United States Plastic Bottles Market Analysis

The United States Plastic Bottles Market size is worth USD 2.52 Billion in 2025, growing at an 3.89% CAGR and is forecast to hit USD 3.06 Billion by 2030.

Plastic bottles made of polyethylene terephthalate, polypropylene, polyethylene, etc., are widely used as they are lightweight and unbreakable, making handling easier. The cost-effectiveness and dependence on packaged, processed food and beverages will influence the plastic bottle market during the forecast period.

- Consumers are increasingly favoring bottled drinks over canned ones, primarily due to cost-effectiveness. The country's consumers swiftly gravitate towards healthier beverage options, with bottled water leading the charge. The beverage segment in the country is witnessing significant growth, driven by a surge in athleticism, heightened health consciousness, and evolving dietary habits linked to lifestyle changes.

- Plastic bottle recycling is growing as manufacturers are concerned about the environmental impact and are encouraging plastic recycling. According to a United Nations Environment Programme(UNEP) report, increasing recycling could reduce plastic pollution by 20% by 2040 after pursuing efforts such as eradicating problematic and unnecessary plastics. Therefore, recycling plastic bottles is expected to positively impact the market.

- Moreover, closed-loop recycling is identified as a cycle in which plastic is reprocessed, and the recyclate produced is used to make another product in the same product category. This method is widely accepted for PET and HDPE milk bottles, allowing companies to use it as a preferred option over other resin types.

- In May 2023, the Closed Loop Partners Association announced a USD 10 million investment in its Closed Loop Circular Plastics Fund from the Japanese multinational banking services institution Sumitomo Mitsui Banking Corporation (SMBC). The partnership aims to advance the recovery and recycling of polyethylene (PE) and polypropylene (PP) plastics in the United States.

- Rising disposable incomes and urbanization are fueling market value growth. The market is also energized by evolving consumer lifestyles and the burgeoning retail sector. Furthermore, the growth rate is anticipated to be amplified by increasing awareness of eco-friendly and biodegradable packaging materials and a surging demand for packaged and processed products.

- Plastic stands out as a significant pollutant driving environmental degradation. Notably, plastic bottles are pivotal in this pollution, impacting oceans and landfills. Their production is resource-intensive, drawing heavily on fossil fuels and water. The Container Recycling Institute highlights a concerning statistic: 86% of disposable water bottles in the U.S. end up as waste, contributing to a staggering 38 billion bottles in landfills. Furthermore, bottling water annually emits a significant 2.5 million tons of carbon dioxide into the atmosphere.

United States Plastic Bottles Market Trends

Demand for Polyethylene Terephthalate (PET) Bottles

- Plastic bottles are made of various raw plastic materials, and Polyethylene terephthalate (PET) ones are preferred owing to their durability, versatility, and cost-effectiveness. As end-user industries such as food, beverage, and pharmacy expand and innovate, the need for plastic bottle packaging also increases. The industry's introduction of new drinks with different flavors and packaging formats will continually encourage the need for rigid plastic bottles.

- PET has become a vital packaging material among bottle manufacturers. The rising trend of using lightweight resins with high strength and toughness, good abrasion and heat resistance, low creep at elevated temperatures, good chemical resistance, and other properties makes PET resins ideal for bottle manufacturers.

- The trend towards lightweight products is cost-effective and helps manufacturers achieve a competitive edge in the market. PET is the widely used resin for packaging, mainly bottles. PET bottles are the convenient bottles commonly used in food-grade packaging.

- Companies operating in the market focus on innovating new solutions as part of their business expansion. For instance, in March 2024, The Coca‑Cola Company is rolling out redesigned, lighter-weight PET bottles across its sparkling beverage portfolio across the U.S. as part of a broader responsibility to create a circular economy for its packaging. For the first time in a decade, 12, 16.9, and 20-oz. bottles of Trademark Coca‑Cola, Sprite, and Fanta and Minute Maid Refreshments, Minute Maid AguasFrescas are sporting new shapes that require less raw material to produce.

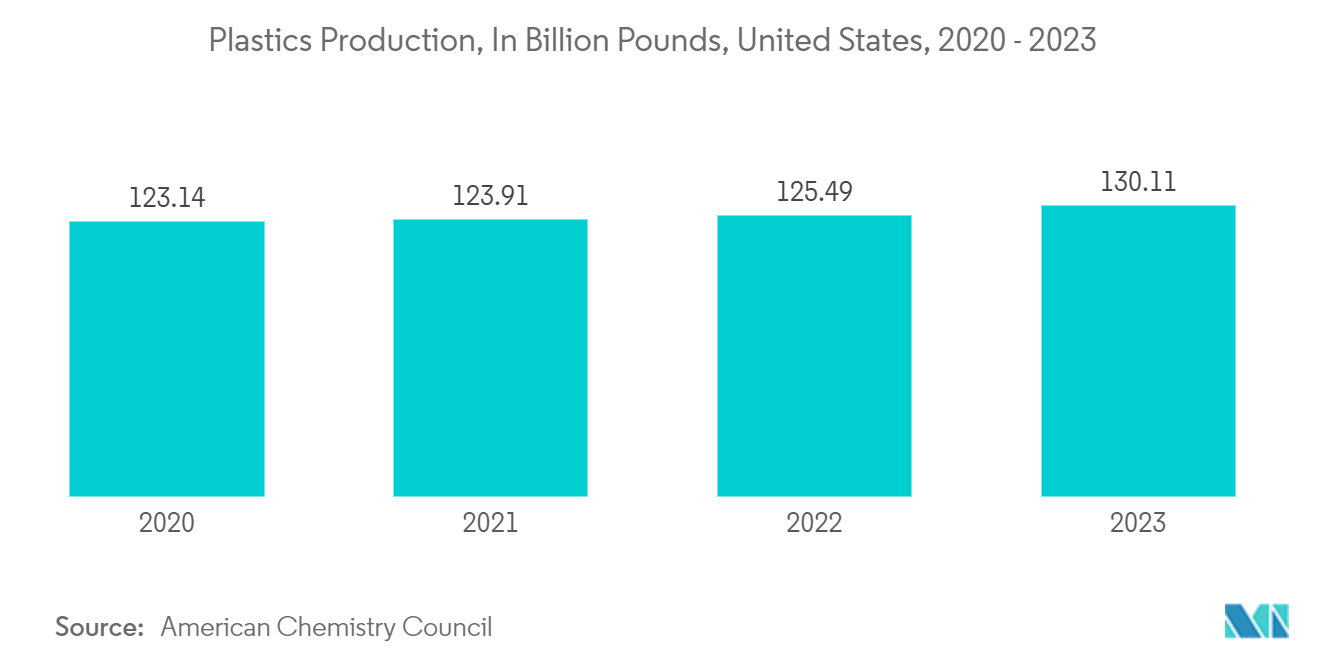

- According to the American Chemistry Council, the total plastic production in the United States in 2020 was 123.14 billion pounds, and it reached 130.11 billion pounds in 2023. The rise in the production of plastics will further push the market for PET resins and products made of PET across the country. Moreover, as consumer products like food, pharmaceuticals, and cosmetics continue to gain popularity, the demand for plastic bottle packaging is expected to surge. A preference for convenient and portable packaging solutions essentially drives this rising demand.

Beverage Segment Poised to Propel Market Growth

- In the beverage industry, bottles ensure the integrity of both carbonated and non-carbonated drinks. These seals guard against foreign particles and preserve the drink's flavor and taste. The beverage market's critical applications of caps and closures include bottled water, fruit juices, ready-to-drink beverages, and energy drinks.

- The United States beverage market is poised for growth, driven by the rising demand for single-serve beverages that extend packaged drinks' shelf life. Companies favor plastic bottles for the hot-fill process, as they eliminate the need for preservatives, promoting healthier consumption. The advantages of plastic bottles are that they offer a longer shelf life without preservatives, are lightweight, and are cost-effective due to their plastic composition.

- As health and wellness concerns rise, consumers gravitate towards healthier beverage options. This growth has led to a surge in demand for functional and organic drinks, including fortified water, sports drinks, vitamin-enriched beverages, and probiotics. Consumers are increasingly spending on products aligned with the wellness trend, such as morning juices and energy drinks.

- According to the Organic Trade Association, the consumption value of organic beverages in the United States 2020 was USD 2.50 billion in 2020, and it is expected to reach USD 2.72 billion in 2024. Consequently, there's a heightened demand for cost-effective and sustainable solutions within the non-alcoholic beverage industry.

- Additionally, in February 2023, Danone invested in a US ready-to-drink coffee factory. The investment will increase the production of coffee and creamer brands in the US, including International Delight, Silk, and Stok. The investment will support Danone North America's long-term growth strategy. It will deliver critical benefits across the United States business, including advancing operational excellence, enabling flexibility in bottle design, accelerating the company's sustainability goals, and driving cost efficiencies.

United States Plastic Bottles Industry Overview

The United States Plastic Bottles Market is fragmented with the presence of global and domestic players such as Amcor Group Gmbh, Berry Global Inc.,

- June 2024 - Berry Global Group, Inc., a global player in sustainable packaging, has unveiled the customizable rectangular Domino bottle. This bottle is crafted with 100% post-consumer recycled (PCR) plastic and targets the beauty, home, and personal care markets. The 250ml Domino bottle boasts a 75-millimetre-wide front face and customizable side panels. This design enables printing on all four sides, allowing brands to craft a unique packaging experience that stands out on shelves.

- April 2024 - Amcor Group, a global frontrunner in crafting responsible packaging solutions, unveiled a pioneering one-liter polyethylene terephthalate (PET) bottle tailored for carbonated soft drinks (CSDs). The bottle is crafted entirely from 100% post-consumer recycled (PCR) materials. This groundbreaking stock option is designed to aid customers in fulfilling their sustainability commitments. Incorporating the one-liter CSD bottle into its 100% PCR stock portfolio ensures brands can swiftly respond to market demands while adhering to rising consumer expectations.

United States Plastic Bottles Market Leaders

-

ALPLA Group

-

Amcor Group GmbH

-

Berry Global, Inc.

-

Comar LLC

-

Plastipak Holding Inc.

- *Disclaimer: Major Players sorted in no particular order

United States Plastic Bottles Market News

- February 2024: Califia Farms, a prominent brand in the premium plant-based beverage sector, has announced a significant packaging update. The brand has transitioned all its bottles in the U.S. to 100% recycled plastic (rPET). This initiative is projected to reduce the company's greenhouse gas emissions by a minimum of 19% and halve its energy consumption. This move underscores Califia's steadfast commitment to promoting a cleaner, healthier planet and its endeavors to diminish the demand for new plastic.

- January 2024: Coca-Cola UNITED has unveiled its initiative to transition a selection of its top-selling 20-ounce plastic products to bottles crafted entirely from 100% recycled plastic (rPET). This move underscores the company's commitment to curbing virgin plastic packaging, slashing carbon emissions, and propelling its ambitions toward a World Without Waste. Coca-Cola UNITED has integrated 100% recycled plastic bottles into its offerings, including 12-ounce, 20-ounce, and 1-liter DASANI bottles.

United States Plastic Bottles Industry Segmentation

The scope of the study characterizes the plastic bottles market based on the product's raw material, including PP, PE, PET, and other raw materials used across various end-user industries such as Food, Pharmaceuticals, Beverage, Cosmetics, and Toiletries. The research also examines underlying growth influencers and significant industry vendors, all of which help to support market estimates and growth rates throughout the anticipated period. The market estimates and projections are based on the base year factors and arrived at top-down and bottom-up approaches.

The United States Plastic Bottles Market is Segmented by Resin (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Other Resin Types), by End-Use Industries (Food, Beverage (Bottled Water, Carbonated Soft Drinks, Alcoholic Beverages, Juices & Energy Drinks, Other Beverages (Powdered and Dairy-based Beverages), Pharmaceuticals, Personal Care & Toiletries, Industrial, Household Chemicals, Paints & Coatings, Other End-Use Industries). The report offers market forecasts and size in volume (Tonnes) and value (USD) for all the above segments.

| By Resin | Polyethylene (PE) | ||

| Polyethylene Terephthalate (PET) | |||

| Polypropylene (PP) | |||

| Other Resins (Polystyrene, PVC, Polycarbonate, etc.) | |||

| By End-use Industries | Food | ||

| Beverage | Bottled Water | ||

| Carbonated Soft Drinks | |||

| Alcoholic Beverages | |||

| Juices & Energy Drinks | |||

| Other Beverages | |||

| Pharmaceuticals | |||

| Personal Care & Toiletries | |||

| Industrial | |||

| Household Chemicals | |||

| Paints & Coatings | |||

| Other End-use Industries | |||

United States Plastic Bottles Market Research Faqs

How big is the United States Plastic Bottles Market?

The United States Plastic Bottles Market size is worth USD 2.52 billion in 2025, growing at an 3.89% CAGR and is forecast to hit USD 3.06 billion by 2030.

What is the current United States Plastic Bottles Market size?

In 2025, the United States Plastic Bottles Market size is expected to reach USD 2.52 billion.

Who are the key players in United States Plastic Bottles Market?

ALPLA Group, Amcor Group GmbH, Berry Global, Inc., Comar LLC and Plastipak Holding Inc. are the major companies operating in the United States Plastic Bottles Market.

What years does this United States Plastic Bottles Market cover, and what was the market size in 2024?

In 2024, the United States Plastic Bottles Market size was estimated at USD 2.42 billion. The report covers the United States Plastic Bottles Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the United States Plastic Bottles Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

United States Plastic Bottles Industry Report

Statistics for the 2025 United States Plastic Bottles market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. United States Plastic Bottles analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.