Latin America Postal Service Market Analysis

The Latin America Postal Service Market is expected to register a CAGR of greater than 2.5% during the forecast period.

- The Latin American postal sector is evolving in an era of fast globalization, technological development, and disruptive innovation. Furthermore, the market is likely to develop throughout the forecast period due to increased demand for on-demand delivery services. The rapid advancement of technology, particularly the emergence of the internet and smartphone devices, has changed the way the world communicates.

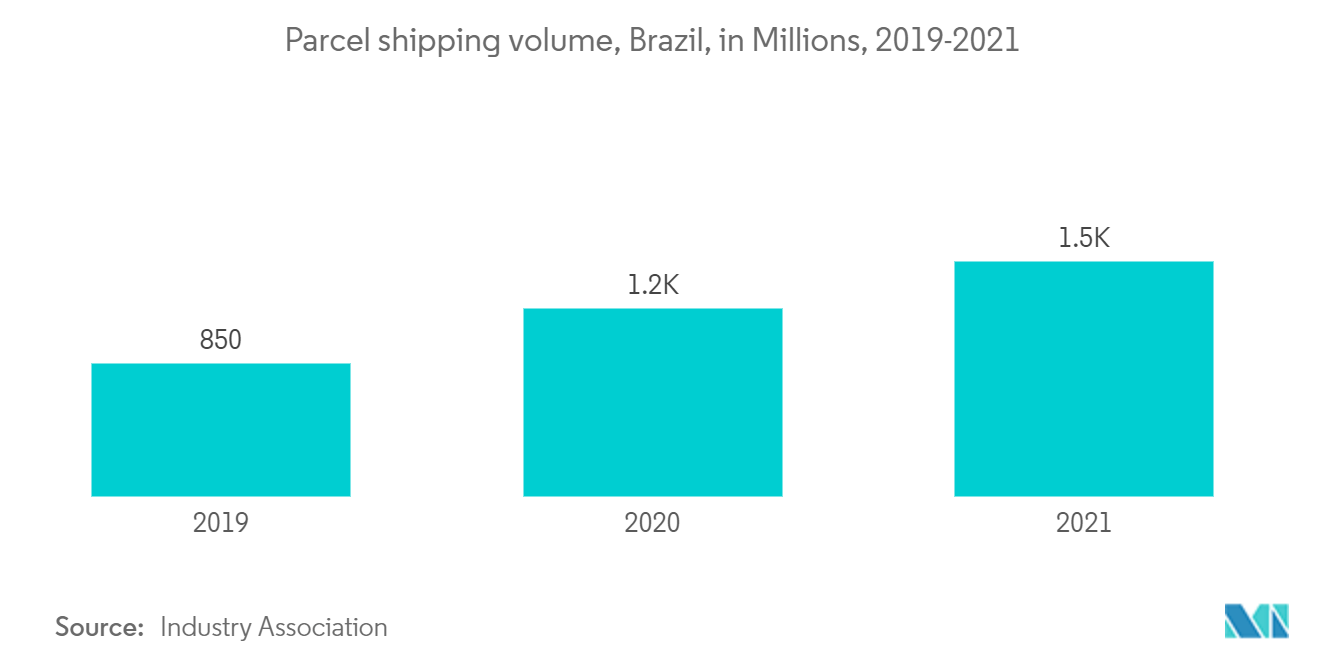

- Furthermore, there is a significant opportunity for the expansion of e-Commerce, with companies appearing to enhance client satisfaction and revenue by utilizing Omni-channel services with connectivity between online and physical purchasing. Postal operators are adapting and changing their operations to satisfy the requirements of customers in the digital age, as well as rethinking how they communicate with consumers, agencies, and governments. Latin America's largest e-commerce economy thrived in 2021. That year, internet shopping in Brazil earned over 161 billion Brazilian reals (USD 30.63 billion) in sales, a figure that was expected to increase by 8% in 2022.

- As the COVID-19 issue progressed and air transport interruptions increased, several postal operators made major efforts to offset the most severe effects of the disruptions in the global supply chain, and therefore in their operations. Some of these steps were just essential and mandatory follow-ups to government-ordered public health and economic measures, creating significant interruptions to business.

Latin America Postal Service Market Trends

The sector is being boosted by Automated Parcel Delivery Terminals

- Customers may pick up their parcels more easily using automated parcel delivery systems. These terminals are frequently positioned in public spaces to offer 24-hour access and to receive or ship items. Furthermore, unique characteristics such as the ability to collect packages from any terminal or unit at any time are promoting the use of these systems. These alternative options have received substantial appeal among e-retailers and logistics organizations, which is projected to fuel the postal service market growth throughout the forecast period.

- In January 2023, Cainiao, a Chinese logistics business, launched a three-year growth strategy for Brazil and established its Latin American headquarters in So Paulo, Brazil, which has also become the distribution hub with the highest degree of automation since Cainiao entered the Latin American market. Cainiao intends to open nine distribution facilities in Brazil over the next three years, encompassing seven crucial southeastern states. In addition, the firm plans to expand its local network activities in areas such as local logistics distribution, customs clearing, distribution centers, and smart express lockers. It intends to open 1,000 more package and food delivery lockers in ten Brazilian cities.

- Recent incidents, such as the COVID-19 epidemic, have heightened interest in automated transportation technology as a means for businesses to assist customers with their purchases using contactless technologies. As a result, the logistics industry has advanced significantly by placing automated package delivery terminals on the market for contactless delivery of goods.

Drone deliveries are likely to strengthen the market

- Growing technology improvements are a major trend that is gaining traction in drone delivery. Drones have grown quite common in recent years, as many individuals and businesses have fully accepted and incorporated this technology into their business strategy. During the COVID-19 period, contactless distribution increased, and drones played a crucial role in ensuring that companies and clients communicated as little as needed.

- In May 2022 Speedbird Aero, a Brazilian firm that creates remotely piloted aircraft (RPA) technology (also known as drones) for commercial deliveries, announced a BRL 35 million (USD 6.66 million) fundraising round. Speedbird, the first Brazilian business to be approved by ANAC, Brazil's equivalent of the FAA, to fly RPA for deliveries, suggests that drones be viewed as a new, viable, and scalable logistics mode for enterprises, logistics, and health services. The startup's goal is to build an "environment of logistics via RPA" that creates employment, assists in the development of new enterprises, and assists firms in the delivery of products.

Latin America Postal Service Industry Overview

The Latin America Postal Service Market is fairly fragmented in nature with the presence of large global players and small and medium-sized local players with quite a few players who occupy the market share. Some of the major players are SkyPostal, Brazilian Post, Correos de México, Serpost, UPS Brazil, and FedEx Mexico.

Latin America Postal Service Market Leaders

-

SkyPost

-

Brazilian Post

-

Correos de México

-

UPS Brazil

-

FedEx Mexico

- *Disclaimer: Major Players sorted in no particular order

Latin America Postal Service Market News

November 2022- UPS has finalized its acquisition of healthcare logistics company Bomi Group to increase its presence in Europe and Latin America. The acquisition, which was initially announced earlier this year, would provide the firm's healthcare subsidiary, UPS Healthcare, with temperature-controlled facilities in 14 countries as well as 3,000 highly experienced personnel to the UPS team across Europe and Latin America.

October 2022- FedEx Ground's new automated package plant in southwest Cedar Rapids is ready to open. The 480,000-square-foot, USD 108.6 million facilities at 1035 Commerce Park Dr SW began construction this summer after the city accepted a term sheet with FedEx Ground and developer Scannell Properties in June 2021.

Latin America Postal Service Industry Segmentation

The postal services market comprises sales of postal services and related items by businesses that provide postal services (organizations, single proprietorships, and partnerships). This industry comprises businesses that provide mail services under a universal service duty. Mail services include accepting, collecting, processing, and delivering letters, printed materials, or mailable items. The report covers the complete background analysis of the Latin America Postal Service Market, including the assessment of the economy and contribution of sectors in the economy, market overview, market size estimation for key segments, emerging trends in the market segments, market dynamics, and geographical trends, and COVID-19 impact.

The Latin America Postal Service Market is segmented By Type (Express Postal Services and Standard Postal Services), By Item (Letter and Parcel), By Destination (Domestics and International), and By Country (Brazil, Argentina, Chile, Mexico, and the Rest of Latin America). The report offers market size and forecasts in value (USD billion) for all the above segments.

| By Type | Express Postal Service |

| Standard Postal Service | |

| By Item | Letter |

| Parcel | |

| By Destination | Domestic |

| International | |

| By Country | Brazil |

| Argentina | |

| Chile | |

| Mexico | |

| Rest of Latin America |

| Express Postal Service |

| Standard Postal Service |

| Letter |

| Parcel |

| Domestic |

| International |

| Brazil |

| Argentina |

| Chile |

| Mexico |

| Rest of Latin America |

Latin America Postal Service Market Research FAQs

What is the current Latin America Postal Service Market size?

The Latin America Postal Service Market is projected to register a CAGR of greater than 2.5% during the forecast period (2025-2030)

Who are the key players in Latin America Postal Service Market?

SkyPost, Brazilian Post, Correos de México, UPS Brazil and FedEx Mexico are the major companies operating in the Latin America Postal Service Market.

What years does this Latin America Postal Service Market cover?

The report covers the Latin America Postal Service Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Latin America Postal Service Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Latin America Postal Service Industry Report

Statistics for the 2025 Latin America Postal Service market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Latin America Postal Service analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.