United Kingdom Plastic Caps and Closures Market Size

United Kingdom Plastic Caps and Closures Market Analysis

The United Kingdom Plastic Caps And Closures Market size is worth USD 1.65 Billion in 2025, growing at an 5.07% CAGR and is forecast to hit USD 2.11 Billion by 2030.

In the United Kingdom, plastic caps and closures are pivotal in packaging, preserving product integrity, and extending shelf life. Their demand surges across diverse sectors, notably food, beverages, personal care, and household chemicals.

- Plastic caps and closures are witnessing growth in the food and beverage industry. With a heightened appetite for bottled water, carbonated beverages, juices, and dairy products, the sector's demand is on a steady rise. Moreover, the emphasis on secure, tamper-proof, and user-friendly packaging is a driving force.

- Moreover, plastic caps are propelled by the rising adoption of advanced closure solutions in personal care and cosmetics. Noteworthy trends in the beverage sector include a shift towards larger pack sizes in segments like beer and carbonates, influencing the choice and dimensions of closures. Conversely, smaller pack sizes are gaining traction in still, packaged water and sports drinks, catering to the rising demand for on-the-go consumption.

- The caps and closure market is expected to grow with the rising number of supermarkets nationwide. For instance, in July 2024, Aldi, the UK's fourth-largest supermarket, has unveiled expansion plans, with intentions to launch an additional 10 stores shortly. These new stores will be spread nationwide, with imminent openings in Waltham Cross, Hertfordshire, and Olney Park, Milton Keynes.

- According to the British Plastics Federation, the United Kingdom annually produces an estimated 1.6 million tonnes of plastic raw materials. Noteworthy players in the UK polymer manufacturing sector, such as Ineos, Basell Polyolefins, Sabic, Inovyn, and Lotte Chemicals, are supported by specialist manufacturers producing materials, masterbatches, and additives. This collaborative effort is instrumental in pushing the boundaries of plastic applications.

- However, the country also faces challenges due to plastic waste. According to a study by Greenpeace, the United Kingdom's supermarkets contribute 800,000 tonnes annually, poised to climb as production escalates. On a per capita basis, the UK generates more plastic waste than nearly any other nation, with a significant portion exported, often to nations needing to be equipped for its management.

United Kingdom Plastic Caps and Closures Market Trends

Plastic Resins Such as Polyethylene and Polypropylene to Push the Market Growth

- Polyethylene (PE) is a highly durable plastic, prized for its chemical resistance and cost-effectiveness. Derived from petroleum polymers, PE boasts resilience against environmental hazards. It's typically categorized into high-density polyethylene (HDPE) and low-density polyethylene (LDPE). While both are widely used, HDPE, being stiffer, finds favor in industries, especially in North America, for its strength, particularly in packaging applications requiring impact resistance.

- Polypropylene (PP), another prominent plastic, boasts superior rigidity and heat, water, and chemical resistance. PP excels in high-temperature scenarios but lags in low-temperature performance. PP, known for its availability and durability, is a top choice in plastic packaging. Its ability to maintain shape, even under rough handling, makes it a standout choice for caps, where durability is paramount.

- According to the British Plastics Federation, supermarkets are returning to reusable products. Similar items are also gaining traction in the automotive supply chain. PP-made caps and closures have seen a surge in demand, especially in the PET bottle market. The mineral water and edible oil segments notably drive this growth.

- In November 2023, LyondellBasell, a prominent player in the chemical industry, unveiled its latest venture: a distribution hub in the United Kingdom dedicated to its Polyolefins grades. This strategic initiative highlights its unwavering dedication to elevating customer satisfaction. The company aims to slash lead times on its orders by strategically locating inventories near its client's facilities. Such expansions would push the country's market for plastic resins.

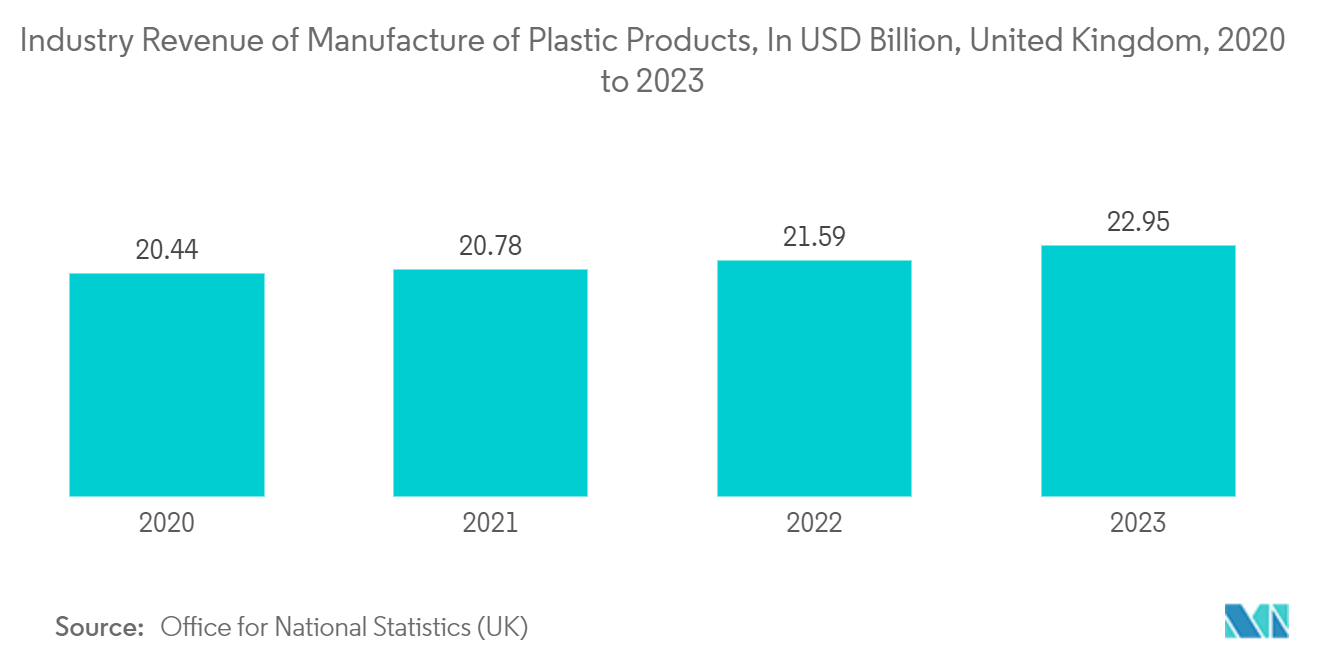

- According to the Office for National Statistics (UK), the manufacture of plastic products in 2020 was USD 20.44 billion and is expected to reach USD 22.95 billion in 2023. The UK plastics industry boasts a sprawling supply chain, from raw materials to additive producers, end-users, and recyclers. With 5,700 companies, the UK is a global plastic sector leader, excelling in material and additive manufacturing, processing, and machinery supply.

Beverage Industry is Expected to Witness Growth

- With a fusion of premium produce and advanced technology, the UK is a beverage innovation pioneer. This dominance highlights the sector's economic significance and the opportunities it offers exporters, investors, and global buyers. The UK's drink industry boasts robust capabilities across its supply chain, excelling at every stage of product development. Moreover, its commitment to research and development and well-defined market strategies position it favorably to cater to evolving consumer demands.

- According to a study by Banco Santander SA, the UK is the world's second-largest exporter of beverages, uniquely boasting a trade surplus in the food and drink sector. This surplus is predominantly attributed to the nation's expertise in alcoholic beverages.

- The beverage manufacturers' primary avenue to reach consumers is via the retail sector, dominated by Tesco, ASDA, Sainsbury's, and Morrison's. However, shifting consumer preferences, particularly a growing appetite for cost-effective options, have propelled discount and private-label retailers like Aldi and Lidl. These discount retailers have steadily advanced in the dominant market share. The rise in supermarkets in the country also pushed the market for caps and closures.

- According to the Office for National Statistics (UK), the revenue from producing soft drinks and bottled waters in 2020 was USD 6.30 billion and is expected to reach USD 7.21 billion in 2024. Soft drinks, commonly called soda or carbonated beverages, are also widely consumed in the country and fall under the umbrella of the non-alcoholic beverage sector. They typically comprise water, sugar, artificial sweeteners, and flavoring agents. Given their widespread popularity, the demand for beverage caps and closures is poised to rise.

- Furthermore, as of March 2024, with its NEO WTR brand, Brookfield Drinks is set to make waves as Europe's pioneer in introducing a 100% Prevented Ocean Plastic bottle. This innovative product is slated to debut in 250 Tesco superstores. NEO WTR, a creation of Brookfield Drinks, has outpaced major soft drink conglomerates by rolling out a new spring water line. With a fully recyclable bottle, label, and cap, NEO WTR is a Somerset-sourced spring water bottle in the UK. Such beverage launches drive the caps and closures market growth in the country.

United Kingdom Plastic Caps and Closures Industry Overview

The United Kingdom Plastic Caps and Closures market is fragmented, with many domestic and significant players, such as Berling Packaging UK, United Caps, Bericap UK Limited, Silgan Holdings Inc., Berry Global Inc., and more. Companies that operate in the region are focused on expanding their business through innovations, collaborations, acquisitions, mergers, etc.

- January 2024 - Berlin Packaging announced its acquisition of Alpack Limited, a Dublin-based family-owned food packaging supplier. Alpack specializes in diverse food packaging products, including glass bottles, twist-off caps, cardboard boxes, and eco-friendly containers. With this move, Berlin Packaging bolsters its foothold in Ireland and significantly enhances its food packaging portfolio, offering its clientele a broader spectrum of solutions.

United Kingdom Plastic Caps and Closures Market Leaders

-

UNITED CAPS Dinnington Ltd

-

Berlin Packaging UK

-

Bericap UK Limited

-

Berry Global Inc.

-

Silgan Holdings Inc.

- *Disclaimer: Major Players sorted in no particular order

United Kingdom Plastic Caps and Closures Market News

- May 2024 - Aldi leads the charge in sustainability by transitioning all its in-house soft drink and water bottles to 100% recycled PET (rPET), a shift projected to slash 10,000 tonnes of virgin plastic annually. Notably, Aldi is poised to be the trailblazer among UK supermarkets. It aims to have its entire range of own-brand soft drinks exclusively in 100% recycled packaging. These initiatives align with Aldi's broader objective of incorporating 50% recycled content in its plastic packaging by 2025. Such initiatives create opportunities for the recycled PET caps and closures market.

- November 2023 - In a strategic collaboration with Berry Global, Kraft Heinz Company unveiled its inaugural fully recyclable cap for its iconic squeezy ketchup bottle. This move underscores a joint commitment to advancing sustainable packaging solutions in the retail sector. The new caps are being introduced across the UK on Heinz Tomato Ketchup bottles, starting from 400ml to variants like the 50% Less Sugar and Salt. Heinz plans to extend this eco-friendly cap to a broader spectrum of its sauce offerings in the UK and Europe.

United Kingdom Plastic Caps and Closures Industry Segmentation

The scope of the study characterizes the plastic caps and closures market based on the raw material of the product, including PP, PE, PET, and other raw materials used across various end-user industries such as Food, Pharmaceuticals, Beverage, Cosmetics and Toiletries and more across the country. The research also examines underlying growth influencers and significant industry vendors, all of which help to support market estimates and growth rates throughout the anticipated period. The market estimates and projections are based on the base year factors and arrived at top-down and bottom-up approaches.

United Kingdom Plastic Caps and Closures Market is Segmented by Resin (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), and Other Plastic Materials), by Product Type(Threaded, Dispensing, Unthreaded, Child-Resistant), by End-user Industry (Food, Beverage (Bottled Water, Carbonated Soft Drinks, Alcoholic Beverages, Juices & Energy Drinks, and Others), Personal Care and Cosmetics, Household Chemicals, and Other End-user Industries). The report offers market forecasts and size in volume (Units) and value (USD) for all the above segments.

| By Resin | Polyethylene (PE) | ||

| Polyethylene Terephthalate (PET) | |||

| Polypropylene (PP) | |||

| Other Plastic Materials (Polystyrene, PVC, Polycarbonate, etc.) | |||

| By Product Type | Threaded | ||

| Dispensing | |||

| Unthreaded | |||

| Child-resistant | |||

| By End-user Industry | Food | ||

| Beverage | Bottled Water | ||

| Carbonated Soft Drinks | |||

| Alcoholic Beverages | |||

| Juices and Energy Drinks | |||

| Other End-user Industries | |||

| Personal Care and Cosmetics | |||

| Household Chemicals | |||

| Other End-user Industries | |||

United Kingdom Plastic Caps and Closures Market Research FAQs

How big is the United Kingdom Plastic Caps And Closures Market?

The United Kingdom Plastic Caps And Closures Market size is worth USD 1.65 billion in 2025, growing at an 5.07% CAGR and is forecast to hit USD 2.11 billion by 2030.

What is the current United Kingdom Plastic Caps And Closures Market size?

In 2025, the United Kingdom Plastic Caps And Closures Market size is expected to reach USD 1.65 billion.

Who are the key players in United Kingdom Plastic Caps And Closures Market?

UNITED CAPS Dinnington Ltd, Berlin Packaging UK, Bericap UK Limited, Berry Global Inc. and Silgan Holdings Inc. are the major companies operating in the United Kingdom Plastic Caps And Closures Market.

What years does this United Kingdom Plastic Caps And Closures Market cover, and what was the market size in 2024?

In 2024, the United Kingdom Plastic Caps And Closures Market size was estimated at USD 1.57 billion. The report covers the United Kingdom Plastic Caps And Closures Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the United Kingdom Plastic Caps And Closures Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

United Kingdom Plastic Caps and Closures Industry Report

Statistics for the 2025 United Kingdom Plastic Caps And Closures market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. United Kingdom Plastic Caps And Closures analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.