentsu

-

Clear Channel

- *Disclaimer: Major Players sorted in no particular order

Italy OOH And DOOH Market News

- July 2024: Pikasso Italia secured an exclusive DOOH ad concession at the Bariblu Mall in Italy's Bari province. The advertising platform at Bariblu will feature a starled screen on the walkway, positioned to overlook the central atrium. Additionally, there will be a channel network comprising eight 75'' LCD totems. This DOOH takeover will encompass all nine screens at the mall.

- February 2024: JCDecaux rolled out a global airport programmatic DOOH (Digital Out-of-home) offering, spanning numerous countries, including Italy. This initiative equips brands and agencies to run targeted, dynamic, seamless, and contextualized advertising campaigns across JCDecaux's programmatic-enabled airports. This is made possible through the VIOOH SSP (Supply Side Platform) and over 30 DSPs (Demand Side Platforms), with Displayce being a prominent inclusion.

Italy OOH And DOOH Industry Segmentation

The study tracks the advertising spending on various OOH formats, including billboards (city-light boards), street furniture (city-light posters), transit and transportation (advertising in and on vehicles used for public transportation), and place-based media (media at the point of sale). The scope of the study includes digital and static advertisements placed indoors and outdoors at shopping malls, airports, streets, transit spaces, etc. The commission and production costs of agencies are excluded from the scope of work.

The report covers the Italian OOH and DOOH market and is segmented by type [static (traditional) OOH, digital OOH (programmatic OOH and others)], application [billboards, transportation (airports and others (buses, etc.), street furniture, and other place-based media], and end-user industry (automotive, retail and consumer goods, healthcare, BFSI, and other end users). The market sizes and forecasts are provided in terms of value (USD) for all the above segments.

| By Type | Static (Traditional) OOH | ||

| Digital OOH (LED Screens) | Programmatic OOH | ||

| Others | |||

| By Application | Billboard | ||

| Transportation (Transit) | Airports | ||

| Others (Buses, etc.) | |||

| Street Furniture | |||

| Other Place-based Media | |||

| By End-user Industry | Automotive | ||

| Retail and Consumer Goods | |||

| Healthcare | |||

| BFSI | |||

| Other End-user Industries | |||

| Static (Traditional) OOH | |

| Digital OOH (LED Screens) | Programmatic OOH |

| Others |

| Billboard | |

| Transportation (Transit) | Airports |

| Others (Buses, etc.) | |

| Street Furniture | |

| Other Place-based Media |

| Automotive |

| Retail and Consumer Goods |

| Healthcare |

| BFSI |

| Other End-user Industries |

Italy OOH And DOOH Market Research FAQs

How big is the Italy OOH And DOOH Market?

The Italy OOH And DOOH Market size is expected to reach USD 344.07 million in 2025 and grow at a CAGR of 5.74% to reach USD 454.82 million by 2030.

What is the current Italy OOH And DOOH Market size?

In 2025, the Italy OOH And DOOH Market size is expected to reach USD 344.07 million.

Who are the key players in Italy OOH And DOOH Market?

JCDecaux SE, Hivestack, Broadsign, Dentsu and Clear Channel are the major companies operating in the Italy OOH And DOOH Market.

What years does this Italy OOH And DOOH Market cover, and what was the market size in 2024?

In 2024, the Italy OOH And DOOH Market size was estimated at USD 324.32 million. The report covers the Italy OOH And DOOH Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Italy OOH And DOOH Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Italy OOH And DOOH Industry Report

Statistics for the 2025 Italy OOH And DOOH market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Italy OOH And DOOH analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.