Nigeria Plastic Caps And Closures Market Size

Nigeria Plastic Caps And Closures Market Analysis

The Nigeria Plastic Caps And Closures Market size is worth USD 0.45 Billion in 2025, growing at an 5.80% CAGR and is forecast to hit USD 0.60 Billion by 2030.

Nigeria's packaging sector draws significant investments, buoyed by rising commitments in key end-user fields like food, beverage, cosmetics, and more. Nigeria's e-commerce sector is surging, fueled by urbanization, heightened consumer spending, a swelling internet user base, and a burgeoning startup scene.

- The nation's landscape, marked by a surge in small and medium enterprises (SMEs) across diverse end-user sectors, presents a promising avenue for FMCG packaging firms. The burgeoning food and beverage sector stands out as a critical driver, fueling a pronounced need for packaging solutions. This would push the country's market for caps and closures.

- Consequently, there's a notable uptick in investments in packaging technologies and the introduction of new products. Nigeria's escalating consumer expenditures and deepening internet penetration are set to bolster the demand for packaging solutions.

- Nigeria stands out as the sole producer of virgin plastic resin in West Africa's coastal regions, as highlighted in a report by the West Africa Coastal Areas Management Program (WACA) commissioned by the World Bank. Despite this, Nigeria's plastic consumption surpasses its production capacity. Recent data from the World Bank reveals that the nation currently fulfills nearly two-thirds of its demand for virgin resins through imports.

- Plastic's cost-effectiveness, durability, and versatility have positioned it as a pivotal factor driving growth in various sectors. Notably, the packaging industry is the largest consumer, accounting for approximately 26% of total plastic usage. As per projections, rising per capita incomes are set to escalate plastic consumption, with estimates suggesting a doubling by 2044 and a quadrupling by 2050. The packaging sector, a cornerstone of domestic manufacturing since the 1960s, witnessed significant expansion. Such growth in the plastic industry in the country would push the market for caps and closures.

- Customer demand for packaging has fueled the industry's rapid growth. Advancements in plastic caps and closures have been pivotal. These polymers cater to customer needs, aid in food preservation, prevent contamination, elevate quality of life, enhance food storage, minimize food waste and product breakage, and introduce new, affordable features.

- Rising environmental concerns surrounding single-use plastics and unsustainable business practices prompt consumers to demand ecologically favorable products. The prevalent use of plastics is a significant contributor to Nigeria's waste management challenges. The repercussions of improper packaging extend far beyond environmental concerns, with plastic pollution leading to flooding and posing risks to human health.

Nigeria Plastic Caps And Closures Market Trends

Beverage Industry is Expected to Drive the Demand

- The soft drink industry in Nigeria presents an exciting landscape for consumers, a stark contrast to a decade ago. With over 100 soft drink brands available, the market is primarily dominated by approximately 15 bottling or drink manufacturing companies. Notably, two-thirds of these enterprises are homegrown Nigerian firms.

- In Nigeria, a concerning trend is emerging: new companies and manufacturers are flooding the market with high-quality products, but they use environmentally harmful, single-use plastic packaging. This reliance on such materials significantly contributes to Nigeria's efforts in waste management. This would encourage packaging manufacturers to start or expand their business in the country, pushing the caps and closures market growth.

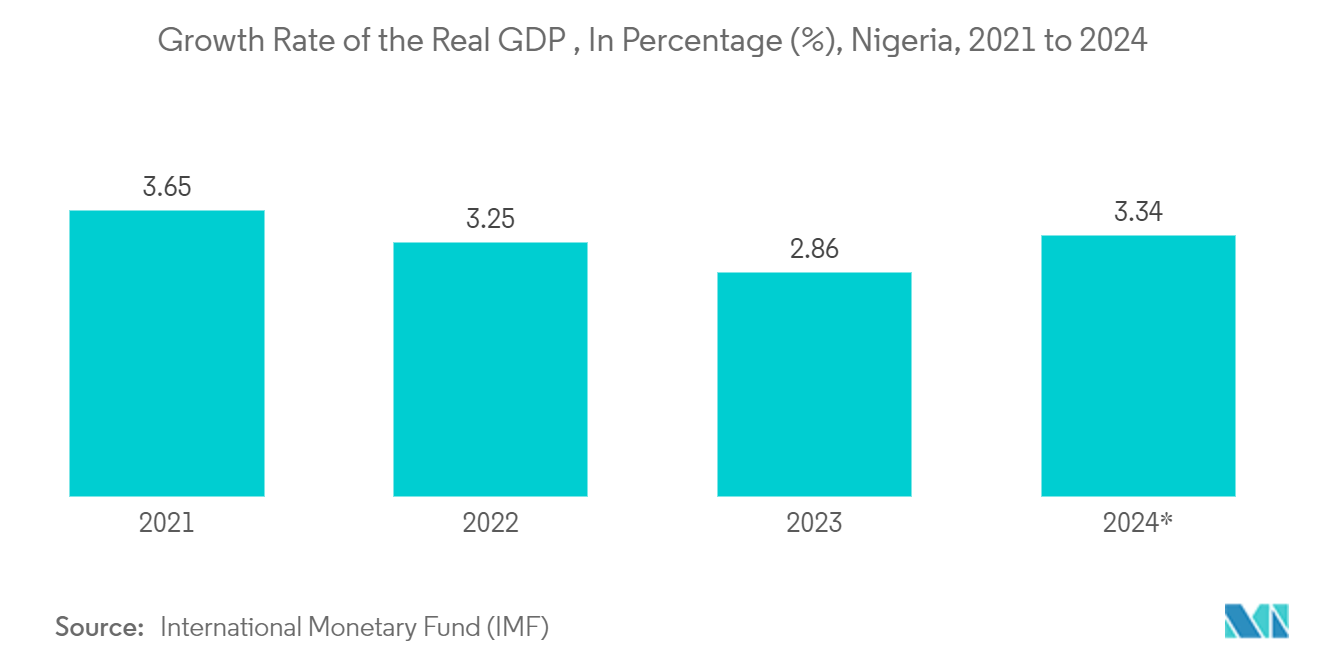

- However, Nigeria's SMEs have been pivotal over the last five years, accounting for approximately 48% of the nation's GDP. With a staggering 17.4 million companies, these SMEs offer half of the industry's employment and dominate the manufacturing sector, claiming nearly 90% of its output. According to the International Monetary Fund (IMF), the GDP growth rate in 2023 was 2.86% and is expected to reach 3.34% in 2024.

- In September 2023, Bord Bia launched its 'Spirit of Ireland' drinks campaign in West Africa as part of the Irish government's trade mission to Nigeria and Senegal. Over the past four years, Bord Bia channeled EUR 1 million (USD 1.08 million) into the 'Spirit of Ireland' initiative.

- Furthermore, in November 2023, Seven-Up Bottling Company (SBC), Nigeria’s one of the leading beverage companies, launched two innovative and refreshing beverages, Hydr8 100 carbonated isotonic drink and D’Vybe flavored carbonated soft drink. The exclusive launch occurred during a 2-day “Jolibration” event in Lagos, with diverse attendees, including customers, celebrities, partners, and Lagos socialites. Such launches by beverage companies would enhance the caps and closures market in the country.

Food Industry To Witness Growth

- Packaging solutions that meet customers' convenience demands and address broader concerns underpin the industry's rapid growth. Improvements in plastic caps and closures enhance their utility, allowing them to preserve food or beverages better, protect against contamination, and improve their shelf life. In Nigeria, the consumption of highly processed foods at home has consistently declined. However, these trends vary significantly based on region, income level, and urban versus rural areas.

- When it comes to packaged food items like jams, pickles, and nuts, storing them in bottles or containers sealed with airtight plastic closures is common. These closures serve a dual purpose: safeguarding the contents from contamination and tampering while ensuring convenient access and dispensing. In addition, caps and closures play a crucial role in prolonging the shelf life of products, shielding them from external elements like dirt and moisture, and regulating oxygen levels within the packaging.

- According to the National Bureau of Statistics, in 2023, the National Disposable Income surged by 9.29% in Q1 and 8.29% in Q2, marking a significant uptick from the 1.55% and 1.84% growth in the same quarters of 2022. Notably, this growth trajectory turned positive in Q4 of 2021, with Q1 and Q2 of 2023 outperforming their 2022 counterparts.

- Consumers witness increased incomes purchase packaged or processed foods consumed at home. This approach is commonly employed to forecast dietary shifts amid ongoing economic development. This shift encourages the market for caps and closures in the food industry.

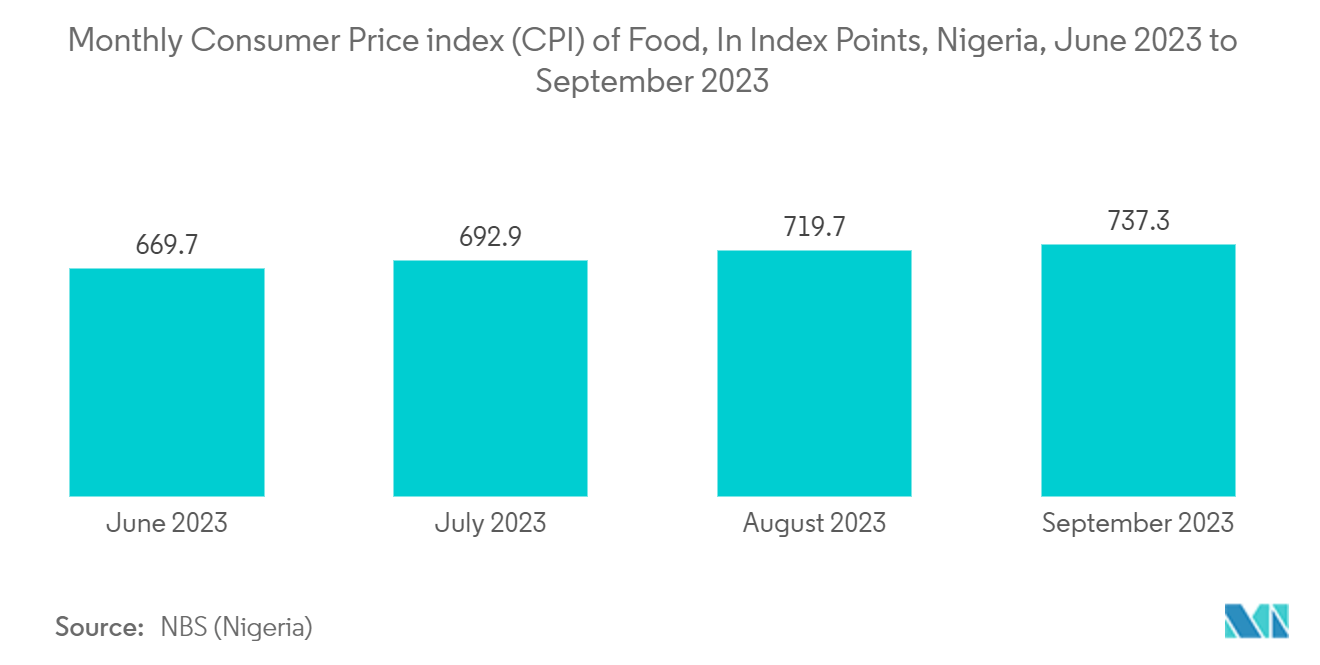

- According to NBS (Nigeria), the monthly consumer price index (CPI) of food in Nigeria in June 2023 was 669.7, which increased to 737.3 in September 2023. The Consumer Price Index (CPI) gauges a currency's purchasing power by tracking changes in the price levels of consumer goods such as food. The rise in CPI can further push the market for packed food.

Nigeria Plastic Caps And Closures Industry Overview

The Nigerian plastic caps and closures market is fragmented, with many domestic and significant players, such as Sacmi Imola SC, Panar Limited, Sacvin Nigeria Limited, Nampak Limited, Tetra Pak International SA, and more. Companies operating in the region are focused on expanding their business through innovations, collaborations, acquisitions, mergers, etc.

- September 2023 - SACMI Nigeria invested in and opened a new branch during the ProPak West Africa exhibition day in Lagos from September 12 to 14. Situated at House 2, 9 Adeyemo Alakija Street, the new premises highlight SACMI's commitment to bolstering customer support and services in Nigeria. This inauguration marks SACMI's continued investment and growth in Africa. This strategic focus solidified SACMI's presence and expanded its facilities and workforce, aligning with the region's burgeoning packaging and beverage industry.

Nigeria Plastic Caps And Closures Market Leaders

-

Sacmi Imola S.C.

-

Panar Limited

-

Sacvin Nigeria Limited

-

Tetra Pak International S.A.

-

Nampak Limited

- *Disclaimer: Major Players sorted in no particular order

Nigeria Plastic Caps And Closures Market News

- April 2025: LOG Pharma Primary Packaging, a worldwide supplier of packaging solutions for the pharmaceutical sector, provides drug manufacturers with a comprehensive, unified packaging solution. By manufacturing both bottles and caps in the same plant, LOG guarantees unparalleled compatibility, minimizes waste, and provides enhanced assurance in packaging reliability.

- February 2025: Coca-Cola Nigeria, along with its authorized bottler, Nigerian Bottling Company (NBC), has launched a new domestic packaging collection center in Apapa, Lagos. This facility aims to enhance Nigeria’s plastics recycling capabilities with the ability to process as much as 13,000 tonnes (t) of plastic bottles each year

Nigeria Plastic Caps And Closures Industry Segmentation

The scope of the study characterizes the plastic caps and closures market based on the product's raw materials, including PP, PE, PET, and other raw materials used across various end-user industries, such as food, pharmaceuticals, beverages, cosmetics, toiletries, and more across the country. The research also examines underlying growth influencers and significant industry vendors, all of which help to support market estimates and growth rates throughout the anticipated period. The market estimates and projections are based on the base year factors and arrived at top-down and bottom-up approaches.

Nigerian plastic caps and closures market is segmented by resin(polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), and other plastic materials), by product type(threaded, dispensing, unthreaded, child-resistant), by end-user industry (food, beverage (bottled water, carbonated soft drinks, alcoholic beverages, juices & energy drinks, and others), personal care and cosmetics, household chemicals, and other end-user industries). The report offers market forecasts and size in volume (Units) and value (USD) for all the above segments.

| By Resin | Polyethylene (PE) | ||

| Polyethylene Terephthalate (PET) | |||

| Polypropylene (PP) | |||

| Other Plastic Materials (Polystyrene, PVC, Polycarbonate, etc.) | |||

| By Product Type | Threaded | ||

| Dispensing | |||

| Unthreaded | |||

| Child-Resistant | |||

| By End-User Industry | Food | ||

| Bevrage | Bottled Water | ||

| Carbonated Soft Drinks | |||

| Alcoholic Beverages | |||

| Juices & Energy Drinks | |||

| Others | |||

| Personal Care & Cosmetics | |||

| Household Chemicals | |||

| Other End-use Industries | |||

Nigeria Plastic Caps And Closures Market Research Faqs

How big is the Nigeria Plastic Caps And Closures Market?

The Nigeria Plastic Caps And Closures Market size is expected to reach USD 0.45 billion in 2025 and grow at a CAGR of 5.80% to reach USD 0.6 billion by 2030.

What is the current Nigeria Plastic Caps And Closures Market size?

In 2025, the Nigeria Plastic Caps And Closures Market size is expected to reach USD 0.45 billion.

Who are the key players in Nigeria Plastic Caps And Closures Market?

Sacmi Imola S.C., Panar Limited, Sacvin Nigeria Limited, Tetra Pak International S.A. and Nampak Limited are the major companies operating in the Nigeria Plastic Caps And Closures Market.

What years does this Nigeria Plastic Caps And Closures Market cover, and what was the market size in 2024?

In 2024, the Nigeria Plastic Caps And Closures Market size was estimated at USD 0.42 billion. The report covers the Nigeria Plastic Caps And Closures Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Nigeria Plastic Caps And Closures Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Nigeria Plastic Caps And Closures Industry Report

Statistics for the 2025 Nigeria Plastic Caps And Closures market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Nigeria Plastic Caps And Closures analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.