Electroactive Polymer Market Size

Electroactive Polymer Market Analysis

The Electroactive Polymer Market is expected to register a CAGR of greater than 5% during the forecast period.

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The growing electrical and electronics industry is expected to drive market growth during the forecast period. However, it is difficult to extract the electroactive polymer, and it is usually harmful to the environment. However, improper disposal of electroactive polymer products could harm the environment, which is anticipated to slow the market's expansion.

- The rising significance of biomimetic and fake muscles for handling complex medical issues using electroactive polymer will likely provide opportunities for the electroactive polymer market over the next five years. The North American region is expected to dominate the global electroactive polymer market.

Electroactive Polymer Market Trends

Actuators and Sensors to Dominate the Market

- Actuators and sensors are expected to dominate due to their wide usage in electrical and electronic components of sensitive electronics and plastic parts. This is due to their ability to prevent dust attraction and electrostatic discharge. Inherently conductive polymers include polythiophenes, polyanilines, polypyrroles, and polyacetylenes.

- Conductive polymers are used in sensors as these are electronically conductive with relatively high and reversible ion storage capacity. The usage of electroactive polymers provides large electromechanical bending at low voltages. Moreover, their soft and flexible structures also help in working efficiently.

- According to the Ministry of Electronics and IT's 'A call to action for broadening and deepening electronics manufacturing' study, India intends to generate USD 300 billion in electrical and electronics manufacturing by 2026, benefiting the market for electroactive polymers during the forecast period.

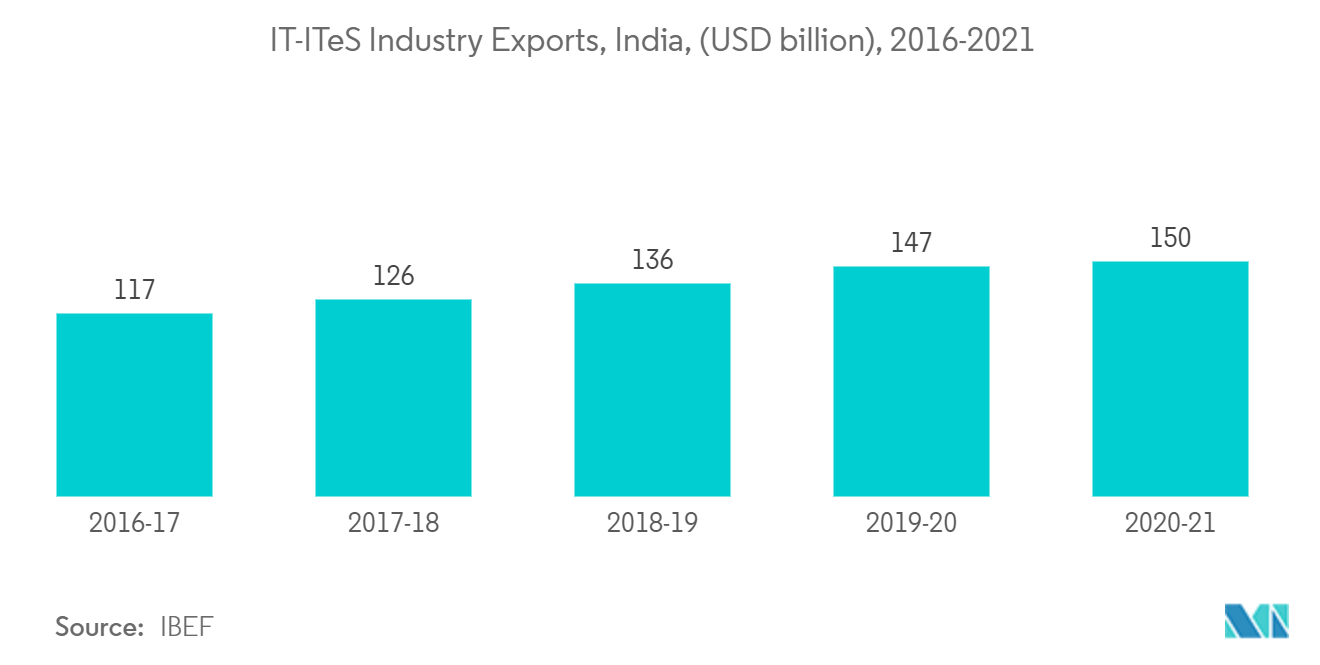

- According to India Brand Equity Foundation (IBEF), India exported USD 2,009.07 million worth of electronics in September 2022, up 71.99% year over year. Key export items in this industry include mobile phones, consumer electronics (TV and audio), IT hardware (laptops, tablets), industrial electronics, and auto electronics, supporting the market growth.

- All the aforementioned factors are expected to drive the electroactive polymer market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is the largest market for electroactive polymers. Factors such as increasing production of electronic devices and changing consumer preference towards miniaturization of daily use of consumer electronics and gadgets have been driving the electroactive polymer requirements in the region.

- Electronic products in the region have the highest growth rates in the consumer electronics segment of the market in terms of demand. With the increase in the disposable incomes of the middle-class population, the demand for electronic products is projected to increase steadily, thereby driving the market studied.

- China has the world's largest electronics production base. Electronic products, such as wires, cables, computing devices, and other personal devices, recorded the highest growth in electronics. The country serves the domestic demand for electronics and exports electronic output to other countries, thus, providing a huge market during the forecast period.

- According to the National Bureau of Statistics (NBS) of China, the overall profit of China's electronics manufacturing businesses increased by 38.9 percent year on year in 2021, thus positively impacting the market's growth.

- Furthermore, according to Japan Electronics and Information Technology Industries Association (JEITIA), the overall production value of the Japan electronics sector increased by almost 10% to around USD 100 billion in 2021. The sector includes electronic devices, components, and consumer and industrial electronic equipment.

- Hence, due to the above-mentioned reasons, Asia-Pacific is anticipated to dominate the market studied during the forecast period.

Electroactive Polymer Industry Overview

The global electroactive polymer market is partially consolidated in nature. Some of the major players in the market include Solvay, The Lubrizol Corporation, Parker Hannifin Corp., Premix Group, and Arkema, among others.

Electroactive Polymer Market Leaders

-

Solvay

-

Premix Group

-

The Lubrizol Corporation

-

PARKER HANNIFIN CORP

-

Arkema

- *Disclaimer: Major Players sorted in no particular order

Electroactive Polymer Market News

- January 2023: Solvay announced the relocation of its headquarters from Neder-over-Heembeek to new facilities in Brussels, specifically designed and equipped to host the Group's Research, Innovation, and administration activities. Located in the Brussels municipality of Haren, Solvay's future HQ site is equipped with large research spaces, high-performance digital infrastructure, and great accessibility, providing Solvay's employees with a future-ready, world-class workplace that enhances innovation and collaboration.

- September 2022: Motion and control technologies company Parker-Hannifin Corp. completed its acquisition of aerospace and defense components manufacturer Meggitt PLC. Meggitt is said to have diverse aerospace and defense exposure with technology and products on almost every major aircraft platform. According to Parker-Hannifin, combining Meggitt's and Parker's product lines will enable greater support of electrification and net-zero emissions goals.

Electroactive Polymer Industry Segmentation

Electroactive polymers (EAP) belong to a group of polymers that change in size and shape in response to an external electrical field. They are used in many applications, including robotics, electrostatic plastics, actuators, sensors, ESD & EMI protection, and drug delivery systems.

The electroactive polymers market is segmented by type, application, and geography. By type, the market is segmented into Conductive Plastics, Inherently conductive plastics, inherently conductive polymers, and inherently dissipative polymers. By application, the market is segmented into actuators & sensors, energy generation, automotive devices, batteries, prosthetics, robotics, and other applications. The report also covers the market size and forecasts for the market in 15 countries across major regions.

For each segment, the market sizing and forecasts have been done based on revenue (USD million).

| Type | Conductive Plastics | ||

| Inherently Conductive Polymer | |||

| Inherently Dissipative Polymer | |||

| Application | Actuators and Sensors | ||

| Energy Generation | |||

| Automotive Devices | |||

| Batteries | |||

| Prosthetics | |||

| Robotics | |||

| Other Applications | |||

| Geography | Asia-Pacific | China | |

| India | |||

| Japan | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| North America | United States | ||

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Rest of Europe | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle-East and Africa | Saudi Arabia | ||

| South Africa | |||

| Rest of Middle-East and Africa | |||

| Conductive Plastics |

| Inherently Conductive Polymer |

| Inherently Dissipative Polymer |

| Actuators and Sensors |

| Energy Generation |

| Automotive Devices |

| Batteries |

| Prosthetics |

| Robotics |

| Other Applications |

| Asia-Pacific | China |

| India | |

| Japan | |

| South Korea | |

| Rest of Asia-Pacific | |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Rest of Europe | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Middle-East and Africa | Saudi Arabia |

| South Africa | |

| Rest of Middle-East and Africa |

Electroactive Polymer Market Research FAQs

What is the current Electroactive Polymer Market size?

The Electroactive Polymer Market is projected to register a CAGR of greater than 5% during the forecast period (2025-2030)

Who are the key players in Electroactive Polymer Market?

Solvay, Premix Group, The Lubrizol Corporation, PARKER HANNIFIN CORP and Arkema are the major companies operating in the Electroactive Polymer Market.

Which is the fastest growing region in Electroactive Polymer Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Electroactive Polymer Market?

In 2025, the Asia Pacific accounts for the largest market share in Electroactive Polymer Market.

What years does this Electroactive Polymer Market cover?

The report covers the Electroactive Polymer Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Electroactive Polymer Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Electroactive Polymer Industry Report

Statistics for the 2025 Electroactive Polymer market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Electroactive Polymer analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.