Tanzania United Republic Container Glass Market Size

Tanzania United Republic Container Glass Market Analysis

The Tanzania United Republic Container Glass Market size is estimated at 54.90 kilotons in 2025, and is expected to reach 63.13 kilotons by 2030, at a CAGR of 2.84% during the forecast period (2025-2030).

- The growing demand for packaged beverages and food products is driving the need for container glass in Tanzania. Glass bottles and jars are widely used in soft drinks, alcoholic beverages, and food packaging.

- Tanzania's healthcare system operates on a mixed public-private model, aiming to provide equitable access to quality healthcare services for its population. The public sector, under the governance of the Ministry of Health, manages a tiered system consisting of dispensaries, health centres, district hospitals, regional referral hospitals, and national hospitals (e.g., Muhimbili). These facilities offer comprehensive services, from primary care to specialized medical treatments.

- Dispensaries, health centres, and hospitals require pharmaceutical-grade glass containers to safely store and distribute liquid medications, injections, and vaccines. Glass is preferred due to its inert nature, which prevents chemical reactions with the contents.

- Developing specialized medical services at regional and national referral hospitals (e.g., Muhimbili) increases the demand for high-quality glass equipment and containers used in medical procedures and laboratories.

- Tanzania's glass manufacturing sector faces limitations in advanced production facilities and technologies required for high-quality glass production. This constraint hinders local manufacturers' capacity to meet increasing demand and compete effectively with international companies.

- The container glass industry relies heavily on raw materials such as silica sand, soda ash, and limestone. Supply chain disruptions, whether from domestic shortages or import difficulties, can significantly impact the market's performance.

Tanzania United Republic Container Glass Market Trends

Beverage Sector Occupies the Largest Market Share

- The beverage container glass market in the United Republic of Tanzania is growing steadily, driven by increasing consumer demand, industrial expansion, and a shift toward sustainable packaging solutions. Tanzania’s diverse beverage industry, encompassing soft drinks, alcoholic beverages, juices, and mineral water, relies heavily on glass containers for packaging due to their durability, recyclability, and ability to preserve the quality and flavour of products.

- The economic expansion increases disposable income, enabling consumers to spend more on packaged beverages, particularly premium options like craft beers, speciality juices, wines, and spirits, which typically use glass packaging for quality preservation and aesthetic appeal.

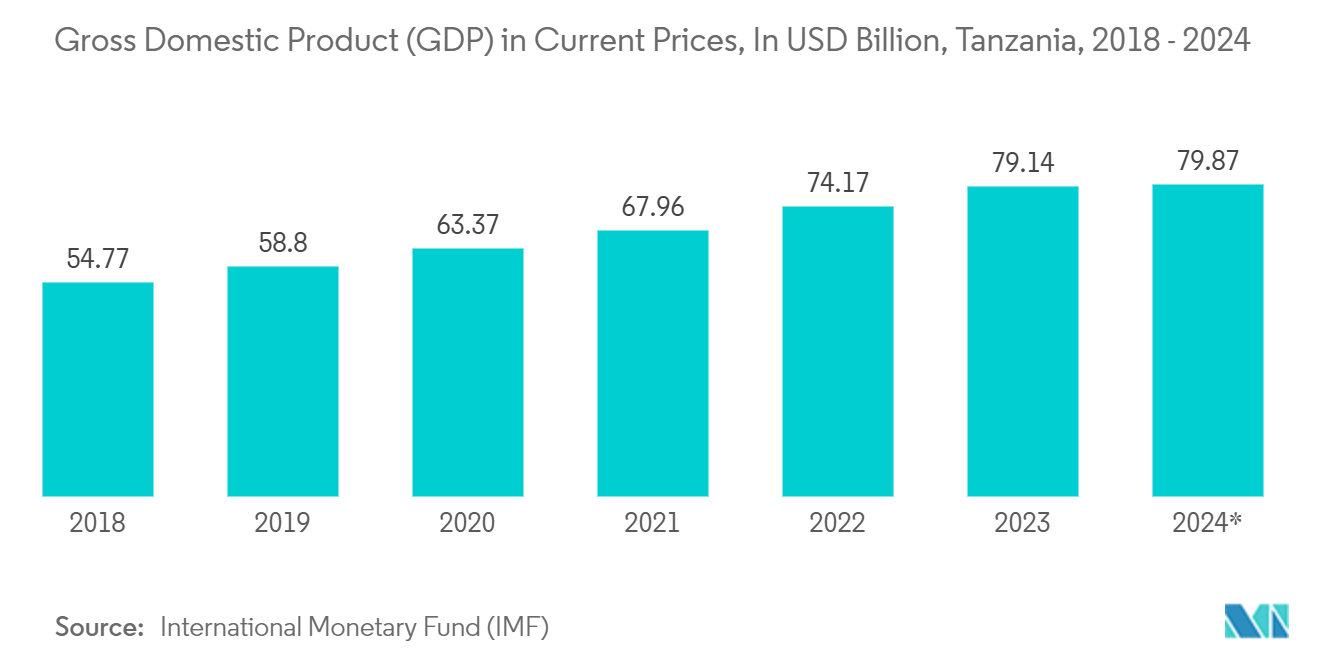

- According to the International Monetary Fund (IMF), Tanzania's gross domestic product (GDP) at current prices was USD 54.77 billion in 2018 and reached USD 79.87 billion in 2024.

- The rise in GDP also promotes industrial growth, leading to increased local beverage production and innovation, driving the need for glass bottles. Sustainability trends, coupled with heightened environmental awareness, push both companies and consumers toward eco-friendly packaging solutions like glass, which is reusable and recyclable.

Food Industry to Show Significant Growth

- The food container glass market in Tanzania is experiencing growth, driven by several key factors. Increasing consumer demand for eco-friendly and durable packaging solutions is one of the main drivers. Glass containers are highly valued in the food and beverage sectors due to their ability to maintain the quality and safety of products. This demand is also bolstered by the global trend toward sustainable packaging, where glass, being recyclable, aligns with both consumer preferences and environmental goals.

- The global shift towards sustainable packaging solutions, especially glass, drives export growth. Glass's high recyclability makes it an attractive option for environmentally conscious consumers and manufacturers. As awareness of eco-friendly packaging increases, food producers increasingly select glass containers for their products. This trend is reinforced by the success of Tanzanian glass container exports, establishing them as a preferred choice in the food industry.

- According to the International Trade Map, Tanzania's export value of glass containers has shown significant growth, increasing from USD 22.27 thousand in 2018 to USD 53.52 thousand in 2023.

- The recyclability and sustainability of glass packaging align with current market demands for environmentally responsible solutions. Food manufacturers respond to consumer preferences by adopting glass containers offering sustainability and product preservation benefits. The export success of Tanzanian glass containers further validates this trend, positioning them as a reliable and eco-friendly option for the food sector.

Tanzania United Republic Container Glass Industry Overview

The container glass market in Tanzania is consolidated, with a few dominant players controlling a significant share of the industry. This market structure is further supported by the strong demand for sustainable packaging, with glass still preferred for many applications due to its durability, recyclability, and aesthetic appeal.

Tanzania United Republic Container Glass Market Leaders

-

Kioo Limited

-

Feemio Group Co., Ltd.

-

Isanti Glass

-

Ardagh Glass Packaging (Ardagh Group S.A.)

-

Pragati Glass Pvt. Ltd.

- *Disclaimer: Major Players sorted in no particular order

Tanzania United Republic Container Glass Market News

- November 2024: Varun Beverages to acquire PepsiCo bottling companies in Tanzania and Ghana. The company will obtain full ownership of SBC Tanzania and SBC Beverages Ghana to expand its operations in Africa. Varun Beverages is extending its international presence by acquiring complete ownership of two PepsiCo bottling companies in Africa and the remaining stake in a third company in its home market of India.

- May 2024: Kioo has obtained a USD 60 million loan to expand its glass facility in Tanzania. This expansion aims to address the growing domestic and regional demand for glass bottles and containers. The International Finance Corporation (IFC) will contribute up to USD 45 million of the loan, supporting Kioo's efforts to increase its manufacturing capacity and reduce its environmental impact. The funding will enable Kioo to enhance its use of recycled glass in the production process, thereby reducing energy consumption.

Tanzania United Republic Container Glass Industry Segmentation

Container glass is used in the alcoholic and non-alcoholic beverage industries due to its ability to maintain chemical inertness, sterility, and non-permeability. Glass packaging is valued for its unique properties, including its transparency, inertness, and ability to preserve the quality and integrity of its contents. It is often chosen for products where purity, safety, and environmental sustainability are paramount concerns.

The Tanzania United Republic container glass market is segmented by end-user vertical (beverages [alcoholic beverages (beer, wine, spirits, and other alcoholic beverages {cider and other fermented drinks}), non-alcoholic beverages (juices, carbonated drinks (CSDs), dairy product-based drinks, other non-alcoholic beverages)], food [jam, jelly, marmalades, honey, sausages and condiments, oil, pickles], cosmetics and personal care, pharmaceuticals (excluding vials and ampoules), and perfumery), by color (green, amber, flint and other colors). The report offers market forecasts and size in volume (kilotons) for all the above segments.

| By End-user Vertical | Bevarages | Alcoholic | Beer | |

| Wine | ||||

| Spirits | ||||

| Other Alcoholic Beverages (Cider and Other Fermented Drinks) | ||||

| Non-Alcoholic | Juices | |||

| Carbonated Drinks (CSDs) | ||||

| Dairy Product Based Drinks | ||||

| Other Non-Alcoholic Beverages | ||||

| Food (Jam, Jelly, Marmalades, Honey, Sausages and Condiments, Oil, Pickles) | ||||

| Cosmetics and Personal Care | ||||

| Pharmaceuticals (excluding Vials and Ampoules) | ||||

| Perfumery | ||||

| By Color | Green | |||

| Amber | ||||

| Flint | ||||

| Other Colors | ||||

| Bevarages | Alcoholic | Beer | |

| Wine | |||

| Spirits | |||

| Other Alcoholic Beverages (Cider and Other Fermented Drinks) | |||

| Non-Alcoholic | Juices | ||

| Carbonated Drinks (CSDs) | |||

| Dairy Product Based Drinks | |||

| Other Non-Alcoholic Beverages | |||

| Food (Jam, Jelly, Marmalades, Honey, Sausages and Condiments, Oil, Pickles) | |||

| Cosmetics and Personal Care | |||

| Pharmaceuticals (excluding Vials and Ampoules) | |||

| Perfumery | |||

| Green |

| Amber |

| Flint |

| Other Colors |

Tanzania United Republic Container Glass Market Research Faqs

How big is the Tanzania United Republic Container Glass Market?

The Tanzania United Republic Container Glass Market size is expected to reach 54.90 kilotons in 2025 and grow at a CAGR of 2.84% to reach 63.13 kilotons by 2030.

What is the current Tanzania United Republic Container Glass Market size?

In 2025, the Tanzania United Republic Container Glass Market size is expected to reach 54.90 kilotons.

Who are the key players in Tanzania United Republic Container Glass Market?

Kioo Limited, Feemio Group Co., Ltd., Isanti Glass, Ardagh Glass Packaging (Ardagh Group S.A.) and Pragati Glass Pvt. Ltd. are the major companies operating in the Tanzania United Republic Container Glass Market.

What years does this Tanzania United Republic Container Glass Market cover, and what was the market size in 2024?

In 2024, the Tanzania United Republic Container Glass Market size was estimated at 53.34 kilotons. The report covers the Tanzania United Republic Container Glass Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Tanzania United Republic Container Glass Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Tanzania United Republic Container Glass Industry Report

Statistics for the 2025 Tanzania United Republic Container Glass market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Tanzania United Republic Container Glass analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.