Malaysia Luxury Goods Market Analysis

The Malaysia Luxury Goods Market is expected to register a CAGR of 4.54% during the forecast period.

The Covid-19 crisis has hit the luxury and fashion industry hard as the pandemic strongly impacted the way consumers perceive their financial situation. Further, the industry has been affected at different levels of the supply chain by the closure of all commercial markets and malls; and the cross-border trade barriers. Moreover, in 2020 and the early months of 2021, changes in tourism flow due to the ongoing COVID-19 travel restrictions wiped out an undeniably large chunk of the purchasing power. According to the data released by the DOSM (Department of Statistics Malaysia), in 2020, Malaysia recorded a decrease of 83% in international tourist arrival compared to the earlier year due to the pandemic. As most of the tourists are from European countries with significant purchasing power, the pandemic has affected the sales of luxury goods substantially during 2020. However, the pandemic has provided an opportunity for luxury brands in online retailing as techno-savvy consumers are opting for e-commerce platforms to purchase various fashion accessories including footwear, bags, and jewelry, among others.

In the medium term, the demand for luxury products is expected to grow significantly as Malaysia is emerging as one of the popular destinations for luxury tourism, thereby making it a potential marketplace for global luxury brand manufacturers and retailers. Further, the emergence of e-commerce has provided easy access to product-related information and prices, through online sources, at any given point of time. This in turn, expected to accelerate the sale of luxury goods through online retail channels.

Malaysia Luxury Goods Market Trends

Increasing Tourism and Growing Cultural Influence

The sustained growth of the luxury goods market can be attributed to the continuing rise in the tourism industry. The travelers visiting the country have high disposable income and often buy luxury goods from the outlets of various multinational brands. Malaysia holds an economically strong market, and therefore, major multinational brands often launch their premium products earlier in these countries than in many others. Travelers visiting from around the world are attracted by the new luxury products, which they almost always purchase. According to a survey by Statistics Malaysia in 2021, the largest share of domestic tourism expenditure came from shopping, which made up 50.3 percent of the total domestic tourism expenditure. In comparison, accommodation made up 5.9 percent of domestic tourism expenditure.

Tourists often prefer perfumes and leather products for luxury purchases. As a result, key brands in the segment are offering a broad portfolio of these products. For instance, Gucci has a product portfolio in the country that comprises more than 29 variants of perfumes. On the other hand, the increasing influence of culture and social pressure in society, along with the growing wealth and super-rich population, who are willing to spend millions on luxury items, is driving the market for luxury goods in Malaysia.

Moreover, high-income households prefer to gift luxury goods such as jewelry and watches to express love, affection, and prestige as branded products are perceived to elevate the owner's social status. The trend is anticipated to continue in the forecast period which in turn augments the market growth.

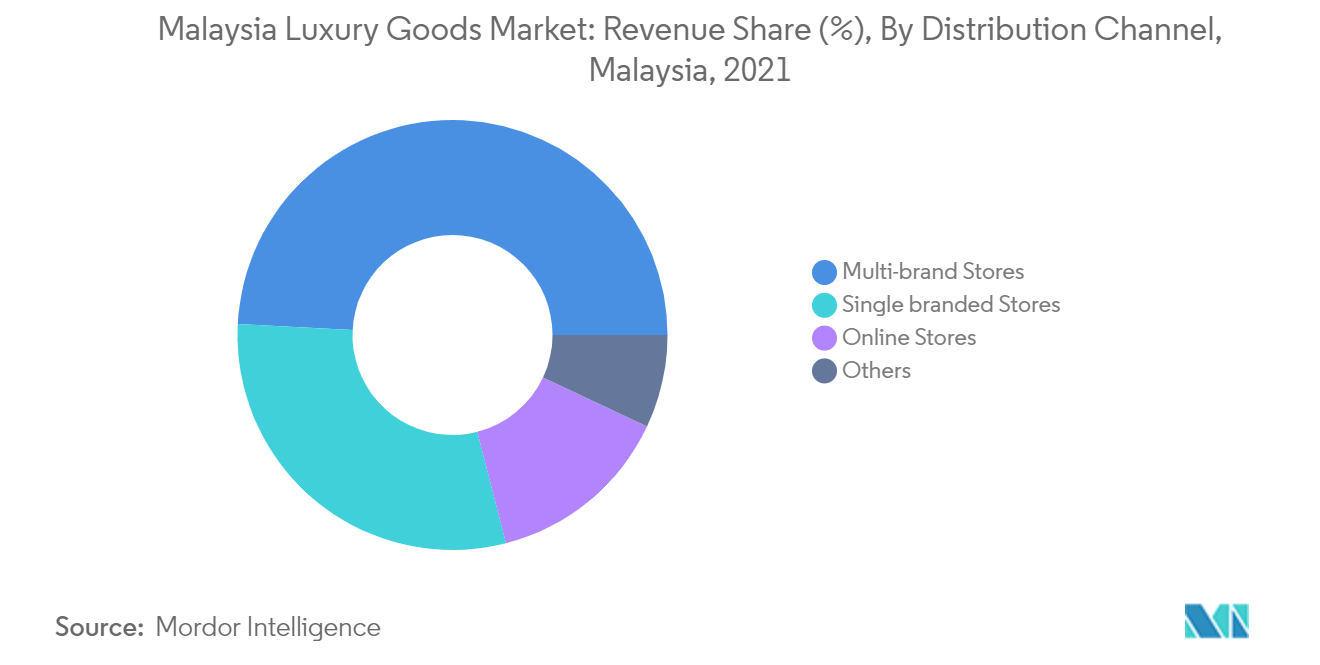

Multi- Brand Store Holds A Prominent Share

The primary distribution channels for the sales of luxury goods in the country include single-brand stores, multi-brand stores, and other offline channels, which include supermarkets/hypermarkets, department stores, and warehouse clubs. Multi-brand stores account for most of the sales of luxury goods, including clothing, footwear, watches, and other accessories, across the country due to an ample market space catering to a wide range of preferences. The luxury goods business has seen an increase in sales of premium products from these mass merchandisers because of the wide availability of various brands, which has been a major factor in evolving customer preferences.

Multi-brand stores showcase a wide range of private-label products. Most of the brands sold in these shops, use an ''own name" approach. Many luxury goods manufacturers opt for local agents or dealers (companies, associations, or individuals) who have the ability and expertise to market and distribute their goods in Malaysia, rather than opening an office or a subsidiary. This allows international firms to benefit from local experience while avoiding any of the costs associated with having a physical footprint in the country.

Malaysia Luxury Goods Industry Overview

The Malaysia luxury goods market is competitive with multinational companies that have gained preference due to their strong market presence through an extensive distribution network. The leading players in the market are Rolex S.A., Prada S.p.A, The Estée Lauder Companies Inc., Burberry Group PLC, and LVMH Moët Hennessy Louis Vuitton, among others.

Merger and acquisition, partnership, expansion of retail channels, and new product development are strategic approaches adopted by leading companies to boost their brand positioning. For instance, in April 2021, Rolex launched new watches of novelties in Malaysia and worldwide. Rolex unveiled a further Explorer II reference featuring a stainless steel case measuring 42mm in diameter and a matching steel bezel.

Malaysia Luxury Goods Market Leaders

-

Rolex S.A.

-

Prada S.p.A

-

The Estée Lauder Companies Inc.

-

Burberry Group PLC

-

LVMH Moët Hennessy Louis Vuitton

- *Disclaimer: Major Players sorted in no particular order

Malaysia Luxury Goods Market News

- In May 2022, Prada Tropico Capsule Collection was launched in Malaysia. It featured flowing silk skirts, Prada-fied Hawaiian shirts, striped bucket hats, and the Prada triangle bag reinvented in rustic raffia. Prada Tropico capsule collection is available at the Prada store in Pavilion Kuala Lumpur.

- In March 2022, NOMOS Glashütte, a German watchmaker expanded its business in Malaysia through a partnership with luxury goods retailer -The Hour Glass.

- In July 2021, Bape x Coach collection was launched in Malaysia. The classic American brand coach merged with Bape to birth this new collection. The range includes a crossbody bag, charter backpack, mini top handle, and saddle bag, totes. The Bape x Coach collection is available on malaysia.coach.com.

Malaysia Luxury Goods Industry Segmentation

Luxury goods are handcrafted with painstaking detail and discipline, featuring extraordinary craftsmanship, and are built with the highest quality materials. The Malaysia luxury goods market is segmented by type and distribution channel. By type, the market is segmented into clothing and apparel, footwear, bags, jewelry, watches, and other accessories. By distribution channel, the market is segmented into single-brand stores, multi-brand stores, online stores, and other distribution channels. The report offers market size and forecasts for Malaysia luxury goods market in value (USD million) for all the above segments.

| By Type | Clothing and Apparel |

| Footwear | |

| Bags | |

| Jewelry | |

| Watches | |

| Other Accessories | |

| By Distibution Channel | Single-brand Stores |

| Multi-brand Stores | |

| Online Stores | |

| Other Distribution Channels |

| Clothing and Apparel |

| Footwear |

| Bags |

| Jewelry |

| Watches |

| Other Accessories |

| Single-brand Stores |

| Multi-brand Stores |

| Online Stores |

| Other Distribution Channels |

Malaysia Luxury Goods Market Research FAQs

What is the current Malaysia Luxury Goods Market size?

The Malaysia Luxury Goods Market is projected to register a CAGR of 4.54% during the forecast period (2025-2030)

Who are the key players in Malaysia Luxury Goods Market?

Rolex S.A., Prada S.p.A, The Estée Lauder Companies Inc., Burberry Group PLC and LVMH Moët Hennessy Louis Vuitton are the major companies operating in the Malaysia Luxury Goods Market.

What years does this Malaysia Luxury Goods Market cover?

The report covers the Malaysia Luxury Goods Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Malaysia Luxury Goods Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Malaysia Luxury Goods Industry Report

Statistics for the 2025 Malaysia Luxury Goods market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Malaysia Luxury Goods analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.