Virtual Goods Market Size

Virtual Goods Market Analysis

The Virtual Goods Market size is estimated at USD 112.33 billion in 2025, and is expected to reach USD 261.36 billion by 2030, at a CAGR of 18.4% during the forecast period (2025-2030).

- The virtual goods market is propelled by rising consumer demand for digital assets, the expansion of online gaming and the metaverse, the integration of blockchain and NFTs, and the influence of social media. Blockchain and NFT technology have revolutionized the landscape of virtual goods by ensuring verifiable ownership of digital assets. With the advent of NFTs, creators can now effectively monetize digital art, collectibles, and a myriad of other virtual goods, paving the way for innovative trading and investment avenues. The blockchain's inherent security and transparency bolster consumer confidence in virtual goods markets, particularly for high-value transactions.

- As digital lifestyles gain traction spanning online entertainment, social engagements, and virtual workspaces the appetite for virtual goods continues to surge. Digital assets, from avatars and skins to virtual gifts, are now pivotal in online social dynamics. Moreover, the ascent of cryptocurrencies, notably Bitcoin and Ethereum, has streamlined cross-border transactions, rendering the virtual goods market more global and accessible.

- The burgeoning popularity of multiplayer online games, especially free-to-play titans like Fortnite, Apex Legends, and League of Legends, has spurred demand for in-game items. These range from skins and characters to various customization options. In gaming, virtual goods transcend mere enhancements; they play a crucial role in social interactions, prompting players to invest more in digital items to elevate their status or connect with peers.

- Free-to-play games leveraging microtransactions (in-app purchases) as their revenue model have significantly boosted virtual goods sales. Players find themselves drawn to purchasing cosmetic items, premium content, and other digital enhancements. Furthermore, subscription services like Xbox Game Pass, PlayStation Plus, and EA Play, which grant access to exclusive in-game content and digital goods, play a pivotal role in amplifying virtual goods consumption.

- Data privacy and personal information security concerns significantly hinder virtual goods markets, which often require online transactions. Users may be reluctant to share payment details or make purchases without security assurances. The increase in fraudulent activities, such as counterfeit virtual goods and scams on third-party marketplaces, erodes trust in the virtual goods market.

- The virtual goods market is influenced by global economic changes, its appeal lies in providing affordable entertainment. The rising trend of digital assets, especially NFTs, could shield the market from severe downturns. An economic slump might curtail spending on luxury virtual items. However, it could boost participation in free-to-play games and heighten the allure of earning virtual assets, like NFTs and digital collectibles, over buying them.

Virtual Goods Market Trends

Online Games is Expected to Witness Remarkable Growth

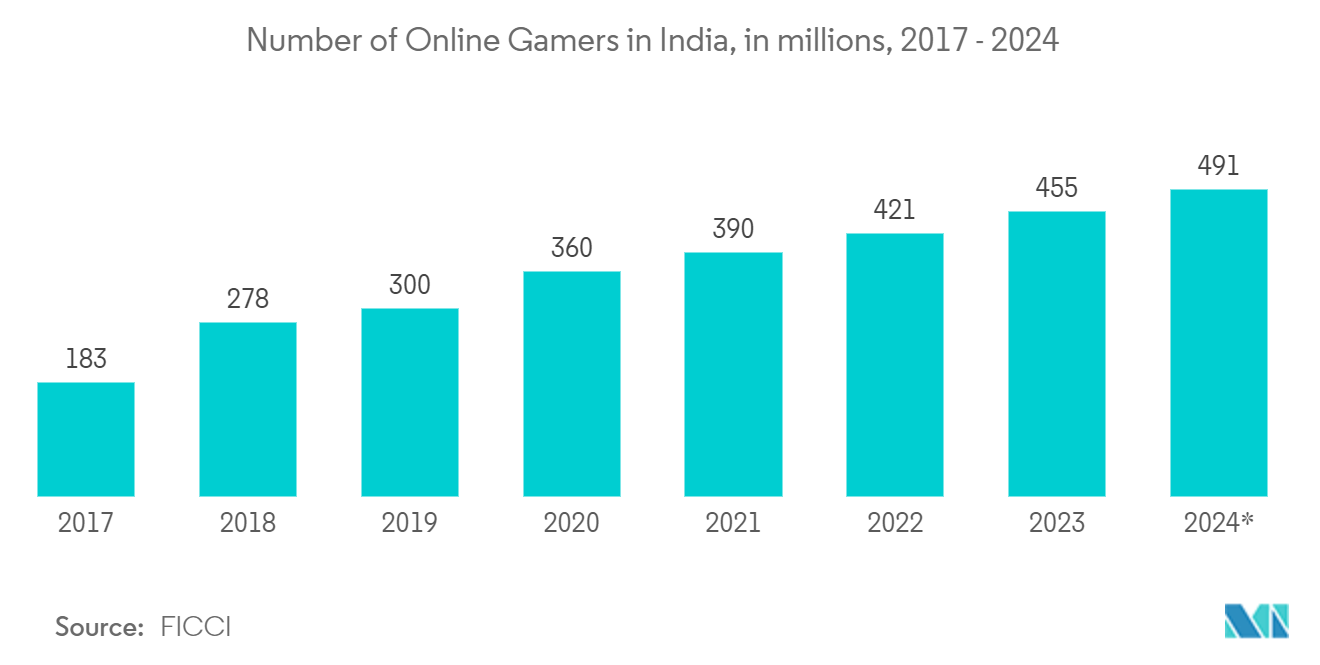

- The global surge in online gaming popularity is driving the growth of the virtual goods market. According to Demandsage, in 2023, the world had over 3.2 billion gamers. In 2024, the global gaming population is set to reach 3.32 billion, an increase of 100 million players from the prior year.

- Mobile gaming, known for its accessibility and ease of use, has significantly contributed to this increase. As engagement in online gaming rises—among both casual and hardcore players—so does the demand for virtual goods, including in-game currencies, skins, and cosmetics. With gaming now accessible on mobile phones, PCs, and consoles, a diverse demographic spanning various age groups and locations is being reached, expanding the potential market for virtual goods.

- The burgeoning metaverse is unlocking new opportunities for virtual goods. Games are increasingly incorporating digital assets, notably NFTs (Non-Fungible Tokens). These tokens enable players to own and trade unique in-game items across platforms and even outside the gaming environment. In 2023, a notable increase in NFT-related transactions highlighted a shift in how players value and trade virtual items. Numerous gaming companies are adopting NFTs, facilitating the buying, selling, and trading of rare in-game items and collectibles. Consequently, games featuring NFT-centric virtual goods are attracting substantial investments, driving the virtual goods market's growth.

- Online gaming has evolved into a social arena, fostering player interactions, community formations, and self-expression. Virtual goods—ranging from skins and avatars to emotes—play a pivotal role in shaping a player's digital identity. This drive for personalization often translates to increased spending, as players seek to distinguish themselves or enhance their gaming experience.

- Contemporary games frequently adopt subscription models or seasonal battle passes, ensuring a steady stream of spending on virtual goods. By offering exclusive rewards and content over designated periods, these models bolster player engagement. For example, Fortnite and Call of Duty have introduced seasonal passes, motivating players to consistently invest to unlock new cosmetics and in-game content.

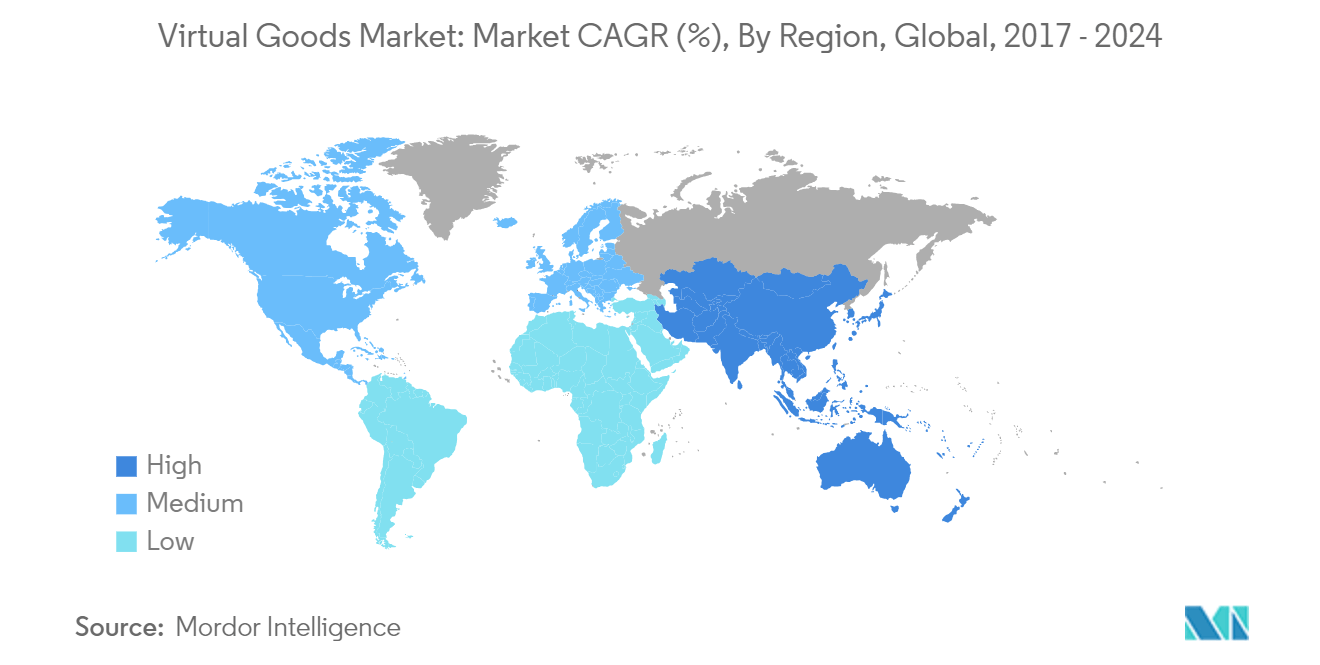

Asia Pacific is Expected to Witness a High Market Growth Rate

- The Asia-Pacific region is set for substantial growth in the virtual goods market, driven by a growing gaming population, cultural preferences for digital customization, a strong esports and streaming ecosystem, and rapid technological advancements. Mobile gaming leads the APAC region, contributing significantly to gaming revenue. The widespread adoption of smartphones has introduced millions of new players to the gaming world, many of whom engage with mobile games that monetize through virtual goods such as skins, character upgrades, and virtual currencies.

- In countries like Japan and South Korea, where customization and personalization are integral to gaming culture, there is a high demand for virtual goods that enable players to express themselves digitally. Virtual goods serve as a form of digital identity, and players are willing to invest in these items to enhance their online personas.

- Asia is the undisputed leader in esports, with countries like China, South Korea, and Japan hosting some of the largest esports tournaments globally. The region generates significant global esports revenue, much of which is linked to virtual goods, including in-game items, skins, and collectibles. Esports players and streamers also drive demand for virtual goods, as fans purchase virtual items to emulate their favorite players and teams.

- The APAC region is also at the forefront of developing and adopting metaverse platforms, where virtual goods play a crucial role in building digital economies. China, Japan, and South Korea are leading in the development of virtual spaces where users can buy, sell, and trade virtual assets. This integration of virtual goods into virtual worlds and metaverse platforms is driving a new wave of demand in the region.

- The adoption of NFTs in gaming has gained traction in Asia, with countries like Japan and South Korea being early adopters. The rise of blockchain-based games and NFTs in the region is contributing to the growth of the virtual goods market. Digital ownership of rare, unique in-game items, such as skins or virtual real estate, is becoming increasingly popular. As of 2023, Asia accounted for a significant portion of the global NFT gaming market, and this trend is expected to continue.

Virtual Goods Industry Overview

The virtual goods market is highly fragmented, with global and local conglomerates and specialized players operating across various segments. While several large multinational companies dominate specific high-value segments, numerous regional and niche players contribute to the overall competition, making the market highly diverse. This fragmentation is driven by the demand for virtual goods across a wide range of end-user verticals, allowing both large and small companies to coexist and thrive in the market.

Leading companies in the virtual goods market include Tencent Holdings Ltd., Meta Platforms, Inc. (formerly Facebook Inc.), Gree Inc., Mixi Inc., Hi5 Networks Inc., Myspace LLC, Tagged Inc., Zynga Inc., Ozone Networks, Inc., Coinbase Global, Inc., Binance Holdings Ltd., Kraken, and Gemini Trust Company, LLC. These companies have established strong brand recognition and extensive global operations, enabling them to command significant market share. Their strengths lie in innovation, broad product portfolios, and strong distribution networks. These leaders often engage in strategic acquisitions and partnerships to maintain their competitive edge and expand their market reach.

Key players of virtual goods in gaming and digital art are increasingly adopting blockchain technology to create NFTs (Non-Fungible Tokens) for digital items. They are investing in virtual land and properties within blockchain-based worlds like Decentraland and The Sandbox. This growing trend is generating new income opportunities through leasing, reselling, or establishing virtual businesses.

Virtual Goods Market Leaders

-

Meta Platforms, Inc. (formerly Facebook Inc.)

-

Tencent Holdings Ltd.

-

Coinbase Global, Inc.

-

Binance Holdings Ltd.

-

Gree Inc.

- *Disclaimer: Major Players sorted in no particular order

Virtual Goods Market News

- November 2024: NatWest, in collaboration with Mastercard's cutting-edge technology, is unveiling a pioneering mobile virtual card payment solution tailored for businesses, regardless of their size. This innovative solution empowers organizations to provide digital wallet-compatible virtual cards to all employees, be they permanent or temporary. This advancement not only removes the reliance on physical credit cards but also enhances flexibility, security, and efficiency in corporate transactions, both online and through tap-and-go methods.

- August 2024: BharatBox, a metaverse initiative in India, is a collaboration between The Sandbox and Brinc. In a strategic alliance with Shemaroo Entertainment, a notable entity in the entertainment sector, BharatBox has unveiled the 'Jab We Met' digital collectibles. Drawing on Shemaroo Entertainment's rich history of engaging audiences with varied content, BharatBox's ambition is to onboard one million users into the metaverse, positioning it as a leader in the blockchain gaming landscape.

Virtual Goods Industry Segmentation

Virtual goods, existing in digital form, are non-physical items commonly found on online platforms, games, or in virtual environments. While intangible and lacking a physical presence, these goods can be bought, sold, traded, or utilized within digital experiences. Typically acquired using real-world or in-game currency, virtual goods enhance user experiences, offer customization, or introduce added functionality in virtual spaces.

The study tracks the revenue accrued through the sale of virtual goods by various players across the globe. The study also tracks the key market parameters, underlying growth influencers, and major vendors operating in the industry, which supports the market estimations and growth rates over the forecast period. The study further analyses the overall impact of COVID-19 aftereffects and other macroeconomic factors on the market. The report’s scope encompasses market sizing and forecasts for the various market segments.

The virtual goods market is segmented by component(in-game virtual goods, digital collectibles, virtual currency, virtual land and property, and virtual services), application(online games, social media platforms, and others), and geography (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The market sizes and forecasts regarding value (USD) for all the above segments are provided.

| By Type | In-game Virtual Goods |

| Digital Collectibles | |

| Virtual Currency | |

| Virtual Land and Property | |

| Virtual Services | |

| By Application | Online Games |

| Social Media Platforms | |

| Others | |

| By Geography*** | North America |

| Europe | |

| Asia | |

| Australia and New Zealand | |

| Middle East and Africa | |

| Latin America |

| In-game Virtual Goods |

| Digital Collectibles |

| Virtual Currency |

| Virtual Land and Property |

| Virtual Services |

| Online Games |

| Social Media Platforms |

| Others |

| North America |

| Europe |

| Asia |

| Australia and New Zealand |

| Middle East and Africa |

| Latin America |

Virtual Goods Market Research FAQs

How big is the Virtual Goods Market?

The Virtual Goods Market size is expected to reach USD 112.33 billion in 2025 and grow at a CAGR of 18.40% to reach USD 261.36 billion by 2030.

What is the current Virtual Goods Market size?

In 2025, the Virtual Goods Market size is expected to reach USD 112.33 billion.

Who are the key players in Virtual Goods Market?

Meta Platforms, Inc. (formerly Facebook Inc.), Tencent Holdings Ltd., Coinbase Global, Inc., Binance Holdings Ltd. and Gree Inc. are the major companies operating in the Virtual Goods Market.

Which is the fastest growing region in Virtual Goods Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Virtual Goods Market?

In 2025, the North America accounts for the largest market share in Virtual Goods Market.

What years does this Virtual Goods Market cover, and what was the market size in 2024?

In 2024, the Virtual Goods Market size was estimated at USD 91.66 billion. The report covers the Virtual Goods Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Virtual Goods Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Virtual Goods Industry Report

Statistics for the 2025 Virtual Goods market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Virtual Goods analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.