Austria Property & Casualty Insurance Market Analysis

The Austria Property & Casualty Insurance Market size in terms of gross written premiums value is expected to grow from USD 5.84 billion in 2025 to USD 7.22 billion by 2030, at a CAGR of 4.32% during the forecast period (2025-2030).

- The property and casualty insurance market in Austria is an important sector of the country's insurance industry. Property and casualty insurance, also known as non-life insurance, provides coverage for risks associated with property, liability, and other types of losses. The biggest driver of growth in property and casualty insurance is motor vehicle damage insurance, which increased significantly yearly.

- An increase in the number of policies and a shift in prices contributed to the positive change. Third-party liability for motor vehicles increased marginally. The non-motor lines of business also showed moderate growth for the year. Both domestic and international insurance companies serve the property and casualty insurance market in Austria.

- These companies offer a wide range of insurance products and services to individuals, businesses, and other organizations. The insurance market in Austria is regulated by the Financial Market Authority (FMA), which ensures compliance with applicable laws and regulations, including solvency requirements and consumer protection measures.

Austria Property & Casualty Insurance Market Trends

The Premium Written for Property and Casualty Insurance is Constantly Increasing

- The premium written for property and casualty insurance and overall non-life insurance has constantly increased over the years in Austria. One of the main driving factors behind the increasing premiums in Austria is the rising costs of claims.

- As the cost of repairing or replacing damaged property increases, insurance companies may adjust their premiums accordingly to cover these expenses. Another factor is the overall economic climate. Changes in the economy, such as inflation or fluctuations in interest rates, can impact insurance premiums. Additionally, changes in regulations or legal requirements can also influence the cost of insurance.

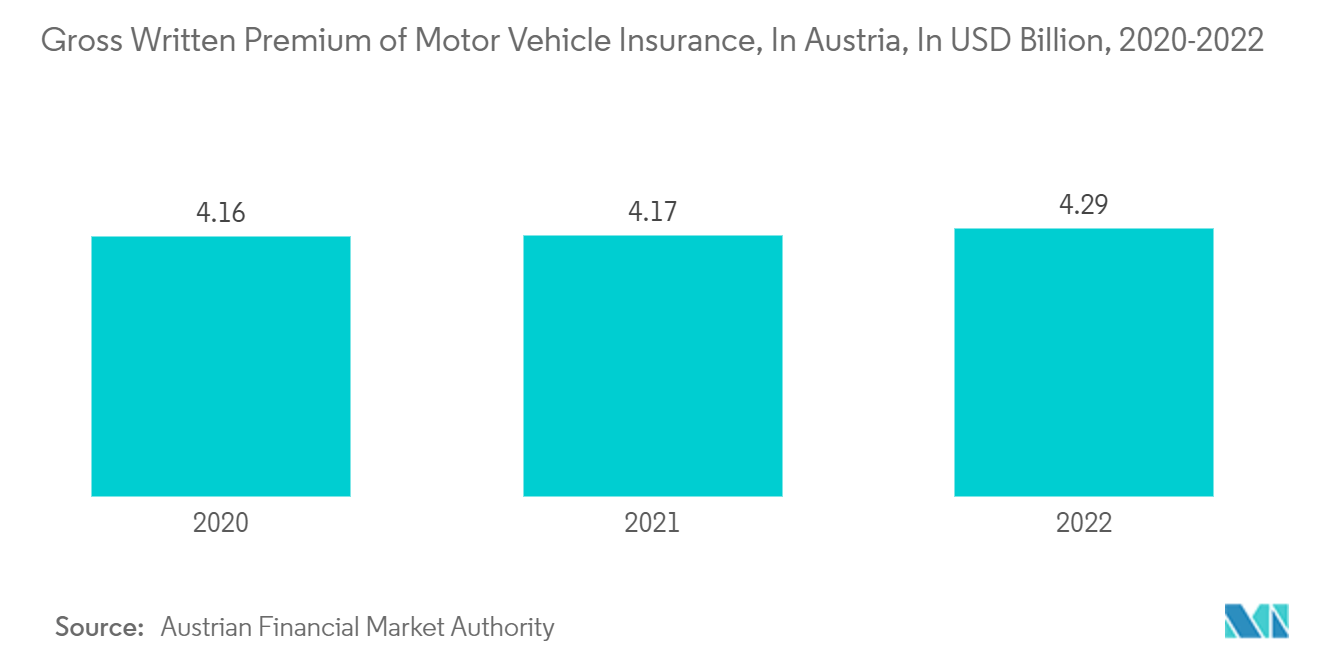

Motor Insurance Premium Contributes for Majority of the Property and Casualty Insurance Premium

- Motor insurance premiums do indeed contribute a significant portion of the property and casualty insurance premiums in Austria. Motor insurance, which includes both compulsory third-party liability coverage and optional comprehensive coverage, is a major component of the property and casualty insurance market in Austria. Austria has mandatory third-party liability insurance for motor vehicles, which covers damages caused to third parties in the event of an accident.

- This compulsory coverage ensures that all vehicles on the road are financially responsible for the damages they cause. Therefore, motor insurance premiums are required for all vehicles registered in Austria. Additionally, comprehensive motor insurance, which covers damages to the insured vehicle caused by accidents, theft, vandalism, or natural disasters, is also commonly purchased by vehicle owners in Austria. Although comprehensive coverage is optional, many vehicle owners choose to purchase it for added protection.

Austria Property & Casualty Insurance Industry Overview

The Austria property & casualty insurance market is fragmented, with many players in the market. A large number of national and international players are operating in the Property and Casualty Insurance Market in Austria. Almost 40 players compete in Austria's non-life insurance market. The largest four companies contribute more than 50% of the country's premium written for property and casualty insurance. UNIQA Osterreich Versicherungen AG is the market leader in the segment, followed by Generali Versicherung AG. Other major players in the market include Wiener Stadtische Versicherung AG, Allianz Elementar Versicherungs-AG, and Donau Versicherung AG.

Austria Property & Casualty Insurance Market Leaders

-

UNIQA Osterreich Versicherungen AG

-

Generali Versicherung AG

-

WIENER STADTISCHE Versicherung AG

-

Allianz Elementar Versicherungs-AG

-

DONAU Versicherung AG

-

Zurich Versicherungs-AG

- *Disclaimer: Major Players sorted in no particular order

Austria Property & Casualty Insurance Market News

- May 2023: Novum-RGI expanded its collaboration with UNIQA, marking a significant step into a new digital era within the insurance sector in Central and Eastern Europe. Novum-RGI is actively assisting UNIQA in establishing its Affinity business, leading to two successful rollouts in Austria and Romania within just a few months of collaboration.

- April 2022: General forged a partnership with the United Nations Development Programme (UNDP). The primary objective of this collaboration is to enhance access to insurance and risk finance solutions.

Austria Property & Casualty Insurance Industry Segmentation

Property and casualty insurance is the type of coverage that protects the policyholder's things and property, such as home, car, and other belongings. It also includes liability coverage, which protects you if you're found legally responsible for an accident that causes injuries to another person or damages to their property.

Austria's property and casualty insurance market can be segmented by product type, which includes fire, motor, general liability, burglary and theft, and other property and casualty insurance, and by distribution channel, including agents, brokers, banks, and other distribution channels.

The report offers market size and forecasts for the property and casualty insurance market in Austria in terms of revenue (USD) for all the above segments.

| By Product Type | Fire Insurance |

| Motor Insurance | |

| General Liability Insurance | |

| Burglary and Theft | |

| Other Property and Casualty Insurance | |

| By Distribution Channel | Agents |

| Brokers | |

| Banks | |

| Other Distribution Channels |

Austria Property & Casualty Insurance Market Research FAQs

How big is the Austria Property & Casualty Insurance Market?

The Austria Property & Casualty Insurance Market size is expected to reach USD 5.84 billion in 2025 and grow at a CAGR of 4.32% to reach USD 7.22 billion by 2030.

What is the current Austria Property & Casualty Insurance Market size?

In 2025, the Austria Property & Casualty Insurance Market size is expected to reach USD 5.84 billion.

Who are the key players in Austria Property & Casualty Insurance Market?

UNIQA Osterreich Versicherungen AG, Generali Versicherung AG, WIENER STADTISCHE Versicherung AG, Allianz Elementar Versicherungs-AG, DONAU Versicherung AG and Zurich Versicherungs-AG are the major companies operating in the Austria Property & Casualty Insurance Market.

What years does this Austria Property & Casualty Insurance Market cover, and what was the market size in 2024?

In 2024, the Austria Property & Casualty Insurance Market size was estimated at USD 5.59 billion. The report covers the Austria Property & Casualty Insurance Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Austria Property & Casualty Insurance Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Austria Property & Casualty Insurance Industry Report

Statistics for the 2025 Austria Property & Casualty Insurance market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Austria Property & Casualty Insurance analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.