Japan Credit Cards Market Analysis

The Japan Credit Cards Market size in terms of transaction value is expected to grow from USD 700.03 billion in 2025 to USD 998.46 billion by 2030, at a CAGR of 7.36% during the forecast period (2025-2030).

Japan's credit card penetration rate is high, with a significant portion of the population using credit cards for financial transactions. Credit card issuers in Japan offer various rewards and benefits to attract and retain customers. Cashback programs, travel rewards, discounts at partner merchants, and loyalty points are standard features credit card providers offer.

JCB, a Japanese payment network, holds a significant share of the credit card market in Japan. Merchants across the country widely accept JCB cards. However, international payment networks like Visa and Mastercard also have a strong presence and are widely accepted. The credit card market in Japan has embraced technological advancements. Contactless payments, mobile payment solutions, and digital wallets, such as Apple Pay and Google Pay, are widely used in the country. Japanese credit card companies have also been at the forefront of developing and implementing security measures to protect against fraud and unauthorized transactions.

The Japanese government has implemented regulations to protect consumers in the credit card market. These regulations aim to ensure fee transparency, safeguard consumer data privacy, and address issues related to debt collection practices. The Japanese credit card market is influenced by cultural factors such as a preference for cash transactions, especially in smaller businesses and rural areas. However, there has been a gradual shift towards cashless payments, driven by government initiatives and consumer adoption of digital payment methods.

Japan Credit Cards Market Trends

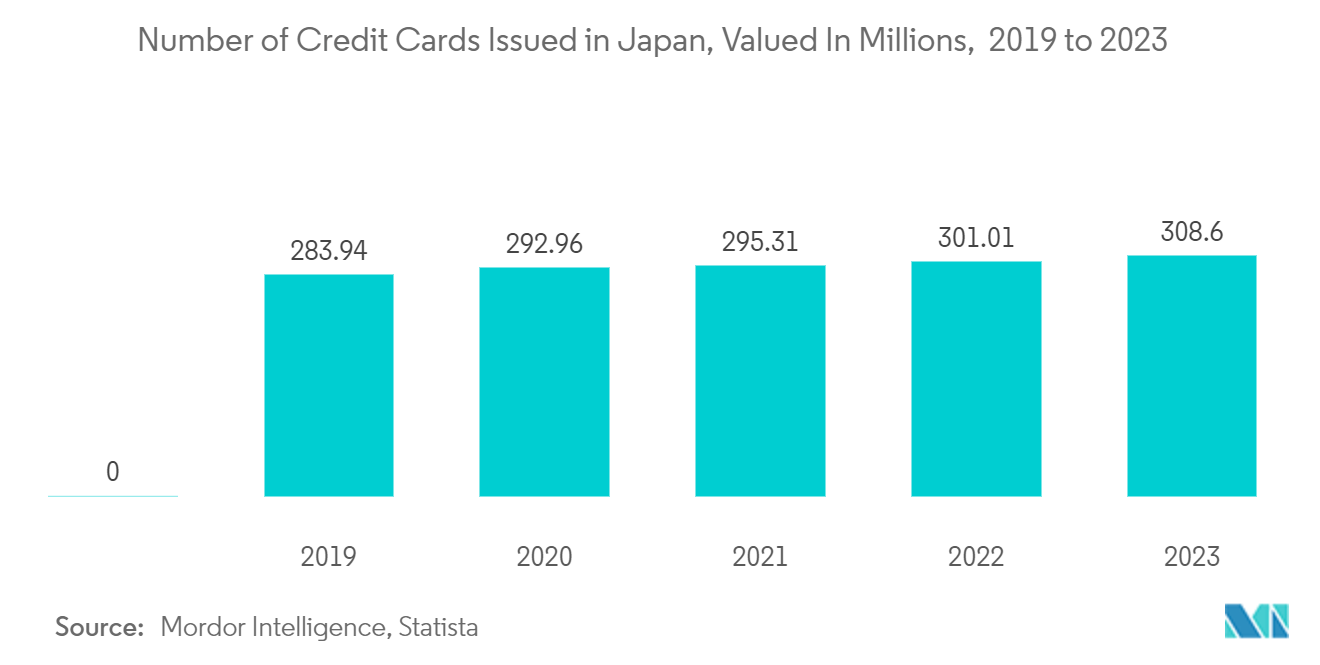

Increasing in Number of Credit Card issued

Credit cards have gained popularity among Japanese consumers, reflecting a shift from traditional cash-based transactions to electronic payment methods. Increased convenience, wider acceptance at merchants, and the availability of various rewards and benefits have contributed to the rising demand for credit cards.

The consumption tax rate was raised from eight to ten percent. The Japanese government and financial regulators have been promoting cashless payments as part of efforts to modernize the economy and increase efficiency in transactions. Cashless payment methods, including credit cards, are being encouraged as a way to reduce the country's reliance on cash and improve convenience for consumers. Traditionally, Japan has been a cash-based society, with many businesses preferring cash payments. However, there has been a shift in recent years as more merchants, including small businesses and restaurants, have started accepting credit cards. This increased acceptance has made credit cards a more viable payment option for consumers.

Credit card issuers often partner with retailers, brands, and organizations to issue co-branded credit cards. These partnerships provide additional incentives and exclusive benefits for cardholders, fostering customer loyalty and driving the issuance of more credit cards. The Japanese government has encouraged cashless transactions and electronic payments as a growth strategy. This has led to initiatives promoting the use of credit cards and digital payment methods, contributing to the increase in the number of credit cards issued.

Credit Cards are the Major Payment Option for Digital Buyers in Japan

Credit cards were indeed a major payment option for digital buyers in Japan. However, it's important to note that the digital payments landscape can evolve quickly, and there may have been changes since then. Credit cards have been widely accepted and used in Japan for various transactions, including online shopping. Major credit card companies such as Visa, Mastercard, American Express, and JCB (Japan Credit Bureau) are well-established in the country and have a significant presence. Many Japanese consumers prefer using credit cards for their convenience, security features, and ability to accumulate reward points.

Credit card companies in Japan often provide special deals and partnerships with merchants to incentivize card usage. This further encourages consumers to use credit cards for online purchases. Some credit card companies also offer installment payment options, making it easier for customers to manage larger purchases.

Japan Credit Cards Industry Overview

The credit card market in Japan is highly competitive, with a wide range of credit card options available to consumers. Credit cards are widely accepted, and the market continues to evolve with technological advancements and changing consumer preferences. Major banks and credit card companies dominate the credit card market in Japan. There are some prominent banks in Japan that provide credit card services. It's worth noting that some of these banks may collaborate with credit card companies or issue cards under their brand names.

Additionally, other regional and specialized banks in Japan offer credit cards to their customers. Companies leverage their existing customer base and banking relationships to provide credit card options to their customers. Technological advancements influence the competitive landscape. Mobile payment services, digital wallets, and contactless payment options are gaining popularity in Japan. Credit card companies and financial institutions are adapting to these trends by integrating mobile payment solutions or offering their digital wallet services. Following is the list of credit card companies in Japan: Rakuten Card, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, Mizuho Financial Group, and Resona Holdings.

Japan Credit Cards Market Leaders

-

Rakuten Card

-

Mitsubishi UFJ Financial Group

-

Sumitomo Mitsui Financial Group

-

Mizuho Financial Group

-

Resona Holdings

- *Disclaimer: Major Players sorted in no particular order

Japan Credit Cards Market News

- May 2023: Sumitomo Mitsui Banking Corporation announced a USD 10 million investment in U.S.-based Closed Loop Partners' Circular Plastics Fund. The Closed Loop Circular Plastics Fund is managed and operated by Closed Loop Partners, an investment firm dedicated to advancing the circular economy. The fund provides catalytic debt and equity financing into solutions and infrastructure that advance the recovery and recycling of plastics, helping keep more materials in circulation while reducing greenhouse gas emissions and leading a shift to the circular economy.

- May 2023: Mizuho Financial Group, Inc. and Greenhill & Co., Inc. announced a definitive agreement for Mizuho to acquire Greenhill in an all-cash transaction at USD15 per share, reflecting an enterprise value of approximately USD550 million, including assumed debt. Through this transaction, Mizuho will likely accelerate its investment banking growth strategy, building on Greenhill's 27-year history of advising important clients on significant mergers & acquisitions, restructurings and capital-raising transactions.

Japan Credit Cards Industry Segmentation

A credit card, known as "kurejitto kādo" (クレジットカード) in Japanese, refers to a payment card issued by financial institutions or credit card companies. It enables cardholders to make purchases and access credit, allowing them to borrow funds up to a certain credit limit from the issuing institution. A complete background analysis of the Japanese credit card market, which includes an assessment of the economy, a market overview, market size estimation for key segments, emerging trends in the market, market dynamics, and key company profiles, are covered in the report.

The Japanese credit card market is segmented by card type, application, and provider. By card type, the market is sub-segmented into general-purpose credit cards and specialty & other credit cards. By application, the market is sub-segmented into food & groceries, health & pharmacy, restaurants & bars, consumer electronics, media & entertainment, travel & tourism, and other applications. By provider, the market is sub-segmented into visa, mastercard, and other providers. The report offers market size and forecasts for the Japanese credit cards market in value (USD) for all the above segments.

| By Card Type | General Purpose Credit Cards |

| Specialty & Other Credit Cards | |

| By Application | Food & Groceries |

| Health & Pharmacy | |

| Restaurants & Bars | |

| Consumer Electronics | |

| Media & Entertainment | |

| Travel & Tourism | |

| Other Applications | |

| By Provider | Visa |

| MasterCard | |

| Other Providers |

Japan Credit Cards Market Research Faqs

How big is the Japan Credit Cards Market?

The Japan Credit Cards Market size is expected to reach USD 700.03 billion in 2025 and grow at a CAGR of 7.36% to reach USD 998.46 billion by 2030.

What is the current Japan Credit Cards Market size?

In 2025, the Japan Credit Cards Market size is expected to reach USD 700.03 billion.

Who are the key players in Japan Credit Cards Market?

Rakuten Card, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, Mizuho Financial Group and Resona Holdings are the major companies operating in the Japan Credit Cards Market.

What years does this Japan Credit Cards Market cover, and what was the market size in 2024?

In 2024, the Japan Credit Cards Market size was estimated at USD 648.51 billion. The report covers the Japan Credit Cards Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Japan Credit Cards Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Japan Credit Cards Industry Report

Statistics for the 2025 Japan Credit Cards market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Japan Credit Cards analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.