LATAM Oilfield Chemicals Market Analysis

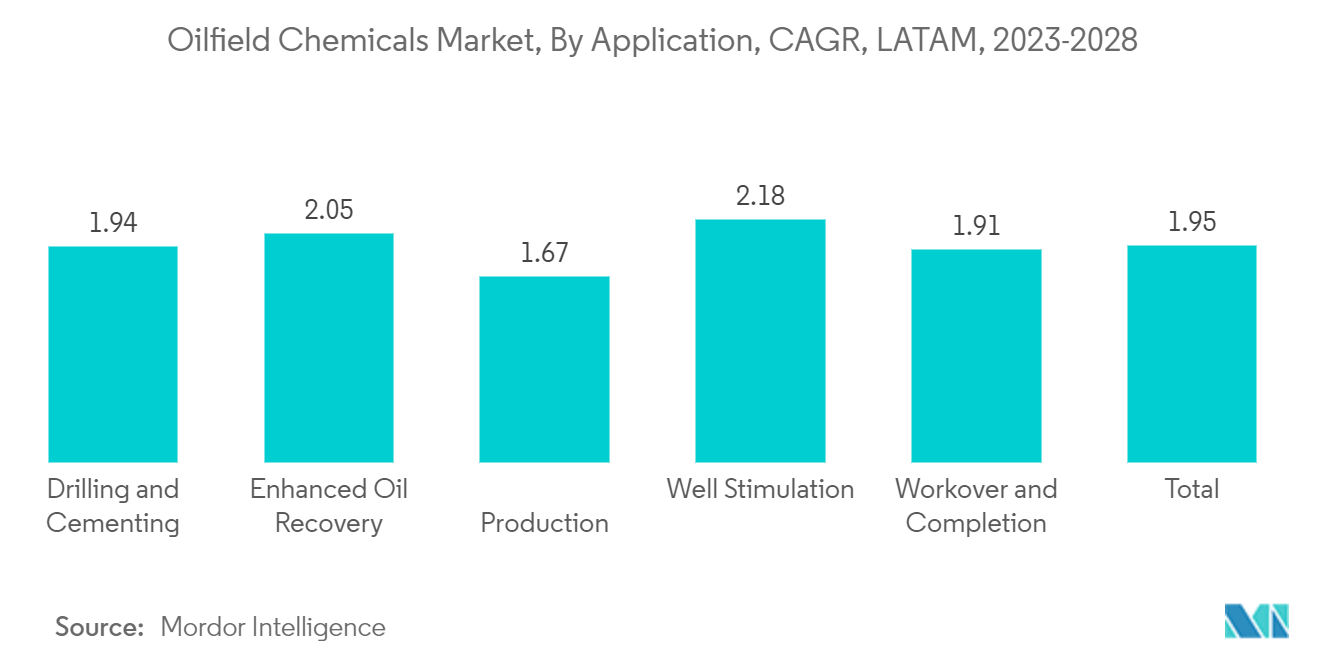

The LATAM Oilfield Chemicals Market is expected to register a CAGR of greater than 2% during the forecast period.

- Following an unusually low level of activity in 2020 due to the Covid pandemic, drilling outside the United States increased at an 8.0% rate in 2021, with major contributions from Latin America. However, in 2022, the drilling performance improved with the growing oil and gas demand and significantly improved commodity prices.

- The major factors driving the market's growth are the increasing offshore activities in South America. Nine potential commercial discoveries were made in Guyana and Suriname, accounting for 21% of the total discovered resources.

- On the other hand, the declining economy of Venezuela is expected to hinder the market's growth.

- The potential discovery of oil and gas reserves in the region is expected to be a future opportunity for the studied market.

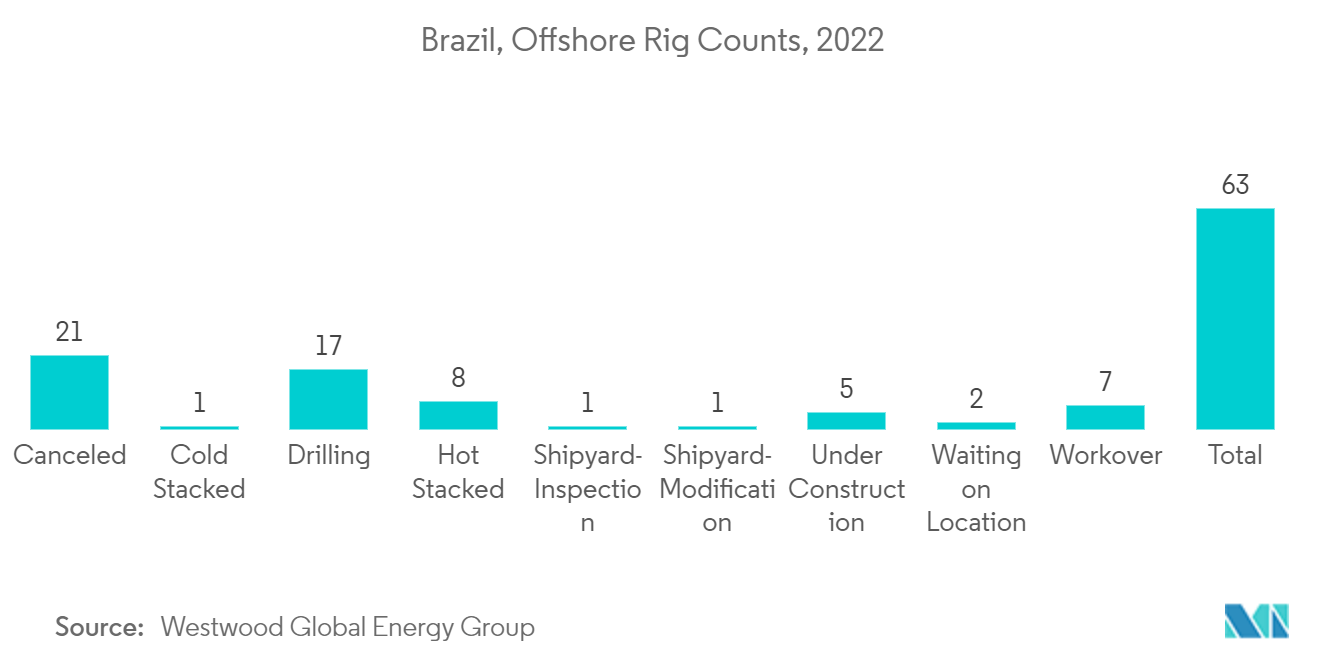

- Brazil is leading in oil and gas exploration activities in Latin America and is expected to drive the demand for oilfield chemicals.

LATAM Oilfield Chemicals Market Trends

Increasing Demand from the Drilling and Cementing Segment

- In the drilling segment, oilfield chemicals are used to stabilize temperature and prevent contaminated products from entering the drilling fluid system. They are also added as additives to the drilling fluids used to maintain the hydrostatic pressure and clear the wellbore from cuttings. The rise in deep-water drilling activities is expected to drive the oilfield chemicals market in the future.

- The increase in deep-water drilling activities is expected to drive the oilfield chemicals market in the future. Moreover, the strong demand for the drilling segment in the Latin American market and the new joint ventures and mergers among the existing big players in the market are expected to engender huge opportunities in the LATAM oilfield chemicals market.

- Latin America is expected to have a significant share in the oilfield chemicals market due to the increasing exploration and production activities in Brazil, Mexico, Guyana, and Argentina. Due to tight investment budgets, the companies operating in the region are taking additional steps in technology and performance for cost-effective operations.

- ExxonMobil has made two new discoveries in the Stabroek block, offshore Guyana, to the southeast of the Liza and Payara developments. The Seabob and Kiru-Kiru discoveries are the sixth and seventh in Guyana in 2022, bringing the total number of discoveries in Guyana to more than 25.

- In 2022, Staatsolie, a Surinamese oil and gold company, announced a plan to invest USD 1.5 billion by 2026, with most of the funds going toward Suriname's offshore drilling program. The state-owned energy company also stated that it intends to promote Suriname's available offshore acreage to attract foreign investment while eventually developing its capabilities to become an operator. Staatsolie also plans to auction offshore Suriname's shallow-water blocks in 2023. Staatsolie's 2021 shallow water auction saw three blocks purchased by Chevron, TotalEnergies, and Qatar Petroleum.

- The increased exploration activities in Guyana, Suriname, Brazil, Colombia, and the Falkland Islands are expected to increase the drilling and production of chemicals, resulting in higher demand for cementing chemicals. The demand for technologically advanced cementing chemicals is expected to boost the market's growth.

Brazil to Dominate the Market

- Brazil's oil and gas sector continues to improve, despite weakness in the external environment. The country's oil and gas sector has been going through the greatest transformation since the foundation of Petrobras in 1953. For the first time ever, the National Energy Policy Council (CNPE) approved a multi-year bid round calendar from 2017.

- Recently, the Brazilian government raised around USD 2.4 billion in signature bonuses under the country's 15th round of bids for oil and gas blocks. The National Agency of Petroleum, Natural Gas, and Bio-fuels (ANP), the national oil regulator, awarded 22 maritime blocks from the 47 offered.

- In addition, some of the projects lined up for completing the well-development phase in 2024 include Itapu (Surplus), Libra Phase 4, and Lara Entorno (Surplus). All these upcoming projects are expected to drive the demand for oilfield chemicals in the country.

- The Brazilian National Agency of Petroleum (ANP) expects 300 offshore wells to be operational by 2027, culminating in an additional 2 million barrels per day of oil production on top of today's 2.5 million barrels per day production.

- TotalEnergies, along with Shell and Repsol Sinopec, will develop the Lapa South-West project in Brazil. TotalEnergies announced its final investment decision of $1bn for the Lapa South-West oil development project. The French company operates the project with a 45% stake in partnership with Shell, which owns 30% and Repsol Sinopec, which owns 25%. Lapa South-West will raise the Lapa field's output by 25,000 barrels of oil per day from 2025, increasing the total production to 60,000 per day..

- These reserves and advancements in offshore drilling technologies are expected to increase domestic and foreign investment during the forecast period. In addition, the recent political ongoings due to the Petrobras corruption scandal are expected to lead to changes in the regulatory policies of the oil and gas industry, paving the way for more private investments in the sector. This is expected to add up to the demand for oilfield chemicals in the country.

LATAM Oilfield Chemicals Industry Overview

The LATAM Oilfield Chemicals market is fragmented in nature, with a large number of players operating in the market. Some of the prominent players in the market include Ecolab Inc., Baker Hughes, Halliburton, Exxon Mobil Corporation, and Schlumberger Limited.

LATAM Oilfield Chemicals Market Leaders

-

Halliburton

-

Schlumberger Limited

-

Ecolab Inc.

-

Exxon Mobil Corporation

-

Baker Hughes Company

- *Disclaimer: Major Players sorted in no particular order

LATAM Oilfield Chemicals Market News

- August 2022: Baker Hughes expanded its presence in Asia by establishing a new oilfield services chemicals manufacturing facility in Singapore, allowing for manufacturing optimization and faster delivery of fit-for-purpose chemical solutions. The 40,000-square-meter facility will manufacture, store, and distribute chemical solutions for the upstream, midstream, downstream, and adjacent industries.

- March 2022: Halliburton opened The Halliburton Chemical Reaction Plant, the first of its kind in Saudi Arabia, producing a wide range of specialty oilfield chemicals for the entire oil and gas value chain. The facility expands Halliburton's manufacturing footprint in the Eastern Hemisphere and strengthens the company's ability to serve Middle Eastern customers' chemical needs.

LATAM Oilfield Chemicals Industry Segmentation

Oilfield chemicals either enable or improve the efficiency of oil and gas production. Oilfield chemicals, such as well stimulation and other additives, play an important role in increasing the productivity of existing (green) and mature (brown) fields.

The LATAM Oilfield Chemicals market is segmented by chemical type, application, and geography. By chemical type, the market is segmented into biocide, corrosion and scale inhibitor, demulsifier, polymer, surfactant, and other chemical types. By application, the market is segmented into drilling and cementing, enhanced oil recovery, production, well stimulation, workover, and completion. The report also covers the market sizes and forecasts in 6 major countries across Latin America (Brazil, Argentina, Mexico, Columbia, Peru, Ecuador, and the Rest of Latin America).

For each segment, the market sizing and forecasts have been done on the basis of revenue (USD million).

| Chemical Type | Biocide |

| Corrosion and Scale Inhibitor | |

| Demulsifier | |

| Polymer | |

| Surfactant | |

| Other Chemical Types | |

| Application | Drilling and Cementing |

| Enhanced Oil Recovery | |

| Production | |

| Well Stimulation | |

| Workover and Completion | |

| Geography | Mexico |

| Brazil | |

| Colombia | |

| Argentina | |

| Peru | |

| Ecuador | |

| Rest of Latin America (Guyana, Venezuela) |

LATAM Oilfield Chemicals Market Research FAQs

What is the current LATAM Oilfield Chemicals Market size?

The LATAM Oilfield Chemicals Market is projected to register a CAGR of greater than 2% during the forecast period (2025-2030)

Who are the key players in LATAM Oilfield Chemicals Market?

Halliburton, Schlumberger Limited, Ecolab Inc., Exxon Mobil Corporation and Baker Hughes Company are the major companies operating in the LATAM Oilfield Chemicals Market.

What years does this LATAM Oilfield Chemicals Market cover?

The report covers the LATAM Oilfield Chemicals Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the LATAM Oilfield Chemicals Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

LATAM Oilfield Chemicals Industry Report

Statistics for the 2025 LATAM Oilfield Chemicals market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. LATAM Oilfield Chemicals analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.